Markets have had two strong years as interest rates have steadied and the rise of artificial intelligence (AI) has led to a boom in tech stocks, particularly those in the US.

It could give some investors confidence that this year will be another one of prosperity – with some willing to take on more risk to achieve higher returns.

As such, Paul Angell, head of investment research at AJ Bell, has highlighted four funds that should do well if markets continue upwards. Yesterday we looked at his defensive and income selections for those who believe this year is likely to be less fruitful.

Adventurous investors

For those looking to take on much more risk, WS Gresham House UK Smaller Companies could be the way to go. Although “less well known” in the IA UK Smaller Companies sector than some of its peers, Angell said the fund’s performance has “started to attract more interest”.

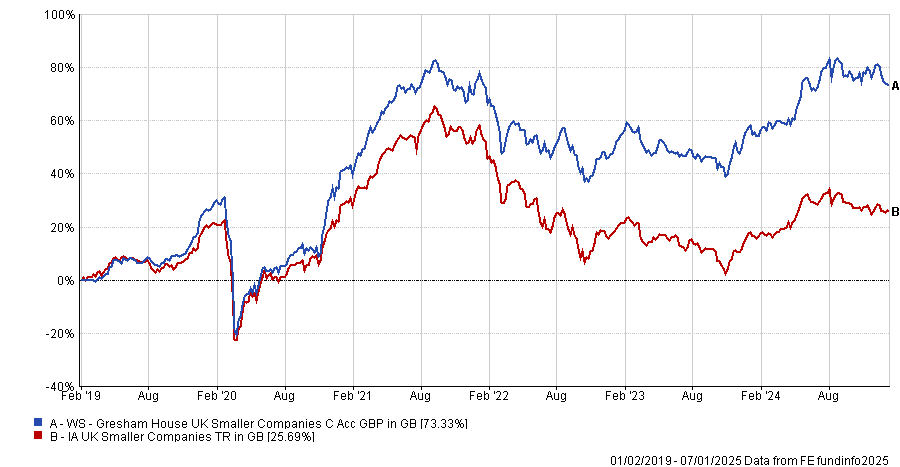

Since its launch in 2019 the portfolio has made 73.3%, almost three times the sector average, with manager Ken Wotton drawing on his previous expertise in the private equity sector.

Performance of fund vs sector since launch

Source: FE Analytics

“The team is made up of five investment professionals, with a mix of both public and private market experience, who look to harness their private equity expertise within public markets,” he said.

Wotton and his colleagues look into the management teams, business strategy, market positioning and financials of investee companies before working out what he believes is a company’s fair value.

“Research goes beyond reviewing company reports and meeting company management teams, as they also take advantage of a large network of external contacts who offer in-depth insights into industry specifics that the team may not otherwise know,” said Angell.

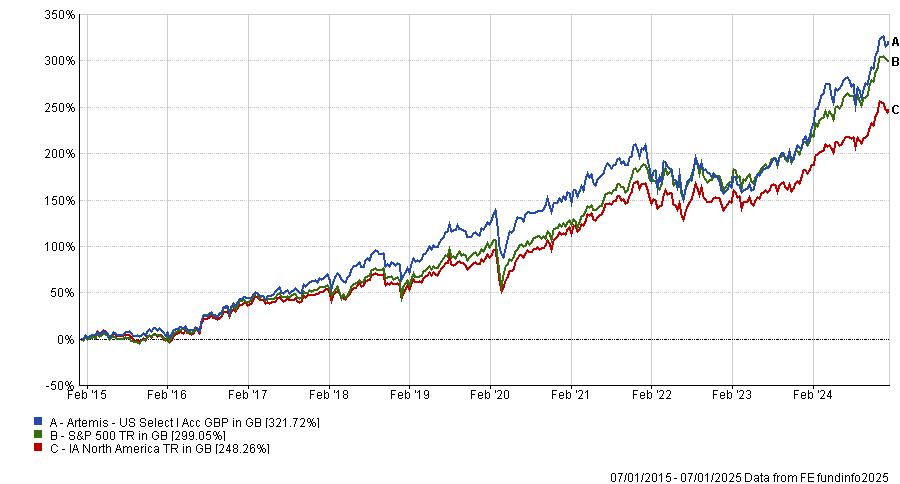

Across the pond, he also suggested Artemis US Select, one of the few US portfolios to beat the S&P 500 index over the past 10 years.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Run by Cormac Weldon since 2014, with Chris Kent joining him in 2022, the fund is style agnostic, although the managers have a two-to-one risk/reward potential which often results in them investing in higher growth names.

