Savers have had a great year so far in 2023 as savings accounts have offered interest rates unseen over the past decade of lax monetary policy.

But with central banks possibly expected to cut base rates soon, yields have already started to come down on these products, as happened earlier this week in the UK.

The money market was never a place to hide forever, according to experts, as investments are much more likely to beat inflation and provide capital appreciation. On top of that, equity income also provides dividend increases, which cash doesn’t (but on the other hand, dividends aren’t guaranteed).

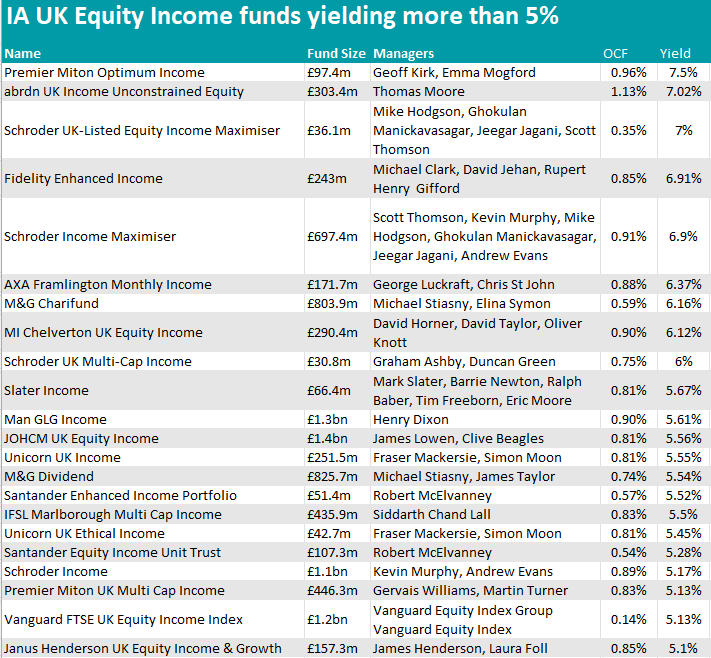

For investors looking for UK-based equity income, in this article, we focus on the funds and trusts yielding more than 5%, which is approximately what savers can get through the best savings accounts available today. Last week we covered global equity income.

Currently the top payer within the IA UK Equity Income sector is Premier Miton Optimum Income, which yields 7.5%.

With this strategy, managers Geoff Kirk and Emma Mogford prioritise maintaining a yield of 7% per annum over potential capital upside, while still aiming to grow it over the long term.

This is a “core”, all-cap strategy, which enhances income through the combination of company shares with a covered call overwriting component.

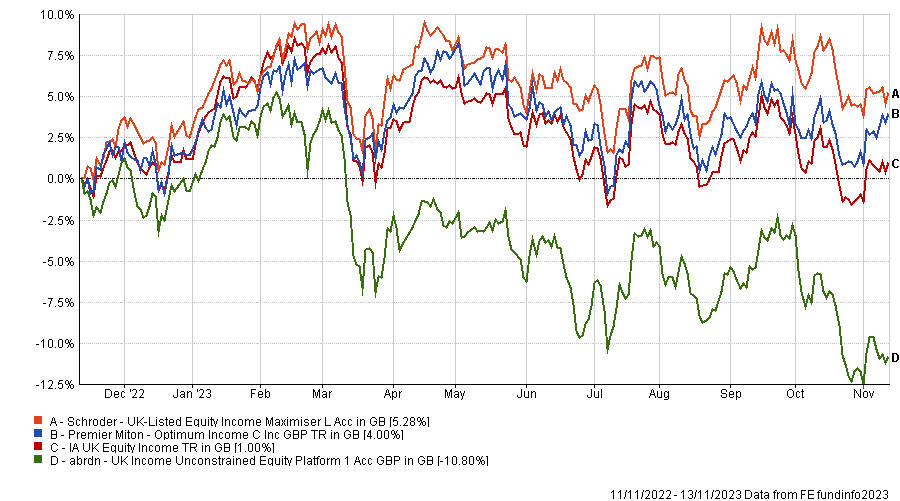

Source: FE Analytics

In second position, abrdn UK Income Unconstrained Equity aims to deliver a yield greater than that of the FTSE All Share Index over a rolling five-year period, while also achieving some capital return before charges. It pays out 7.02%.

