Troy Asset Management’s funds come into their own during periods such as the current tariff-induced crisis. Designed to protect wealth first and foremost but also grow investors’ capital, Trojan Ethical and its stablemates have provided a defensive ballast in recent months with allocations to inflation-linked bonds and gold, alongside a relatively low 30% equity weighting.

The £860m Trojan Ethical fund is a top-quartile performer within the IA Flexible Investment sector over one and three years, although relative returns have been more challenging over five years due to the fund’s conservative stance.

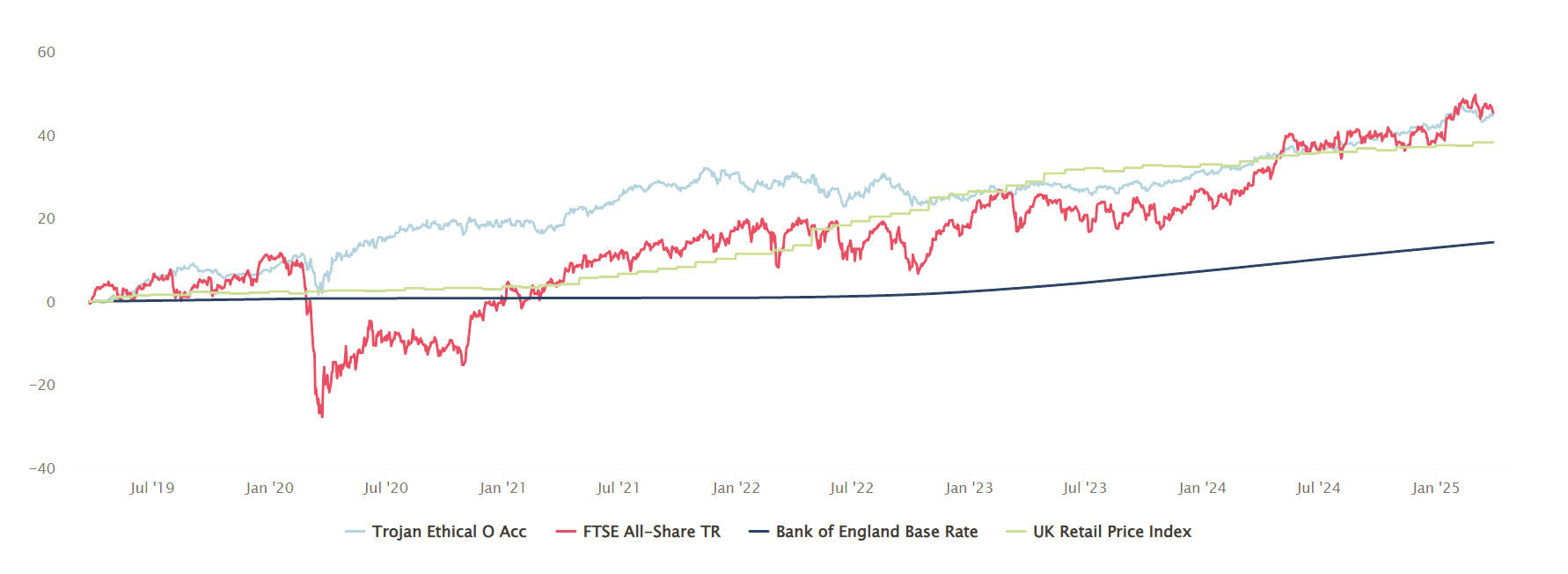

Over its full six-year history, Trojan Ethical has compounded returns at 7% per annum and has smoothed out the investment journey, with much lower volatility than domestic equities, as the chart below shows.

Performance of fund vs benchmarks since inception

Sources: Troy Asset Management, Lipper, Waystone Management; performance data is from 29 Mar 2019 to 31 Mar 2025 on a total return basis, net of fees, in sterling terms.

Below, lead manager Charlotte Yonge explains why tariffs will be inflationary and why she believes policymakers need to inflate away the colossal levels of government debt.

What is your investment strategy?

