The US market has been on the precipice of a bear market this week following US president Donald Trump’s ‘Liberation Day’ tariff announcements last Wednesday.

From its peak in February, the S&P 500 has dropped 17.5%, leaving it flirting with a 20% decline that would officially declare the drop as a bear market.

Yet it closed Monday higher and early trading on Tuesday was also in positive territory. Russ Mould, investment director at AJ Bell, said the benchmark “has started to try and scramble to safety”.

“The S&P 500’s rally on Monday takes it out of bear market territory, but the technology-laden Nasdaq Composite has fallen by 23% from its December zenith, so the situation remains delicately poised, especially as share prices seem to be hanging upon president Trump’s every word on the subject of trade and tariffs.”

But not all are convinced that we have seen the last of the down markets. Having often been described as a bubble for the past decade and a half, if the recent Donald Trump-induced sell-off has indeed pricked it, the downside could surpass 50%, according to Brian Dennehy, managing director at Dennehy Wealth.

“Investors already know about the extreme valuations in the US and about the particularly over-excited borrowing of record sums to throw at the S&P 500,” Dennehy said. “If this is the US bubble well and truly bursting and the beginning of the much anticipated ‘reset’, we also know that history informs us to expect falls in excess of 50%.”

As China announced its retaliatory tariffs against the US, an accelerating trade war looks the most likely outcome, he said, adding that Europe must now step out from behind China and defend itself from Trump’s “cowboy economics”, although this term is “deeply offensive to cowboys”.

He noted: “Will Europe retreat to warm words or hit hard? What is the best way to deal with the bully in the playground? Everyone acts together. Better still, a cooler head might emerge and provide global leadership, and turn Trump away from his absurd tariff policies without making him feel the idiot he is. Right now, the latter feels like the least likely outcome, so an accelerating trade war is probably the path of least resistance.”

This, however, would mean the US market will continue to tumble. “As trust in the US continues to deflate, sales of the S&P 500 will persist.”

Ruairi Dennehy, chartered financial planner at Dennehy Wealth, said: “Purely crunching the numbers to compare today to history, [American economist John] Hussman notes that the S&P would need to fall 73% to restore the index to a run-of-the-mill valuation,” Ruairi Dennehy said.

“Such falls can occur quickly or take years, no one knows precisely how in advance. But prices typically swing from one extreme to another, not back to run-of-the-mill. These point to valuation extremes comparable with 1929 and 2000 in particular, and, depending on which US index you use, falls were from 50% to 80%”.

Financial history tells us that bubble valuations and an investor mania are very dangerous – a long-term chart of the S&P suggests a bear market end point can be as much as 70% down from the peak, the financial planner explained.

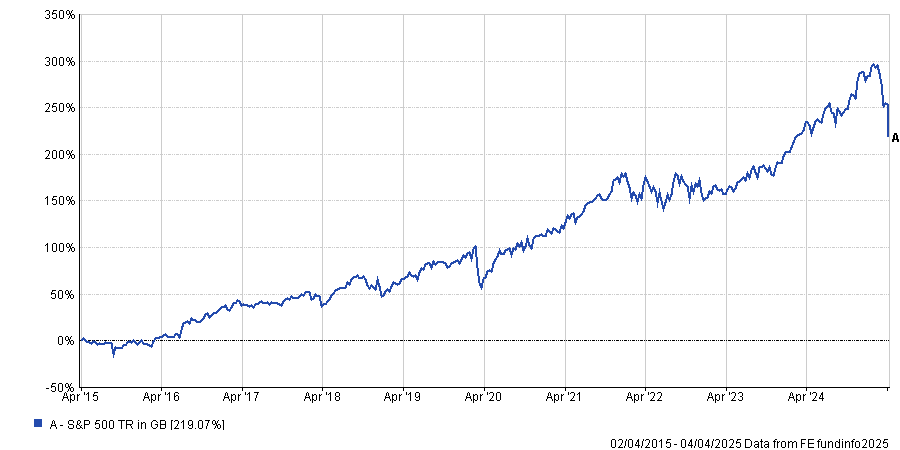

Performance of index over 10yrs

Source: FE Analytics

“It’s a rough guide, but good enough to give investors a sense of the risks. Of course, that bubble and mania combination has been in place for five years and recognising this vulnerability doesn’t require making a prediction, it is just how history informs us as to the risks.”

Geared investors will be first to head for the exit, Brian Dennehy anticipated, should the US market continue to slide, as well as foreign investors.

“US-based institutions dare not be seen to sell for fear of a Trump-tribe backlash, but they will find ways to do so. The foreign investors in the S&P 500 are an interesting bunch. Full of enthusiasm, buoyed by the idea of American exceptionalism, largely oblivious to the considerable valuation risk, let alone political risk, they piled into.”

The problem is not so much that European investors are “horribly over-exposed to the US” (they holding about 17% of the value of the US stock market, not far off the value of all European stock markets combined), but that the US stock market is “very sensitive to the whim of increasingly nervous European investors”.

If markets really do tumble, the average bear market in the S&P 500 since 1950 has lasted 381 days, said Mould.

“However, it does look like the bigger the prior bull market gain, the bigger the post-party hangover can be,” he warned.

“The thumping bull market gains of 1990-2000 and 2002-2007 were followed by two shocking bear markets, not least as valuations had become very stretched relative to historic averages. As a result, the bear markets of 2000-03 and 2007-09 were much deeper and longer than average, which is something that investors need to ponder in the current circumstances.”