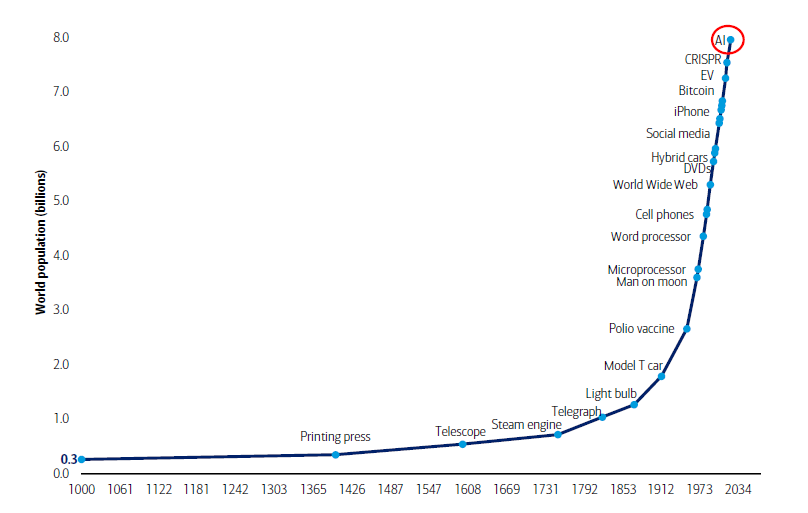

Talk of technological disruption is almost constant and the latest innovation to dominate the headlines is generative AI models such as ChatGPT.

In its latest The Longest Pictures report, Bank of America highlights the long history of technological disruption as a major drive of disinflation and asset prices over the past 30 years.

Technological disruption since 1,000AD

Source: BofA Global Investment Strategy, Global Financial Data

“Technological disruption has reduced the price of goods and services (internet increased supply) and the price of labour (via robotics, automation, internet and now AI),” its strategists said. “Unambiguously disinflationary this century, the evidence that tech disruption has increased productivity is much less compelling.”

Despite this, tech remains the leading sector in the global stock market, especially in the US equity space. However, negative side-effects such as the social and wealth inequality resulting from tech disruption, the monopolistic power of Big Tech and worries around the impact of AI has cast a shadow over the sector and calls are mounting for greater regulation and more taxation.

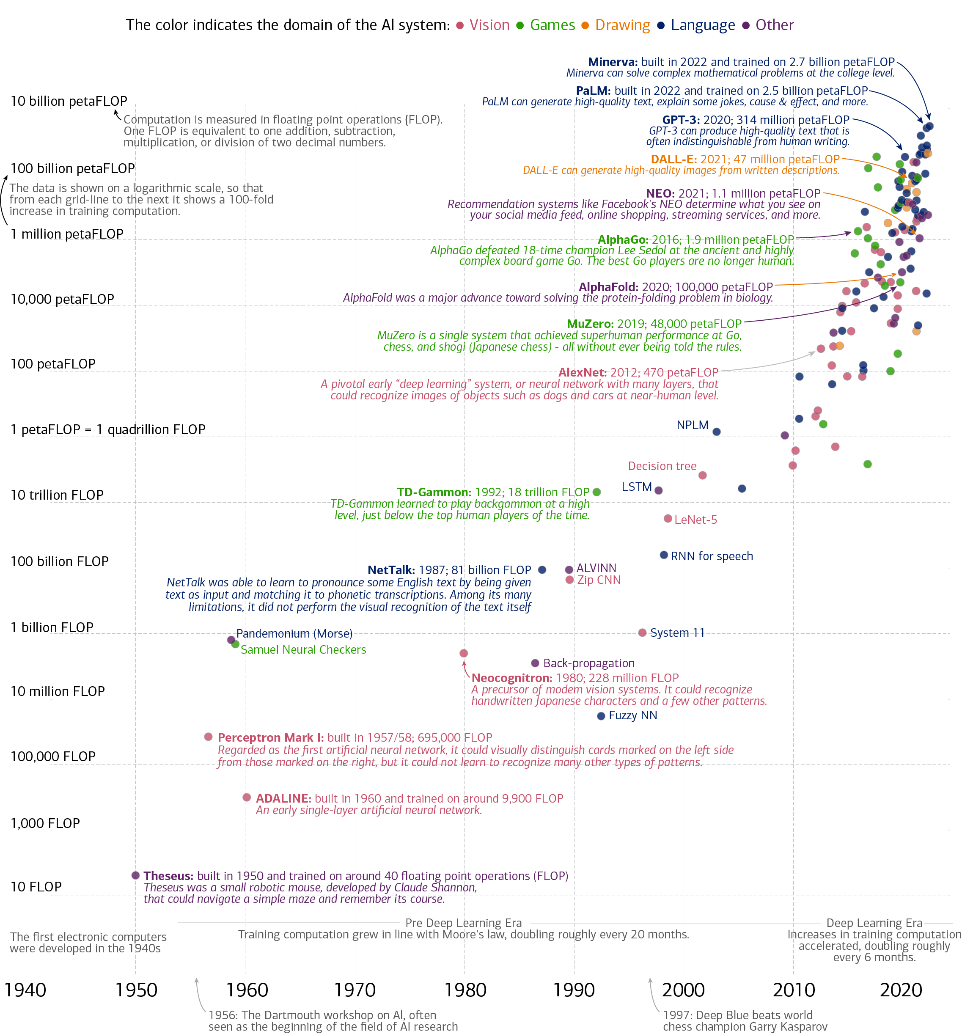

Rise of AI and related technologies over the past 80yrs

Source: BofA Thematic Research, Sevilla et al (2022) Parameter, Compute, and Data Trends in Machine Learning

When it comes to AI, the advance has been rapid. The chart above shows the evolution of ‘floating point operations’ (FLOPs) in AI. This is how computing power is measured; one FLOP is equivalent to one addition, subtraction, multiplication or division of two decimal places.

One of the first examples of AI was Theseus, a small robotic mouse that could navigate a simple maze, which was built in 1950 and trained on around 40 FLOPs. Fast forward to today: an AI called Minerva designed to solve complex maths problems was trained on 2.7bn petaFLOPs (one petaflop is 1 quadrillion FLOPs).

“The race for dominance in AI has in 2023 caused a massive rerating in stocks involved in the AI ‘arms race’ and has led to much market bullishness that a fourth industrial revolution is underway that will structurally boost productivity growth and increase profits,” Bank of America said.

“Bears will point out that from steam power to the internet there has always been a lag between innovation and widespread social, corporate and economic adoption; in addition the quickest way for AI to increase productivity is via a significant rise in unemployment.”