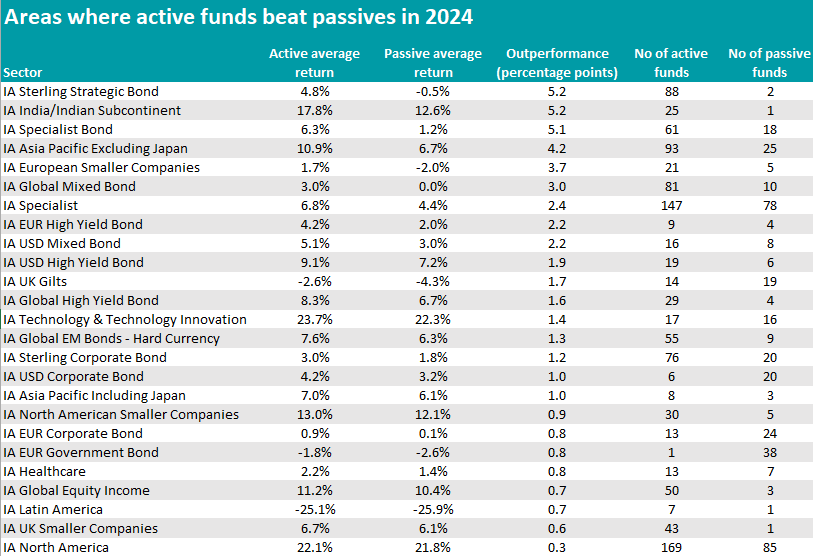

India, Asia and fixed income are the areas where active managers outperformed passive vehicles in 2024, whereas investors in financials, China and Europe funds had no benefit from paying a person to be in charge and might as well have chosen a cheaper tracker.

For this study, we calculated the average 2024 return of active strategies in any Investment Association sector and contrasted it with that of the average passive (as identified by FinXL).

Because there is an uneven number of active and passive strategies in each sector, the performance of single funds had a varying impact on the results.

For example, it’s difficult to invest passively in the IA India/Indian Subcontinent sector, where there is only one passive strategy, the Franklin FTSE India UCITS exchange-traded fund (ETF). In 2024, it made 12.6% against the average 17.8% of its 25 peers and skewed the results in their favour.

The same goes for the IA Sterling Strategic Bond sector, where the only two passive strategies – BlackRock Charities UK Bond and the Virgin Money Bond and Gilt – couldn’t compete with their 87 active peers, losing 0.4% and 0.5%, respectively.

Numbers become more interesting in the IA Specialist Bond sector, where 18 passives remained on average five percentage points behind their 61 active peers. In general, fixed income fans tend to be more skewed towards active investing to avoid a common problem with bond index trackers – gaining too much exposure to indebted companies, which have more weighting in the index.

Source: FE Analytics

Active bond managers had the upper hand in the IA Global Mixed Bond sector (by 3 percentage points), in the high yield sectors (2.2 percentage points in Europe, 1.9 in the US, 1.6 globally), UK gilts (1.7) and in the corporate bond sectors (1.2 in the UK, 1 in the US and 0.8 in Europe).

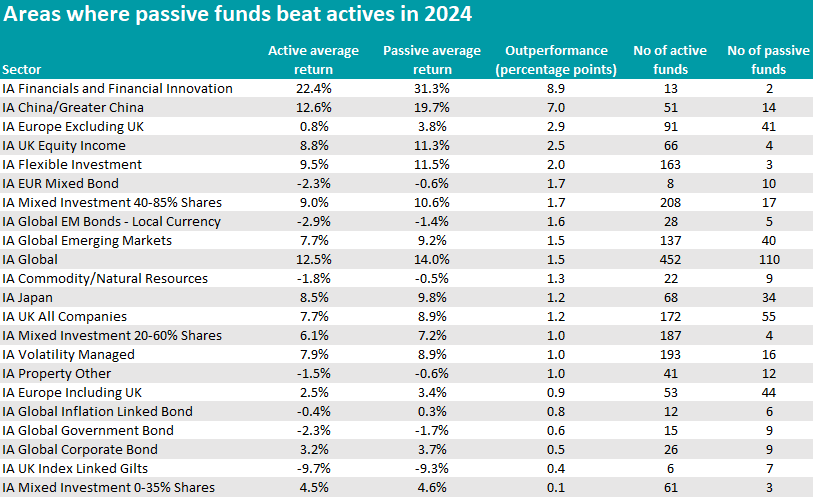

Tables turned in the IA EUR Mixed Bond sector, where the active/passive distribution is almost even (8 to 10) and passive strategies came out on top, with an average advantage of 1.7 percentage points. Global bond sectors had a similar dynamic (IA Global Corporate Bond, IA Global Government Bond and IA Global Inflation Linked Bond), albeit with a smaller distance between the two factions.