It is first to protect capital and then to grow. We're supposed to be the part of the portfolio that investors worry a lot less about.

We have a very long-term time horizon and, for us, capital preservation means not losing money over five or 10 years. But we are also conscious of how investors experience returns so we focus on minimising the drawdown.

In difficult periods such as Covid or the financial crisis, we have historically drawn down much less than the market, which is important for our investors because it's quite often at those points, when the world is imploding, that they might need to take money out.

During Covid, the market fell quite sharply and in that first quarter of 2020, the Trojan Ethical fund was flat, so at least our investors hadn’t lost money.

The long-term goal of growing wealth is equally important. We need to keep pace with inflation and ideally grow well ahead of it.

What's your view on the recent market downturn?

In the past two months, everyone has gone from animal spirits to thinking that tariffs aren't going to be good for the economy. A lot of underlying factors that were there in January, but people were just ignoring, have come to the fore.

Tariffs are a huge unknown and, at the same time, the economy is still dealing with the fastest interest rate hiking cycle for over four decades. You can see it in auto delinquencies and credit card delinquencies, which are both the highest they've been since the financial crisis. Consumers struggling with the higher cost of credit are not going to love paying more for everyday goods due to tariffs.

Why do you have such a large allocation to index-linked bonds?

The Trojan Ethical fund has 35% in index-linked bonds, predominantly in shorter-dated US treasury inflation-protected securities (TIPS).

We believe there is an inflationary risk that precedes tariffs but is linked. There is a move away from free trade (and all the benefits that brings, not only for growth but also for lower prices) and towards more nationalised industries. With that comes a higher cost of goods and services.

We think inflation is probably what policymakers need to bring down debt levels relative to the economy. Inflation is a nice way of engineering an effective default on your debt without actually having to default.

More than 90% of US government debt is not linked to inflation, so that debt will just stay static, but if inflation starts taking off, obviously the size of the economy will rise. That's very useful at a time when US government debt to GDP is the highest it's been since the second world war.

What was your best performing holding in the past year?

Gold: it was up 30% in sterling terms last year and contributed over 3 percentage points to our performance. We've taken profits, which we think is sensible risk management, even though we're still positive. If we hadn't done anything, gold would be 19% of the portfolio now, but it's 12% because we've consistently taken profits.

Gold is increasingly being used as an alternative to the dollar by central banks, especially in emerging markets, who want to manage their foreign exchange reserves.

In February 2022, the confiscation of Russia’s dollar-denominated foreign exchange reserves sent a shockwave through all central banks that own dollars. That was the highest year on record for central bank purchases of gold, which aligns with that moment where there was clearly a question over how safe dollar reserves are going to be in the future.

In the past, when central banks have made a currency reallocation, particularly in terms of gold, that move has continued for several years. For instance, Poland was the largest central bank buyer of gold last year and has a mandate to increase its gold allocation to 20% from 15%.

The current situation is not like the rally in 2011, which was driven by gold exchange-traded commodities (ETCs) and institutional investors. Until last August, institutional investors were net sellers of gold. There's another leg to the gold price, potentially, if institutions start buying on a greater scale.

What was your worst-performing investment last year?

Nestlé, which is experiencing a reset after Covid when it became very expensive because people were buying more pet food and drinking more coffee at home. It detracted just under 0.5% from performance last year. It was actually our only detractor in the ethical fund, everything else was positive.

We added to our position in Nestlé in November when it became apparent that the market hated the stock. The market was essentially saying that, because of weight loss drugs, nobody is going to be consuming any of Nestlé’s products in the future. But we think the market is missing the point on what will drive the business.

I'm conscious that when people think of Nestlé, they think of chocolate, but chocolate is a small part of the company. In America, Nestlé doesn’t have any confectionary but pet food and coffee are huge businesses.

It also has Nestlé Health Science, which specialises in innovative nutritional solutions, such as vitamin-infused products for building muscle mass. People taking GLP-1 medication often become protein deficient and lose muscle mass.

What do you enjoy doing outside of investment?

I have a one-year-old and a two-year-old, so I enjoy spending time with them, my husband and our dog.