Concluding the top three, Schroder UK-Listed Equity Income Maximiser makes use of derivatives to replicate the performance of the FTSE 100 index with an income over 7% per year.

The strategy is to minimise overall trades and avoid higher trading costs associated with less frequently traded securities, FE fundinfo analysts explained.

“The strategy used to maximise income is common and investors should not be put off by the derivatives overlay. The derivatives strategy is only employed on top of a passive strategy, while many of its peers use it on top of an active fund, which can significantly underperform the index,” they said.

“Investors with a high income target, and who have less regard for capital return, are best suited for this fund, which, relative to similar strategies, is simple and more cost-effective.”

Performance of funds vs sector over 1yr

Source: FE Analytics

But the cheapest fund in the list (and also one of the largest in assets-under-management (AUM) terms is the passively managed Vanguard FTSE UK Equity Income Index, which only charges 0.14% for a 5.13% income rate.

The portfolios that are larger than £1bn are Schroder Income, JOHCM UK Equity Income and Man GLG Income, all of which have a correlation to each other of 94% or higher. All invest with a value tilt – looking for misprice stocks they hope will rebound – but differ in their exposures, especially to utilities, industrials and consumer products.

The Schroder Income fund was given an ‘A’ rating by analysts at Square Mile. They said: “The strategy is a credible one that we feel should add value over the longer term, yet it is also a little different from the more traditional equity income approach.”

Also given an ‘A’ rating by the firm is the Man GLG portfolio managed by FE fundinfo Alpha Manager Henry Dixon. The fund is recommended by analysts Barclays as well, who put it on the company’s best-buy list.

They noted: “While past performance is not necessarily an indicator of future performance, when we analyse the performance of this fund, we feel confident that it has been driven by successful stock selection decisions, rather than a simply being in the right style of companies at the right time (for example, being in mining companies or smaller companies at the time when they outperform the wider market).”

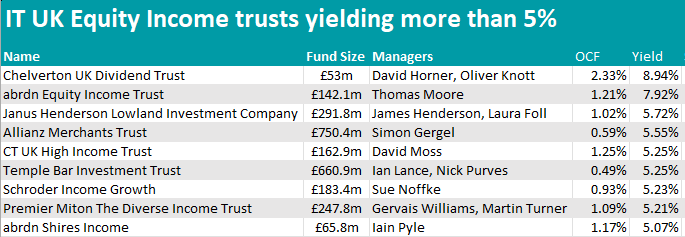

In the investment trusts universe, the yields are even higher.

Topping the list is the FE fundinfo five Crown-rated Chelverton UK Dividend Trust, which pays an income of 8.94% generated through investing predominantly in UK listed small- and mid-cap companies. It currently trades on a 0.17% discount.

Source: FE Analytics

The abrdn Equity Income Trust also beats its mutual funds peers and is part of the Association of Investment Companies (AIC)’s Dividend Heroes list. It currently trades at a discount of 0.65% and yields 7.92%.

Analysts at Kepler Trust Intelligence said the trust “should appeal to investors looking for a high-income yield that is well-protected against inflation, while also offering long-term capital growth potential”. They noted its high yield and resilience to inflation, but warned that the value style has meant returns have disappointed in the medium term and that gearing could exacerbate losses.

It’s a big drop from here to the third position, where FE fundinfo Alpha Manager James Henderson’s Lowland Investment Company resides. It pays out 5.72%.

In the trust’s latest monthly factsheet, managers Henderson and Foll said they remain bullish on the outlook for UK stocks going forward, as they are “trading at a significant discount to their long-run average valuation level”.

“This discount extends across the majority of sectors, as well as different company sizes, with medium-sized companies in the FTSE 250 index also trading at a discount to their long-run average level. In our view this creates an opportunity, as there are many UK-listed businesses that are market leading, well managed and capable of achieving attractive long-run sales and earnings growth.”