Among all the things that can get in the way of small-cap investors fund size could be the biggest. While growing assets under management is not a problem for funds that invest in the large-cap end of the market, as these tend to be more liquid (easily tradeable), smaller companies are harder to trade as there are naturally fewer buyers, making position sizing key.

But small-cap funds can also run into issues when trying to get the balance of their portfolios right. If they own too much of a company’s shares, they could be forced to make a bid to buy the stock outright.

As such, as smaller companies funds that scale in size they have two options: either invest in larger companies where this will not be an issue or take smaller stakes (relative to the size of the overall portfolio) and spread their money more evenly.

The former limits their options and potentially moves them away from the smaller end of the spectrum many investors expect them to be hunting in, while the latter limits the impact of getting a stock pick correct (even if it makes a 100% gain, it may not move the needle on the overall portfolio).

Retired veteran small-cap manager Harry Nimmo voiced these very concerns in 2011, when his then abrdn UK Smaller Companies fund became the largest in the IA UK Smaller Companies sector. Its AUM was £1.2bn, representing 20% of the whole market.

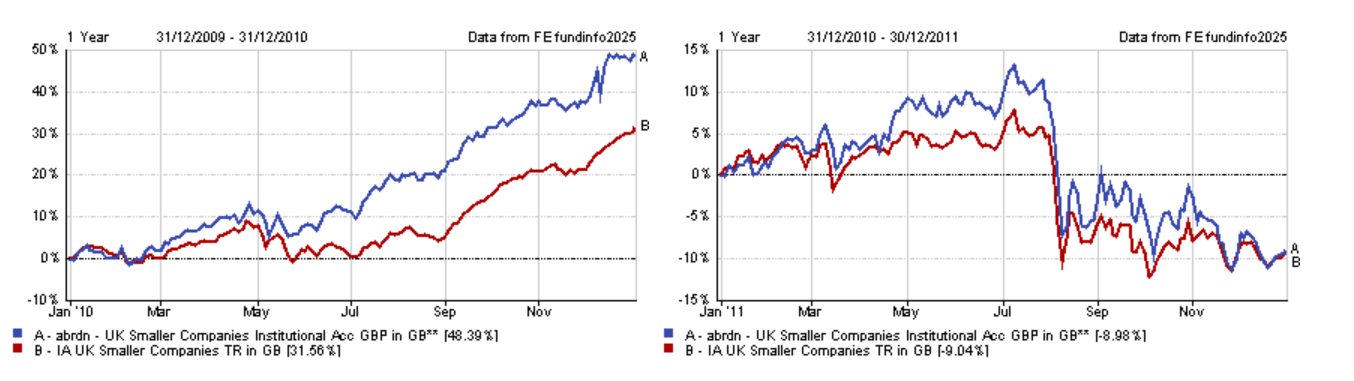

In 2010, the portfolio was worth £441.1m and performance was leaps ahead of the average peer, as the left-hand chart below shows. Returns were more in line with the rest of the market in 2011, however, after the fund ballooned in size, as highlighted on the right-hand side.

Performance of fund against index and sector in 2010 and 2011

Source: FE Analytics

This is when the fund was soft-closed (it stopped accepting new investments) – one of the tools managers have to regulate inflows. The following year, the AUM had stopped growing (at £964.5m) but performance had turned around, closing and then surpassing the rest of the sector.

At Trustnet, we wanted to see if this paradigm of larger size, smaller returns held true for the abrdn fund, as well as all other strategies in the IA UK Smaller Companies sector.

Using FE data, we looked at the five funds with the most assets under management at the start of each year from 2012 to 2021 and analysed their three-year returns from that starting points onwards to see if there was a trend.

