Fears surrounding Brexit has held most investors back from owning UK equities for the past four years, but as the uncertainty finally draws closer to an end, Premier Miton Investors’ head of equities Gervais Williams believes it presents a “sensational” opportunity.

Veteran small-cap investor Williams who oversees the £88m Premier Miton UK Smaller Companies fund said any investors left holding UK equities in recent years have usually focused on international earners to mitigate any Brexit impact on sterling and domestic-facing companies.

He explained: “Most investors have gone off to make money elsewhere, and I think that’s even true for domestic institutions, wealth managers, and others, who have probably scaled back their UK weightings over the last four or five years.”

As a result, “the UK hasn’t really had as much fun as the rest of the markets around the world compared to the US and Asian markets”, admitted Williams.

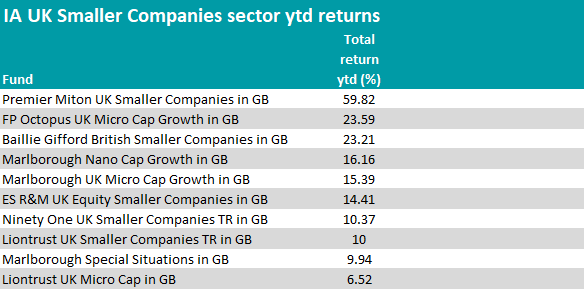

Indeed, the FTSE All Share has lagged other major markets year-to-date and is down 9.93 per cent.

Performance of major indices YTD

Source: FE Analytics

“The UK is only halfway up the hill, really, over the last four years,” Williams said. “So, I think we [will] start off with a degree of catch up to be had at some stage.”

As such, the Premier Miton manager said it is a good time for investors to reconsider exposure to strategies that hold a lot of high-beta growth stocks such as those listed on the US Nasdaq which have seen remarkable rallies year-to-date. He said if inflation takes off, or is less benign than expected, the enthusiasm for high beta stocks such as those in the Nasdaq could quickly fade, undermining their lofty valuations.

Instead, Williams favours UK smaller companies that are “generating cash” and “are less dependent on new fundraisings to put into growth going forward”.

“I think there’s been such a disparity between the enthusiasm for many of these high-beta stocks,” Williams said. “There's been such a tiredness about buying companies such as the mining companies or perhaps the banks, that most people have almost given up.”

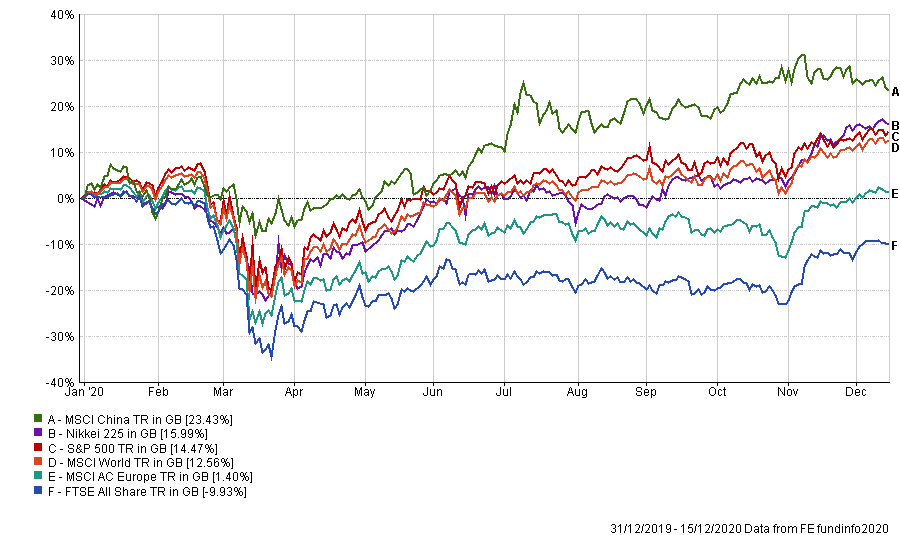

After suffering poor performance and client redemptions in 2019, his Premier Miton UK Smaller Companies fund has become the top-performing fund in the sector this year by a wide margin.

Source: FE Analytics

The performance has come off the back of a strong rally in certain UK small-cap stocks, as well as a successful put option on the FTSE 100 that Williams purchased before the crisis.

Despite the strong uplift in performance, Williams is confident that the rally in UK small caps has only just begun.

“The risk-reward ratio is really the best I’ve come across in my career. It’s sensational,” he said. “We’re buying companies at what I consider are not just inexpensive relative to other companies, but in absolute stock valuations stunningly cheap.

“That is a real surprise at this stage in the bull market, normally most things are a bit expensive, and some are more expensive than others, but I don’t think that’s the case at the moment.

“I think there are some cases in the UK, particularly outside the largest companies in the UK, in some small- and mid-sized companies where the valuations are absolutely stunningly low.”

One company he declined to name but is currently buying is a £500m financial company trading at a price-to-earnings ratio (P/E) of 3.2.

Another unnamed company is a construction business that was trading at below cash value earlier in the year, “doing mid-year turnover of around 10 times its market capitalisation”.

“That’s just extraordinary to find these companies sitting around and being able to buy stock,” he said. “Just amazing.”

One company Williams did name was AO World, the UK-based electrical retailer. The stock has rallied over 350 per cent year to date and is now the fourth largest position in the fund.

“If you go on their website, they’re sold out of most things,” he said. “Their volumes are through the roof. The chief executive there, his main objective is to have enough people to deliver, so he’s really massively scaled up.

“The billions of deliveries are up three times what they would have been in this year, and they still can’t keep up with demand. It was about 60p when we bought it and despite it now trading at 390p, we’re still not selling it.”

He continued: “The risk-reward ratio, not just off the upside, but the scale of the upside is just an abnormally large amount. It’s just exceptional.”

Since setting up the Premier Miton UK Smaller Companies fund in 2012, Williams noted that it is ranked fourth out of 45 in terms of alpha – a measure of a fund’s over- or underperformance relative to the benchmark – and has one of the lowest beta figures – which measures how sensitive a fund is to movements in its benchmark – in the sector.

“In all normal circumstances, this fund should have massively underperformed, but because we’ve been able to add value through stock selection – alpha – we’ve managed to offset that,” Williams finished.

Performance of the fund vs sector & benchmark since launch

Source: FE Analytics

Premier Miton UK Smaller Companies has delivered a total return of 204.3 per cent since launch, compared to 142.01 per cent from the average fund in the IA UK Smaller Companies sector, and 92.92 per cent from the Numis Smaller Companies index.

The fund is co-managed by Gervais Williams and Martin Turner. It has an ongoing charges figure (OCF) of 0.91 per cent.