Index trackers have outpaced their active peers in many of the specialist industry fund sectors such as tech and financials, research by Trustnet shows.

This annual series scores funds on 10 key metrics: cumulative three-year returns to the end of 2024 as well as the individual returns of 2022, 2023 and 2024 (to ensure performance isn’t down to one exceptional year), three-year annualised volatility, alpha generation, Sharpe ratio, maximum drawdown and upside and downside capture, relative to the sector average.

We then used each fund’s average percentile ranking for the 10 metrics to discover which were consistently at the very top of their sector across the board. Essentially, the lower a fund’s average percentile score, the stronger it has been over the past three years.

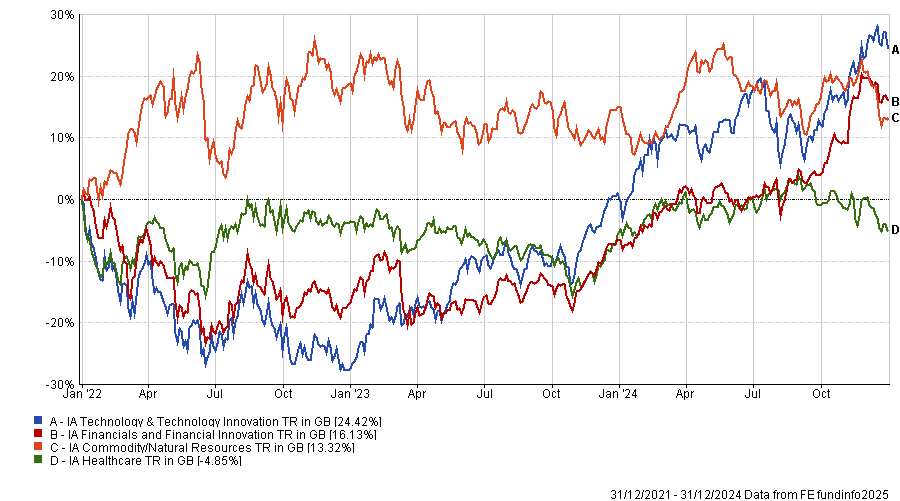

Performance of sectors over 3yrs to end of 2024

Source: FE Analytics

In this research, Trustnet has put the Investment Association’s four industry-focused sectors – IA Technology & Technology Innovation, IA Financials and Financial Innovation, IA Commodity/Natural Resources and IA Healthcare – under the spotlight.

As the chart above shows, these sectors have experienced mixed fortunes over the past three years with some investing in the market’s leading companies and surging as a result while others handed their investors losses.

Source: FE Analytics

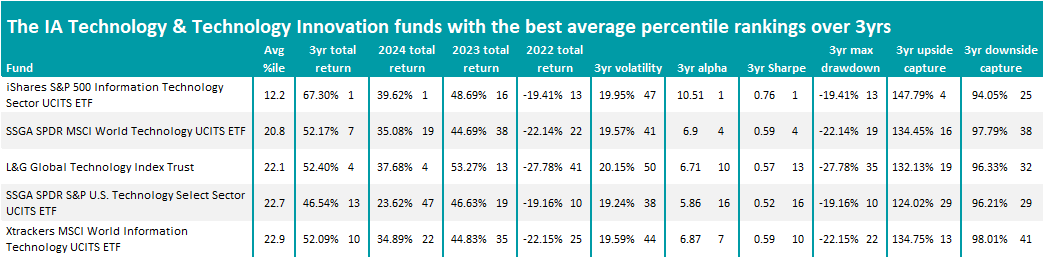

We start with the IA Technology & Technology Innovation sector which, thanks to the artificial intelligence (AI) revolution and the rise of the so-called Magnificent Seven, has generated some strong returns in recent years. The average fund in this peer group has made a total return of 24.4% over the three years to the end of 2024.

In this study, the best performer was the iShares S&P 500 Information Technology Sector UCITS ETF, with an average percentile ranking of 12.2. The fund tracks the S&P 500 Information Technology index, which means its largest holdings are US tech mega-caps like Apple, Microsoft, Nvidia and Broadcom – all of which are beneficiaries of the AI theme.

It is a similar story with the other four funds in the table above – all are index trackers and therefore have significant exposure to the Magnificent Seven (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla) and other large US tech businesses, which have led the market in recent years.

The highest-ranked active fund is Fidelity Global Technology, which is in sixth place with an average percentile ranking of 24.7. This fund differs from many of the index trackers in the sector, in that it is underweight the US and, while it does own some of the Magnificent Seven, its largest holding is Taiwan Semiconductor Manufacturing Company.

Trackers are also found mid-table in this research, while the worst-performing member of the sector – WisdomTree Cloud Computing UCITS ETF, down 21.9% over the three-year period – is also passive.