“The broader team is made up of six analysts split by sector who travel to the US a number of times a year and who each have around 25 stocks under coverage at any point. The fund has enjoyed a return to form in recent years, with stock selection within the Magnificent Seven being particularly beneficial,” said Angell.

Balanced investors

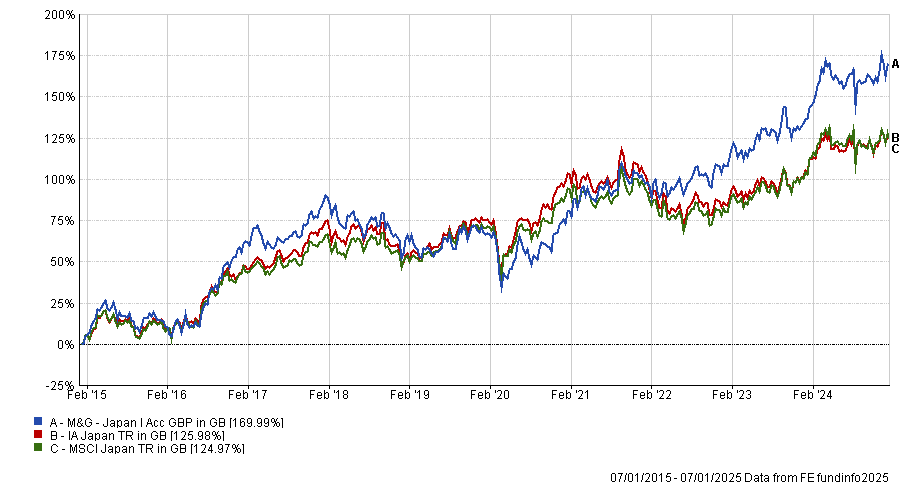

For those one notch down on the risk scale, Angell highlighted M&G Japan as one to keep an eye on in 2025. FE fundinfo Alpha Manager Carl Vine looks at a range of factors outside just the traditional financial measures, such as how a company generates profits, the sustainability of revenues and what might impact returns in the future.

“The fund’s manager considers risk management to be equally as important as stock selection. As such, he looks to mitigate against excessive sector over/underweights, with individual stocks additionally assessed based on their correlation with each other,” said Angell.

It has been super consistent, sitting in the top quartile of the IA Japan sector over one, three, five and 10 years, and has been particularly strong since 2020. The fund suffered a three-year period from 2018-2020 when it sat in the bottom quartile of the sector each year, before three consecutive years of top-quartile returns. Last year it was ahead of the average, in the second quartile.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

“The balanced approach to portfolio construction should ensure that stock selection is the main driver of returns and limit some of the volatility historically seen when investing in a particular style in Japan,” said Angell, who also noted the 0.5% fee as helping the fund to “stand out” in the peer group.

For thematic investors, Polar Capital Global Insurance could be an option for those looking outside the more typical technology specialists.

“This fund has many of the elements that make for a great specialist fund – a genuine niche in market exposure (non-life insurance businesses), an experienced and specialised team (Nick Martin and Dominic Evans), and the corporate backing of a committed parent (Polar Capital),” said Angell.

The industry has come to the fore over the past year with the rise in cyber attacks, such as the Crowdstrike saga last year, as well as higher interest rates, which boost yields.

“The managers target at least 10% book value growth across the portfolio each year. This growth is made up of the underwriting margins of the invested companies, alongside the market returns from their respective investment portfolios,” he said.

“The expectation is that this book value growth should, over time, lead to an equivalent share price growth, and therefore a doubling of capital returns for the fund every seven to eight years.”

Polar Capital Global Insurance has surpassed this over the past decade, up 252.2%, more than tripling investors’ money over the period.