China has been struggling to meet investors’ expectations in the post-Covid world, but just when people started wondering whether it was high time for a rebound, the CSI300 index (which tracks the performance of the top 300 stocks on the Shanghai and Shenzhen stock exchanges) shot up by 15.7% last week, taking some by surprise.

The catalyst for this sudden upswing came from the People’s Bank of China, which freed up about ¥1tn in long-term liquidity by reducing the reserve requirement ratio for banks by 0.5 percentage points, allowing them to lend more and support the economy.

It also cut the seven-day reverse repo rate (a tool used to manage liquidity and control short-term interest rates in the banking system) from 1.7% to 1.5%.

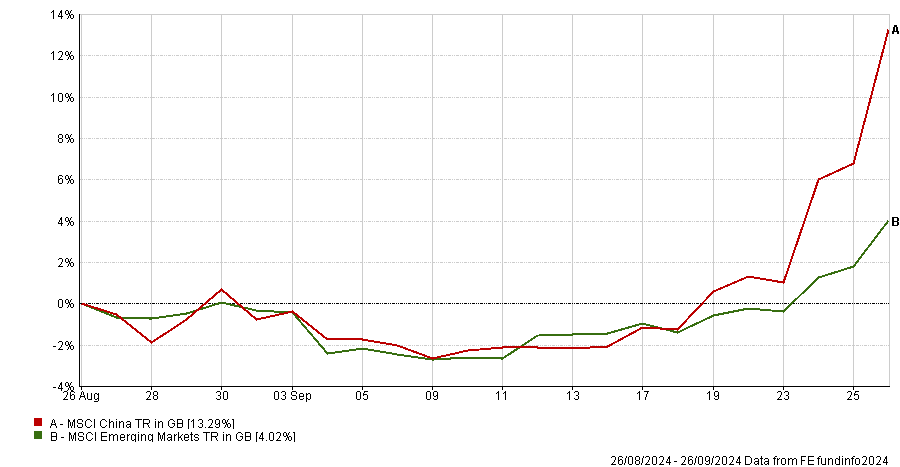

Performance of indices over 1 month

Source: FE Analytics

These measures triggered the best week in nearly a decade at China’s stock exchanges, as well as an upswing in European equities given the region’s trade links with China. But one good week doesn’t mean China is out of the woods. Below, Trustnet asked experts what investors should make of China’s stimulus package and how long the rally can continue.

Franklin Templeton’s Ness: Some of our best performers are Chinese companies

China used to be one of the largest underweights in the Templeton Emerging Markets Investment Trust portfolio, but manager Andrew Ness has gradually closed that underweight over the past three to four years. When last week’s moves began, the trust’s Chinese exposure was close to matching the 24.4% allocation of its benchmark, the MSCI Emerging Markets index.

“People talk about this China rally as if it has just happened, but if we look year-to-date, a significant number of our largest performers in the portfolio were Chinese names.”

They included internet and technology company Tencent, which was up 63% year-to-date, white goods manufacturer Haier Smart Home (+68%) and Brilliance China, the BMW joint venture partner.

Despite being “not without a challenge”, China remains an “investible” market, with plenty of strong points, including its “highly educated work force, world-class infrastructure and significant advantages in manufacturing, renewable energy and elective vehicles”.

The manager also argued that China could be considered as “politically stable, unlike much of the rest of the world”.

Whether the rally continues will depend on domestic consumption and investment, Ness said.

“Last week’s stimulus is going to be impactful in the short term, but the long-term sustainability of this rally is dependent upon the real economy impact and a pickup in domestic confidence from both a consumption and investment perspective,” he explained.

“The government finally recognizes that it needs to stimulate both those areas now, but will the combination of the monetary policy changes be sufficient for that? We are not sure. It is just too soon to say.”

Dennehy Wealth’s Richardson: We feel positive about China over the long-term

Joe Richardson, a discretionary investment manager at Dennehy Wealth, sold out of China a couple of months ago and decided to await “a more stable footing before considering re-entry”. He previously had direct exposure to Chinese stocks but used a stop-loss.

To him, the country is in a “painful but necessary” transition period and still facing “significant headwinds”, including an aging population and US sanctions.

“There is only so much technology you can copy, at some point China needed to innovate internally, shifting from producing low-tech goods like furniture and textiles to much more advanced sectors, such as semiconductors and broadcasting equipment,” he said.

“While still far behind Taiwan, it is making strides in key areas like electric batteries and artificial intelligence (AI).”

Almost 68% of top-quality electric battery papers cite Chinese research, compared to just 10% for the US. Similarly, in AI, 31% of top papers reference Chinese work, while the US accounts for 14%.

“They are really pushing technological breakthroughs so their limited labour force with high skills and capital can still flourish – that’s their number one priority,” he said. “We feel positive about China over the long-term.”

AJ Bell’s Mould: Chinese stimulus measures have a patchy success rate

Among the sceptics was AJ Bell investment director Russ Mould, who thinks the rally implies a level of investors’ FOMO (fear of missing out) but warned that in the past, stimulus measures have not lived up to investors’ expectations.

“A veritable feast of economic stimulus measures has led investors to take a more optimistic view of the earnings potential for Chinese companies,” he said.

Lower borrowing costs, smaller deposits for buying homes and more capacity for banks to lend money should lay the foundations for “greater economic activity” among businesses and consumers.

“On paper, it looks interesting. But whether the desired results end up meeting investors’ expectations is another thing,” he continued.

“China is notorious for throwing stimulus measures left, right and centre, and the success rate is patchy to say the least.”