Fund managers are deploying some of the cash held on the sidelines over the past year, a closely watched survey has revealed, adding to both bonds and equities as optimism over a potential soft landing for central banks and interest rates grows.

In November, the average cash balance fell from 5.3% to 4.7%, the lowest in two years, the Bank of America Global Fund Manager Survey found.

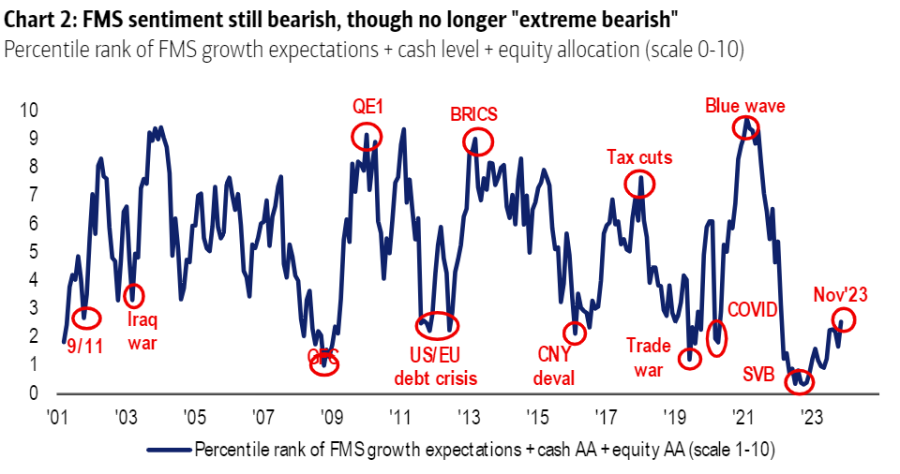

Fund managers remain cautious but their expectations have lifted from ‘extremely bearish’ to ‘bearish’, the survey found. They are nervous about the macroeconomic picture, with a net 57% expecting a weaker global economy over the next 12 months, but have turned bullish on interest rates, with a soft landing and lower rates expected in 2024.

Source: Bank of America Global Fund Manager Survey

A soft or no landing is now predicted by 74% of respondents, up from 64% a month ago, with hard landing fears down from 30% to 21%.

Around three-quarters of those surveyed said the Federal Reserve was likely done with interest rate rises, up from 60% last month. The US central bank paused its rate hikes for the second consecutive meeting earlier this month.

“Consensus is for lower short-term rates and lower inflation, with expectations for both hovering near financial crisis highs. Only 6% expect global CPI to inch higher in 2024 (a three-month low) and just 6% expect higher short-term rates,” the report said.

As a result, worries over inflation and central banks is “rapidly diminishing” with a quarter of participants believing high inflation keeping central banks hawkish is the main risk for markets, down from 45% in July. Geopolitics now holds the top spot with 31% noting this as the biggest risk in markets.

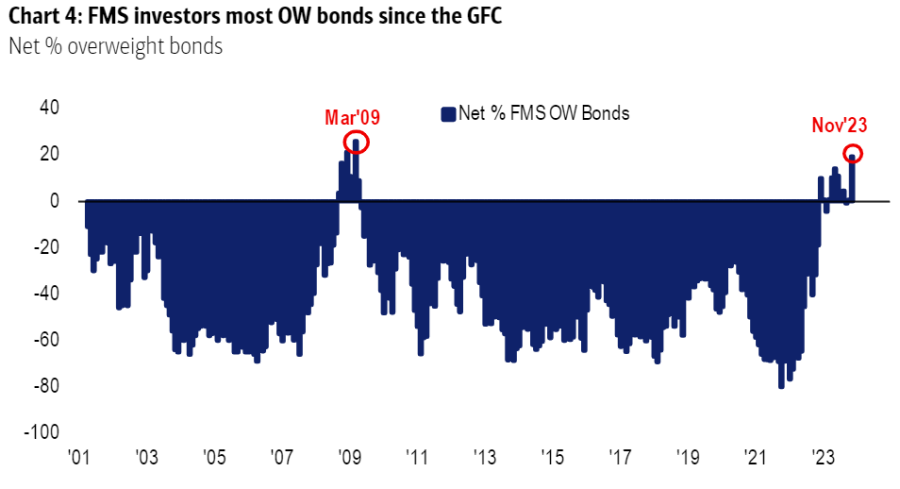

The main beneficiary of this more positive stance has been bonds, with a higher conviction in lower inflation, interest rates and yields. A record 61% now expect lower bond yields in 12 months' time, the report noted.

Fund managers moved to their largest overweight to fixed income in 14 years, a level that has only been eclipsed since the turn of the century in March 2009 and December 2008 – the height of the financial crisis.

Source: Bank of America Global Fund Manager Survey

More than half (54%) expect fixed income to be the best performing asset next year, with 29% forecasting stocks to outperform all other asset classes. Some 94% expected bonds, stocks and commodities to outperform cash.

Participants also noted a small overweight to equities – the first time they have done so since April 2022, which is also based on a stable macro outlook and much more optimistic view on rates.

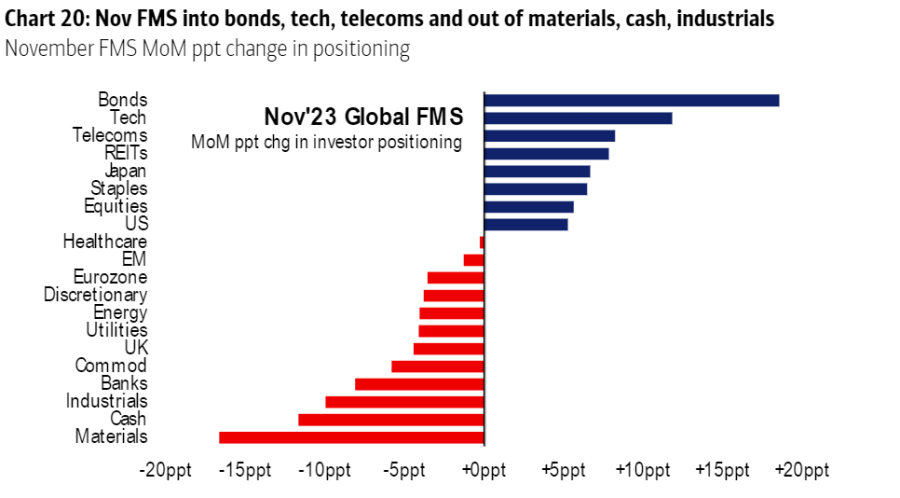

Going long large-cap technology is the most “overcrowded” trade, along with shorting Chinese stocks, according to the report.

Investors bought tech stocks at the fastest pace since May 2023 last month and are now at their most overweight since November 2021, eschewing banks, which went from a net 2% underweight to 10% underweight.

Source: Bank of America Global Fund Manager Survey

At a country level, fund managers moved money into Japan and the US and took cash away from UK and European companies. The relative overweight between the Japan and the US versus the UK and Europe is now at its widest since November 2008.

The survey polled 265 asset allocators running a total of $632bn on their positioning and outlook.