Fidelity Index World and Vanguard LifeStrategy 100% Equity both provide low-cost passive exposure to global equities and are immensely popular, having amassed £10.6bn and £8.5bn in assets under management, respectively.

They are also quite different. Fidelity Index World is a classic, straight-forward, passive fund, replicating the MSCI World index by holding all the stocks within it. Like its benchmark, it focuses on developed markets and has 71.5% in the US (as of 31 March 2025).

Vanguard LifeStrategy 100% Equity is a different kettle of fish. Rather than replicating a single global index, it invests in 10 regional passive funds within the Vanguard stable and has no designated benchmark. Due to its structure, Vanguard’s ongoing charges figure of 0.22% is higher than Fidelity Index World’s 12 basis points.

Vanguard’s fund has a significant home bias with 25% in UK equities and, unlike Fidelity Index World, it has exposure to emerging markets and smaller companies.

Below, Trustnet compares and contrasts the passive global equity behemoths.

Which fund has performed better?

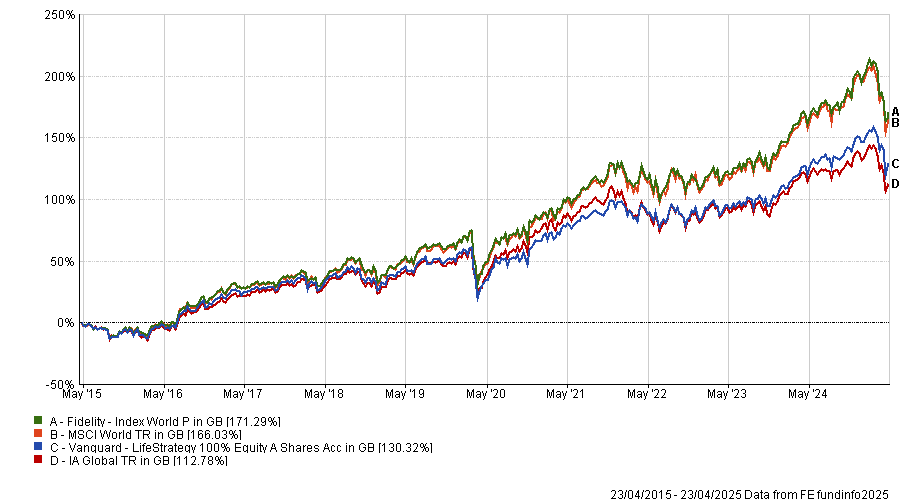

The geographical exposures of the two funds are reflected in their relative investment performance. For Vanguard, having 25% in the UK and 10% in emerging markets has been a headwind for much of the past decade but served the fund well during this year's sell-off.

Performance of funds vs sector over 10yrs

Source: FE Analytics

Why does Vanguard have a home bias?

Vanguard said its strategic home bias “stems from a historic preference for domestic investments among UK investors”. This 25% UK target is static but is reviewed regularly by Vanguard’s Strategic Asset Allocation Committee to ensure it continues to align with clients’ preferences.

The firm also offers a LifeStrategy model portfolio solutions (MPS) range for financial advisers, with one version that includes the home bias and another without it, which instead has a global market capitalisation weighting.

Vanguard regularly rebalances the underlying funds back to its strategic target weights and does not try to add value through tactical asset allocation.

Alex Farlow, associate director, multi-asset research at Square Mile Investment Consulting & Research, said some investors like the static nature of the LifeStrategy range given how difficult it is to consistently add value through tactical asset allocation.

Separately, having 25% in sterling-denominated assets can be helpful for UK-based investors who do not want to take on currency risk, especially as sterling has been stronger than the dollar recently.

Over the past 10 years, however, sterling has weakened significantly versus the dollar, Farlow noted.

Looking under the hood

Another difference between the funds is the number of holdings, said Richard Philbin, chief investment officer (investment solutions) at Hawksmoor Investment Management. “If you did a look through at the number of holdings between the two funds, there will be many, many more in the Vanguard fund.”

Fidelity Index World fund owns more than 1,350 companies that constitute the MSCI World Index.

By contrast, the Vanguard U.S. Equity Index fund – just one component of the LifeStrategy product – invests in more than 3,500 companies. This is because it tracks the Standard and Poor’s Total Market index, which covers mega, large, medium and small-cap stocks (rather than the more popular S&P 500).

“What is also interesting to note is that the Vanguard funds invest across different index providers – FTSE, S&P, MSCI for instance – and all three index providers have slight nuances to their approach, companies in the index, criterion used for inclusion and so on,” Philbin pointed out.

Fund management teams

Fidelity Index World is managed by passive specialist Geode Capital Management in Boston. It was established in 2001 as a division of US-based Fidelity Investments and became independent in 2003. While Geode is responsible for investments, Fidelity International handles sales, marketing and compliance for the fund.

Danielle Farley, a passive investment analyst at Hargreaves Lansdown, said this is an unusual arrangement for passive funds but “we think Geode’s scale and passive investment specialism combined with Fidelity’s operations and commercial expertise makes for a good partnership”.

Geode has a well-resourced team and its investment professionals have an average of two decades of experience or more, she added.

“Cost management is very important to Geode. The fund managers try to make up for the factors that detract from performance, such as dealing commissions, taxes and the cost of running the fund,” Farley said.

Farlow said Vanguard also has strong resources, an impressive team and a long track record in passive investing, and Square Mile has given both funds a ‘Recommended’ rating.

Which fund should investors and advisers choose?

Which fund investors opt for will depend on what geographic exposures they want, said Jason Hollands, managing director of Bestinvest.

“LifeStrategy has been designed with a UK-based investor in mind who wants a home bias to UK assets, whereas Fidelity Index World is purely market-cap weighted in its allocations. This UK overweight has been helpful in recent weeks given the sharp sell-off in US equities,” he noted.

Yet the main reason Fidelity Index World is on Bestinvest’s Best Funds List – and Vanguard LifeStrategy 100% Equity isn’t – is fees. “A key factor affecting deviation from global indices is costs. The Vanguard fund has 0.22% ongoing costs, significantly higher than the 0.12% ongoing charges figure of the Fidelity World Index fund,” he explained.

Farlow said financial advisers may prefer Vanguard for consistency, as they can use other LifeStrategy funds for clients with different risk profiles. The remaining LifeStrategy funds are multi-asset portfolios with a bond component and between 20-80% in equities. There is “an element of I know what I’m getting” with the LifeStrategy range and its home bias, he said.

Farley concluded that the two funds can be used in different ways depending on an investor’s needs. “Fidelity Index World could complement other funds in a portfolio that are focused more on the UK or emerging markets,” she explained.

“The Vanguard LifeStrategy 100% Equity fund provides broader exposure to global markets and could be a simple way to form the share portion of a portfolio but comes at a slightly higher cost.”