Self-Invested Personal Pension (SIPP) drawdown investors are showing an increasingly bullish attitude towards the market, favouring high-risk assets, particularly in technology and US-based investments, according to data from Hargreaves Lansdown.

A SIPP is a retirement savings plan available in the UK that allows individuals greater control over their pension investments. Unlike traditional pension schemes, SIPPs offer a broader range of investment options, including stocks, funds, and other assets.

Emma Wall, head of investment analysis and research at Hargreaves Lansdown, said: "Optimism abounds amongst the golden oldies. Despite stubborn inflation, compelling cash rates and a hazy economic outlook, HL clients investing in drawdown are looking to artificial intelligence to fund their retirement."

As the growing popularity of technology-focused investments mounts, passive funds are also gaining traction among SIPP drawdown investors.

This shift towards passive investing is driven by a desire for simplicity and cost-efficiency with index funds effectively tracking the market's performance over time.

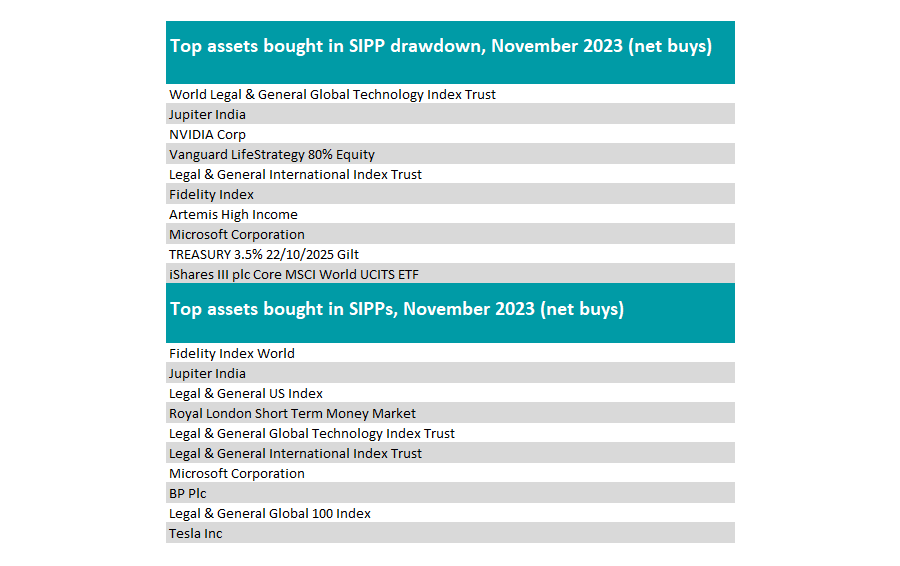

Key passive funds that have attracted the attention of SIPP drawdown investors include the World Legal & General Global Technology Index Trust and the iShares III plc Core MSCI World UCITS ETF.

The former offers broad exposure to the technology sector while minimising management fees, while the latter is a global equity tracker dominated by the US tech sector, making both attractive options for investors seeking to capitalise on the sector's long-term growth potential.

Retirees are opting for riskier investment choices, deviating from the conventional practice of de-risking during retirement. Although the bulk of the list is in high-risk strategies, some lower-risk assets such as gilt investments and multi-asset funds are present, albeit in fewer of them.

Source: Hargreaves Lansdown

In addition to technology-focused investments, emerging markets and income funds have emerged as popular choices among SIPP drawdown investors seeking to diversify their portfolios and generate regular income streams.

The Jupiter India fund has been a consistent performing sitting second in the IA India/Indian Subcontinent sector over one and three years and third over five years. The £898m fund is managed by Avinash Vazirani, who aims to capitalise on India's dynamic economy and potential for long-term growth.

Artemis High Income is managed by FE Fundinfo Alpha Manager Ed Legget, Jack Holmes, and David Ennett and has also been a top performer in the IA Sterling Strategic Bond sector, recording a top-quartile return over one, three five and 10 years. The £785m fund has attracted investors seeking consistent income streams. The fund's focus on high-yielding bonds provides investors with a regular source of income while aiming to preserve capital.

These funds, along with passive options such as the £9.7bn Vanguard fund offer SIPP drawdown investors a range of strategies to suit their risk tolerance and investment objectives.

Those SIPPs in the accumulation phase are also invested in predominantly tech-heavy investments such as Microsoft, Tesla, and BP, although one money market fund cracked the list. This divergence in investment approaches between drawdown and accumulation stages underscores varying risk appetites among pension investors.

Wall urged investors to evaluate their risk tolerance and investment objectives carefully, however. While US investments remain popular, concerns about valuations suggest a need for diversification across styles, sectors, and countries.

The market's current valuation suggests caution, especially regarding the overvaluation of top S&P 500 constituents compared to broader market indices.

Wall added: "Investors at all stages of their pension saving should consider their investment goals and their appetite for loss before investing, as well as what is already in their portfolio.

"Valuations in the US look close to fair value when compared to their history. The top 10 constituents of the S&P 500 are trading at significantly higher valuations compared to the rest of the market; the gap between the Magnificent Seven and their index siblings is a chasm and a widening one."