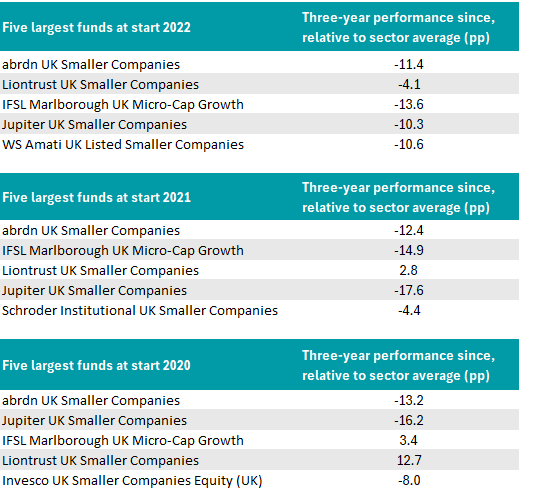

At the start of 2022, the five largest funds in the peer group were abrdn UK Smaller Companies, Liontrust UK Smaller Companies, IFSL Marlborough UK Micro-Cap Growth, Jupiter UK Smaller Companies and WS Amati UK Listed Smaller Companies.

In the three years to the end of 2024, all five were among the worst performers in the sector, with most trailing the sector average by more than 10 percentage points (except Liontrust), as the table below shows.

It also highlights the largest funds at the start of 2021 and 2020. In each case, the majority of these large funds failed to beat the average peer.

Source: Trustnet

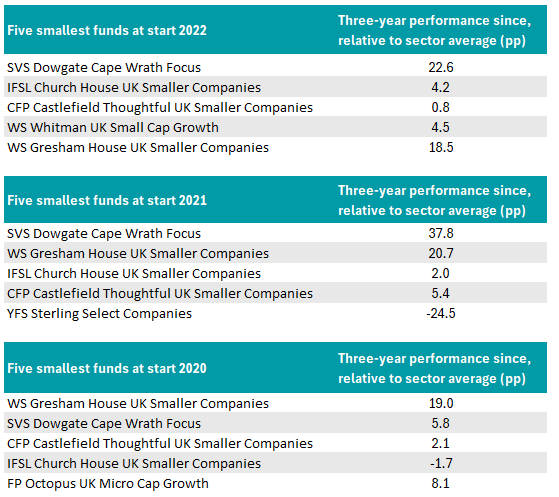

Conversely, funds with fewer assets under management have largely outperformed the average peer group, as the below table shows.

Source: Trustnet

Trustnet reached out to the managing team of all five funds mentioned above, receiving a reply from four. All of the respondents, arejected the idea that size was a key cause of their underperformance.

A Jupiter spokesperson said: “Performance challenges between 2022 and 2024 were driven mainly by a sharp change in the market leadership of our tech-driven growth stocks.”

The Liontrust Economic Advantage team had a similar take: “The peak of assets in 2021 coincided with the peak of the small-cap market. We then benefited during the Covid recovery, when the market backdrop was particularly favourable to our quality-growth style bias. This reversed in 2022 and since then, the backdrop has been much more challenging.”

Eustace Santa Barbara, co-manager of the IFSL Marlborough UK Micro-Cap Growth, blamed investors who turned their backs to the sector: “It’s widely recognised that UK smaller companies have fallen out of favour with many investors in recent years. These and other factors have impacted performance over the shorter term.”

Aberdeen’s Glennie said: “We are always conscious, as peers will be, of fund size and the ability to successfully manage the mandate in the best interests of existing clients. However, fund size is only one factor to consider – other factors being the constituent holdings, the market cap range and the liquidity of underlying positions.

Daniel Lockyer, senior fund manager at Hawksmoor, added that many investors may have sold out of abrdn UK Smaller Companies as Nimmo retired, “even though the succession plan had been well communicated and the current management team is very good”.

Lockyer generally agreed with the four managers, all of which maintain a growth-style bias. He argued this can be blamed for the underperformance and the subsequent selling-off spiral as investors ran for the exits.

Retail investors have a bad reputation for buying the best performers and selling the worst, but Lockyer also noted that many advisers use investment processes that are based on one- or three-year quartile rankings, meaning that they buy top-quartile and sell bottom-quartile funds.

“Small-caps generally have been struggling as investors have been fleeing UK equities, with outflows persisting for 40 plus months,” he said.

“Whether the fund is in redemption or inflow mode has an impact, because having to sell holdings you know are cheap just to fund a redemption is tough and puts downward pressure on that asset at a time when there are no buyers, so the price tends to fall – a vicious circle.

“Starting today, the small-cap asset class is much smaller than it has been for decades, so the funds need to be smaller to maintain flexibility and nimbleness,” Lockyer concluded.