Falling in love with a stock is a dangerous thing but there are some companies that have reciprocated by providing stellar returns for managers, earning a place in their hearts and their portfolios.

Not all love lasts. When the time is right, managers must be cruel to be kind and cut ties before the relationship goes downhill. But there are some partnerships that are far from a fleeting fancy and have become long-term commitments.

Below, Trustnet asked UK and global fund managers for the stocks that rewarded them for their affection.

AO World

Gervais Williams, manager of The Diverse Income Trust, chose electrical retailer AO World this Valentine’s day.

The manager explained he "fell in love" with the stock because of how it treated its customers rather than its performance.

He said: “AO World go into battle with the manufacturers on our behalf.” Because the company insists all electronic repairs are completed by the next day and is willing to step in and replace the devices themselves if they are not, AO World has built a loyal and dedicated customer base.

“If love is about genuine care, then in my view, AO World delivers it in spades,” he concluded.

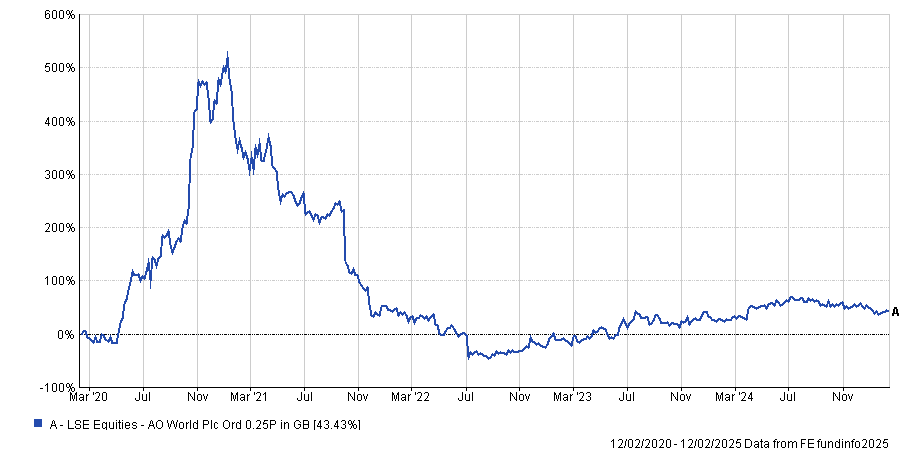

Performance has certainly been mixed. The stock struggled following its initial public offering (IPO) in 2014 and remains some 73.6% lower than its start price.

It surged during Covid as the online retailer benefited from a wave on enthusiasm for e-retailers as people were forced to stay at home during lockdowns, but has fallen back since.

Despite this volatility, it remains up 43.4% over five years – ahead of the FTSE All Share’s 35.2% gain. As a result, this stock will be loved by some who could have made big profits by timing their trades well but is unlikely to be loved by all as there will be many who have made significant losses by buying at the wrong time.

Total return over the past 5yrs

Source: FE Analytics

AJ Bell

Ben Needham, manager of the Ninety-One UK Equity Income fund, said investment platform AJ Bell is celebrating its sixth anniversary at the "bedrock of the portfolio".

“It is a simple, clean and capital-light company that is perfectly positioned to benefit from increasing economies of scale”, Needham said.

He explained the business was fundamentally impressive, having doubled its user base since its initial listing on the stock market in 2018, and has benefited from more investors have looking to "take ownership of their wealth and invest”.

“For us, AJ Bell is unique in that it has a dual-pronged approach to the savings market through its direct-to-consumer and adviser-led businesses”, Needham said. As a result, it has customers across a broad range of UK demographics, positioning it well for further growth.

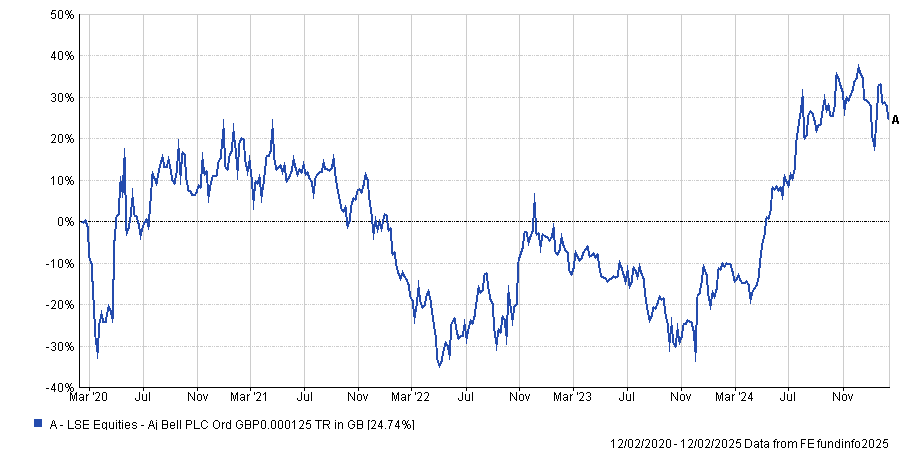

Total return over the past 5yrs

Source: FE Analytics

AJ Bell has delivered a 24.7% total return in the past five years, below the FTSE All Share, but has rocketed over the past 12 months, up 38.6%. Despite this, Needham argued it remained cheaply valued and underappreciated by many investors.

Shopify

Greg Eckel, portfolio manager at Canadian General Investments, identified Shopify as his Valentine's favourite. He explained the stock remains relatively unknown to investors despite being the second-largest e-commerce platform outside of China.

Its straightforward business model has enabled it to build a loyal customer base, serving both small independent companies and global businesses such as Nestle, he noted.

This has allowed it to grow sustainably over time, with Eckel highlighting its third-quarter earnings report in 2024 as a reflection of this. The firm announced net income has risen to $828m, up from $718m in 2023.

Share price performance over the past 5yrs

Source: Google Finance

Eckel has been in a long-term relationship with the stock since 2016, keeping faith in the company even during a sharp sell-off in 2022. “Shopify's turnaround is a testament to the power of patient investing – a mindset often overlooked in today's fast-paced world” he concluded.

Comfort Systems

Nick Sheridan, manager of the Janus Henderson Horizon Global Smaller Companies fund, described his process as "fairly unemotional" so does not have a stock he was “in love with”. However, he “currently fancies” building services provider Comfort Systems.

Share price performance over the past 5yrs

Source: Google Finance

Based in the US, the business provides heating and ventilation for data centres and other industrial and commercial buildings. This has tied it to the rapidly expanding Artificial Intelligence (AI) megatrend.

Sheridan added the company benefits from several structural tailwinds beyond AI investment, such as the early adoption of climate control in the US, with buildings needing technology to control air quality and temperature variations.

Despite expecting growth to continue in the medium term, Sheridan said they did not plan to hold this stock forever.

“In line with the Valentine's Day analogy, one might describe us as ‘users’ when it comes to stocks: we follow them carefully when they have utility for us and ditch them without a second glance when they become overvalued", Sheridan said.