While UK bond investors will be unable to make the kind of returns markets have recorded over the past 20 years, there are still opportunities for those willing to take a more selective approach, says Schroders Jonathan Golan.

Golan – manager of the £1.1bn Schroder Sterling Corporate Bond fund – said that UK investment-grade corporate bonds have outperformed equities over the last two decades by a significant margin, due largely to the collapse in interest rates.

But with rates at or near zero, such outperformance is unlikely to be repeated in the future, he warned.

Performance of indices over 20yrs

Source: FE Analytics

“The expected stability in interest rates imply that UK corporate bonds should hold on to their gains, but adding to them will not be so easy in future,” said Golan. “Buying the market is unlikely to get the same results over the next 20 years as it did previously.”

Sterling corporate bonds had offered plenty of value in the wake of the Covid-19 pandemic, but have now returned to more long-term norms.

“Outright yields are low and credit spreads to government bonds are roughly in line with the long-term median level,” explained the fund manager.

Indeed, rates are also unlikely to rise in the foreseeable future as they could harm individual and corporate finances while the UK economy continues to recover from the Covid-19 pandemic.

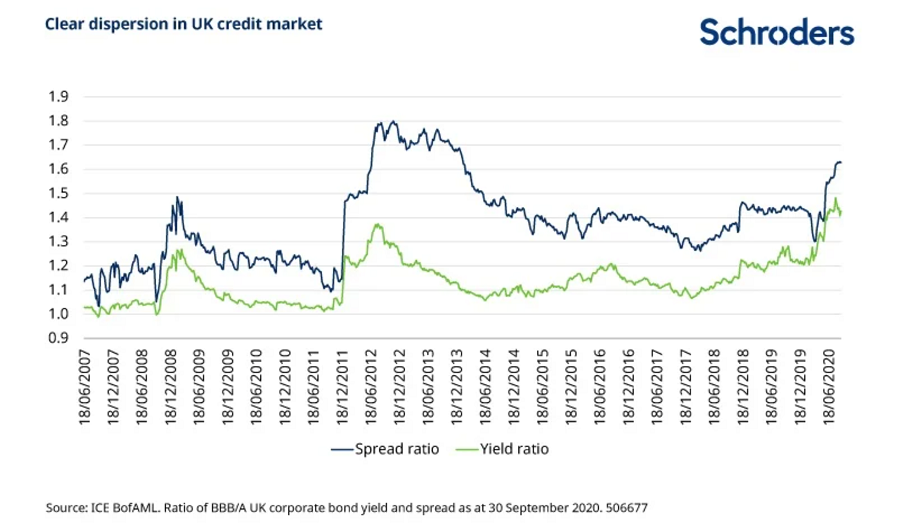

And with substantial dispersion within the sterling corporate bond market, for active managers, there are some “golden opportunities” to be found, according to Golan.

“Even as the market valuation has become less exciting in aggregate, the dispersion of the market looks interesting,” the manager said. “A wider range of prices implies a degree of mispricing and therefore scope to generate good returns, through an active approach.”

The above chart shows the ratio of yields and spreads on BBB to A-rated UK credit with a higher ratio indicating a wider gap and a greater array of investment opportunities.

A more selective approach is more favourable than the indiscriminate buying of the market employed by passive strategies, he explained.

“The overall market valuation has become unexciting, but there is considerable opportunity for security selection,” Golan said.

“Key, amid such a uniquely uncertain situation, is identifying companies with tenable balance sheets and business models which will remain unimpaired on the other side of Covid.”

He added: “Our north star is the margin of safety, which means only investing in bonds where the yield greatly overestimates the company’s default risk.”

Many of the mispriced opportunities are being found in the ‘tail’ of smaller constituents in the UK corporate bond market, which he described as ‘fairly concentrated’, with the ICE BofA Sterling Corporate index comprises over 450 issuers, of which the 50 largest account for 45 per cent of the total value of the market.

“It is in the ‘tail’ of smaller index constituents where more interesting and mispriced opportunities are more abundant,” Golan said.

And with the Covid-19 crisis and economic lockdown putting pressure on companies’ revenues and earnings, dividend cuts and stockpiling of cash is “a very positive development for creditors”, he added.

“This is not to say that the future entails only sunlit uplands,” he cautioned. “The environment we are experiencing today is unique and fraught with risks we did not experience in our lifetimes.

“A great deal of care and diligence is needed to identify businesses that will survive and thrive in the post-Covid world.”

He finished: “Navigating the UK corporate bond market successfully will increasingly depend on getting individual corporates’ fundamentals right.”

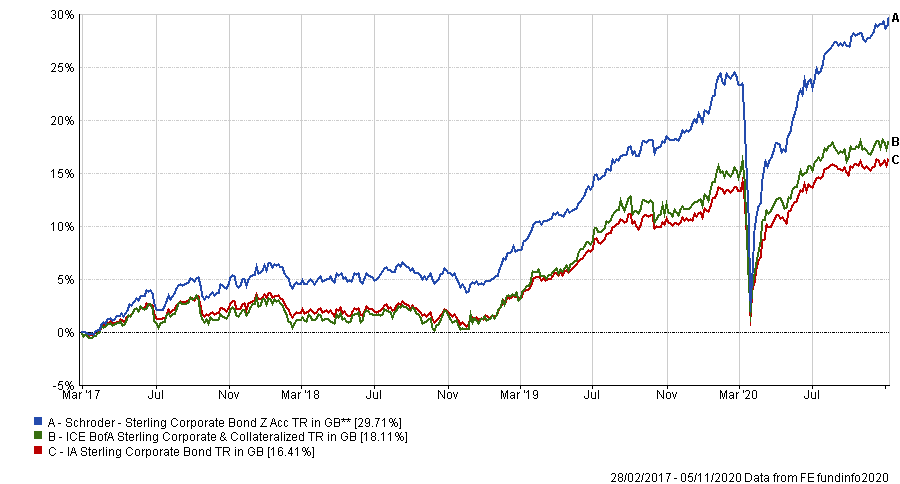

Golan has managed the four FE fundinfo Crown-rated Schroder Sterling Corporate Bond fund since February 2017. Under his tenure the fund has made a total return of 29.71 per cent compared with a gain of 18.11 per cent for the benchmark ICE BofA Sterling Corporate & Collateralized index and a 16.41 per cent return for the average IA Sterling Corporate Bond peer.

Performance of fund vs sector & benchmark under manager

Source: FE Analytics

It has a yield of 3.94 per cent and an ongoing charges figure (OCF) of 0.62 per cent.