The UK is second only to the US in terms of investment opportunities, according to Sanford DeLand’s Keith Ashworth-Lord, who said this is one of the main reasons he is launching the UK Buffettology Smaller Companies Investment Trust.

Ashworth-Lord is the manager of CFP SDL UK Buffettology, the top-performing fund in the IA UK All Companies sector since its launch in March 2014, and co-manager of CFP SDL Free Spirit, the third best performer in the sector since its launch in January 2017.

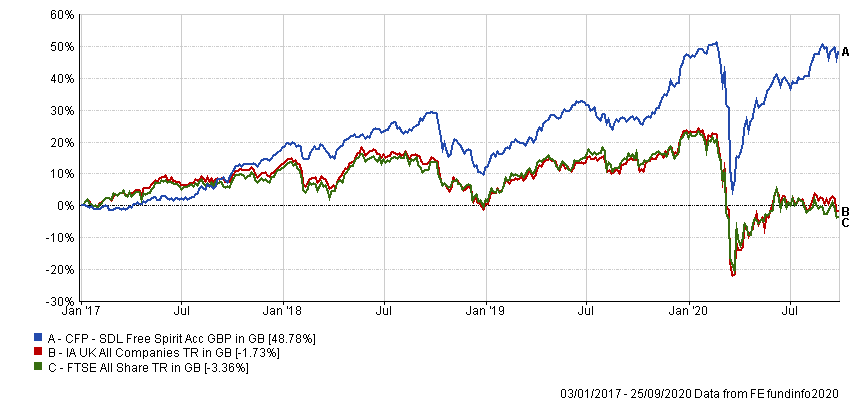

Performance of fund vs sector and index since launch

Source: FE Analytics

“We took a conscious decision to exit those positions last summer,” he said. “That was not a reflection of the company or the management, it was because we owned between 15 and 20 per cent of each and we obviously didn't want to go above 20 per cent, as they start asking you to join the board and daft things like that.

“And in aggregate, they accounted for 1.5 per cent of our NAV [net asset value], so if one of them had doubled it wouldn't have moved the dial, yet they all demanded research resource.

“We've been coming up with ideas at that £20m to £200m area which realistically couldn't go into Buffettology and we thought the ideal structure for this would be a closed-ended fund because it is permanent capital. And then I don't have those liquidity worries that I always have with the smallest stuff with Buffettology being open-ended.”

As a result, Ashworth-Lord has decided to launch the UK Buffettology Smaller Companies Investment Trust. The trust, which is seeking to raise a minimum of £100m, will be run according to the same “Business Perspective Investing” approach used in the Buffettology and Free Spirit funds, based on the philosophy used by Berkshire Hathaway chairman Warren Buffett.

But there is more to the fund launch than assuaging liquidity concerns, with Ashworth-Lord pointing to irrationally low valuations in the UK market.

“The final consideration is just this environment where I keep saying to people, the United Kingdom is probably second only to the United States as a place you want to be as an investor,” he said.

“We've got that entrepreneurial team spirit, we've got the language, we've got the time zone, we've got the accounting standards, the legal standards – it's a great place to be. But you would never believe that if you read the press, because they constantly doom monger about first Brexit and then Covid and now the transition period and all this.

“And the consequence is that the UK market relative to Wall Street or continental European bourses looks depressed. The valuations look compelling compared with other worldwide stock markets.”

And this is just large caps – Ashworth-Lord (pictured) said that the valuation discrepancy becomes even more apparent the further you go down the market cap scale.

A common misconception is that small cap means ‘domestically focused’ and as a result this area has been shunned by investors who are worried about how it will fare once the Brexit transition period ends. Yet the manager pointed out that it is not difficult to find small caps that are global businesses.

“Look at AB Dynamics, which has a £400m market cap, look at Bioventix, which has a £200m market cap,” he continued.

“These are businesses deriving single-digit revenues from their home market while the other 90-odd per cent is spread around the world. It is a fallacy to think that all small companies are domestically oriented, but the great thing is that has driven down valuations as well. So, you've got a double whammy, you've got the UK not liked, then you've got smaller companies [also] unliked.

“And then what's happened with MiFID II, and the fact that smaller-company research has dried up as people have moved to bigger market caps, that has played into our hands because we do all our own research and don't rely on brokers at all.

“The fewer people that are fishing in that area of the pond, the better. We have more chance of finding valuation anomalies, so it just seemed to us that the stars were really aligned.”

Ashworth-Lord said there is little difference between analysing a mid-cap and a micro-cap – he is still looking for the same traits, such as margin expansion, a high return on equity, good cash generation and steady growth. As he puts it, “it's the same tell-tale signs that basically say, ‘hey, look at me, I'm an enduring franchise, I've got pricing power’”.

One of the traits most commonly associated with Buffett’s style of investing is that of an economic moat and, while it is easy to see how a $200bn company such as Coca-Cola can erect barriers to entry, it is more difficult to picture how a company worth £20m can prevent competitors muscling in on its action.

Yet Ashworth-Lord said that while these companies don’t have moats of scale, they can build barriers that are just as effective by becoming specialists in a niche area.

“The moat could be human capital: it has got something special that nobody else has got,” he explained.

“It could be it captures a piece of the customer’s mind – think about Games Workshop, that is a business that the customers are absolutely locked in to.

“It could be there is patent protection around the product – like with AB Dynamics.

“It could be Bioventix, which is regulatory: it takes three-to-five years to get its antibodies approved on both sides of the Atlantic. Once you're on the gig with Siemens or J&J, you're on it for the lifetime of the product – it is a royalty-type payment that's 2 per cent every time there is a blood test on one of their machines. The switching cost is high, but the actual cost to the machine manufacturers is low.

“That's the sort of thing we love: businesses that don't want to switch, they want to develop the next generation product with the existing supplier. We kill for them.”

There are numerous warnings from history about star managers who have failed to replicate the performance on their old fund when they have launched a new product – often because they have moved out of their area of expertise. Yet Ashworth-Lord is at pains to point out this will not happen with him.

“The key message is there will be no style drift,” he said. “What we have been doing with Free Spirit is what we will be doing with the Buffettology trust.

Performance of fund vs sector and index since launch

Source: FE Analytics

“And please get it firmly in your mind that we are not going anywhere near unquoted investments or things like private equity. This is going to be all stuff listed on the stock exchange, or quoted on AIM. That is our pond that we are fishing in.”

The new trust will have an annual management charge of 0.65 per cent.