Source: FE Analytics

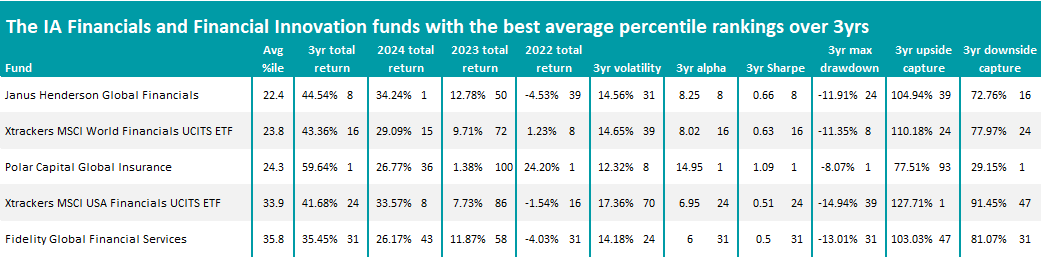

In the IA Financials and Financial Innovation sector, an active fund – Janus Henderson Global Financials – came in first place with an average percentile ranking of 22.4, scoring strongly for three-year returns, alpha and Sharpe ratio.

The portfolio is underweight the US and overweight the UK, Italy, France and Austria. Manager John Jordan recently said: “We have identified a number of European banks that appear positioned to return significant capital to investors going forward, aided by a backdrop of non-zero interest rates and relatively stable and predictable regulation. While the market has begun to reward such stocks, we believe they still trade at attractive valuations.”

Two other active funds (Polar Capital Global Insurance and Fidelity Global Financial Services) are also among the top five with the best average percentile rankings but so are two passives (Xtrackers MSCI World Financials UCITS ETF and Xtrackers MSCI USA Financials UCITS ETF). It is important to note that these are the only index trackers in the sector, meaning they have outperformed the majority of their active peers.

Source: FE Analytics

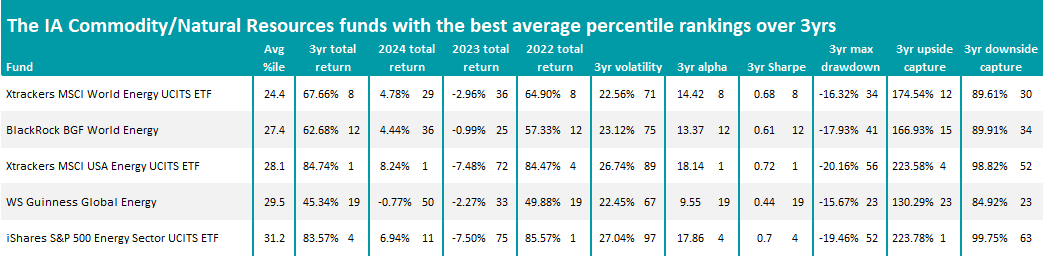

Passive funds also came out strongly in the IA Commodity/Natural Resources sector, with Xtrackers MSCI World Energy UCITS ETF taking first place and two US-focused trackers (Xtrackers MSCI USA Energy UCITS ETF and iShares S&P 500 Energy Sector UCITS ETF) holding the third and fifth spots.

BlackRock BGF World Energy and WS Guinness Global Energy are the active funds that came out best in this research. BlackRock BGF World Energy is the best performing active fund in the sector, with a three-year return of 62.7%, and its managers are members of BlackRock’s respected natural resources team.

WS Guinness Global Energy, meanwhile, has a place on FE Investment’s Approved List. The team’s analysts said: “This fund provides a concentrated exposure to traditional energy companies and the team is extremely experienced investors in the market, having been through several energy market cycles. The management team tends to be bullish on the oil price, such as the fund appears to be more volatile than other energy peers.”

The peer group’s worst fund in this research is an index tracker: iShares Global Clean Energy UCITS ETF has an average percentile ranking of 93.1, driven by a 40.2% three-year loss.

Source: FE Analytics

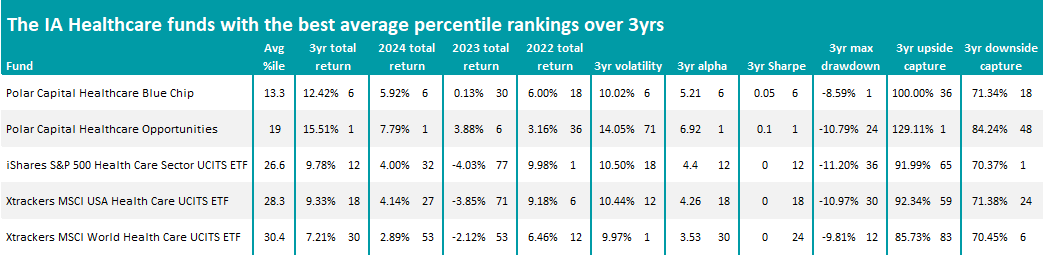

Finally, the IA Healthcare fund with the best average percentile ranking in this study is Polar Capital Healthcare Blue Chip, with Polar Capital Healthcare Opportunities taking second place. They are the only funds in the sector to make double-digit gains over the three years under consideration.

The active funds are managed by members of Polar Capital’s eight-strong specialist healthcare team, which was established in 2007. Many of its members have previously held senior industry roles, including careers such as research scientist, clinical specialist or working in academic laboratories and institutes.

Passive funds investing in global or US healthcare stocks round out the top five funds but the worst performer – WisdomTree BioRevolution UCITS ETF with a loss of 33.3% – is also an index tracker.