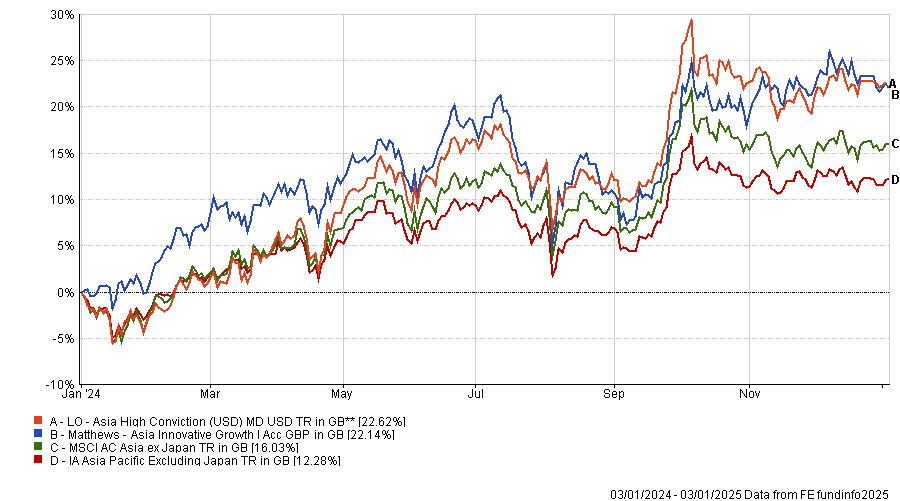

Back in equity markets, IA Asia Pacific Excluding Japan managers proved their worth with an average distance to passives of 4.2 percentage points. With a 19.9% return, the best performer in 2024 was the $265m LO Asia High Conviction fund.

Managers Ashley Chung’s and Faye Gao’s portfolio is concentrated in about 50 companies that they ascribe to either a growth, value or turnaround element. This strategy was closely followed by Matthews Asia Innovative Growth, which added 19.7%.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Against that, the average index tracker grew only 6.7%. The best passive returns came from the iShares MSCI AC Far East ex-Japan UCITS ETF (14.2%).

Traditionally, smaller companies are more of an active manager’s remit, and that was also true in 2024 – particularly in Europe, where they stood out by 3.7 percentage points to passives.

JPM Europe Small Cap, the two Mirabaud Discovery Europe strategies and Invesco European Smaller Companies managed to make double-digit returns in a sector where almost half the number of funds made a loss and the top tracker (SPDR MSCI Europe Small Cap UCITS ETF) only made 0.9%.

Source: FE Analytics

On the flip side, the IA Financials and Financial Innovation sector has only two passive funds (the Xtrackers MSCI USA Financials and Xtrackers MSCI World Financials UCITS ETFs) but they wiped the floor with the rest of the peer group, outdoing the average active manager by 8.9 percentage points.

The only exception was the £157.6m Janus Henderson Global Financials fund, managed by John Jordan.

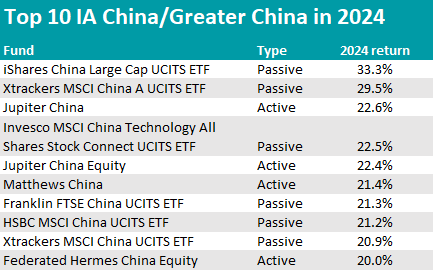

Another market where it wasn’t worth paying up for someone to make decisions was China, where the average tracker was solidly ahead of the average active manager (7 percentage points). Six of the top 10 funds by returns were passive, as the table below shows.

Source: FE Analytics

Similarly, investors in the IA Europe Excluding UK, IA UK Equity Income and IA Flexible Investment sectors saw higher returns (2 percentage points on average) by investing without a person leading their strategies.

But what’s true on average isn’t true in absolute terms. In the UK Equity Income sector, for example, passives did better on average but the best passive, the Vanguard FTSE UK Equity Income Index fund, only made 12.7% against the 21.4% return of the top fund in the sector, TM Redwheel UK Equity Income, managed by Ian Lance and Nick Purves.

There was no difference between active and passive investing in the IA Infrastructure sector, where both camps returned an average of 3%.