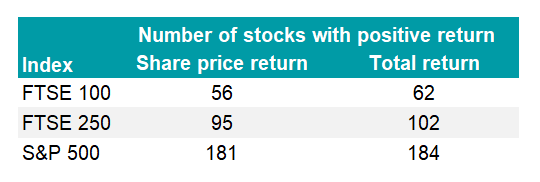

UK equity fund managers have had an almost 50/50 chance of picking stocks that have made money so far in 2025, whereas active US equity managers have had a much tougher gig, according to data provided by AJ Bell for Trustnet.

Just 37% of stocks within the S&P 500 delivered a positive total return (share price gains plus dividends) this year to 25 April. That compares with 62% of the FTSE 100 and 41% of the FTSE 250 – or 47% of the FTSE 350.

This may feel like payback time for UK equity managers after a few tough years of toiling in a relatively unloved, undervalued, under-owned region.

Percentage of stocks with a positive YTD return in each index

Sources: AJ Bell and ShareScope, data from 1 Jan to 25 Apr 2025. The second column shows the number of stocks with a positive return based on share price, whereas the third column also factors in dividends.

In further support of domestic equities, UK mid-caps are one of only four markets to regain their pre-Liberation Day highs. Mid-caps have been rewarded for their domestic focus, which should insulate them somewhat from the pernicious impact of Donald Trump’s tariffs and trade wars, according to Dan Coatsworth, investment analyst at AJ Bell.

Across the FTSE 350, 25 companies gained more than 10% since the market close on 2 April and 8.30am on 28 April, he said. Retailer Dunelm and housebuilder Berkeley rose 20.7% and 14.9%, respectively, while Sainsbury climbed 11.7%.

Other strong performers so far this year include miner Fresnillo (up 55.4% year-to-date by mid-morning on 29 April), defence company BAE Systems (48.5%), mobile phone provider Airtel Africa (42.4%), Rolls-Royce (29.2%), NatWest (21%), Barclays (11.8%) and housebuilder Persimmon (10.1%).

Some active managers were better placed than others to pick winners and capitalise upon the UK’s relatively good fortunes this year.

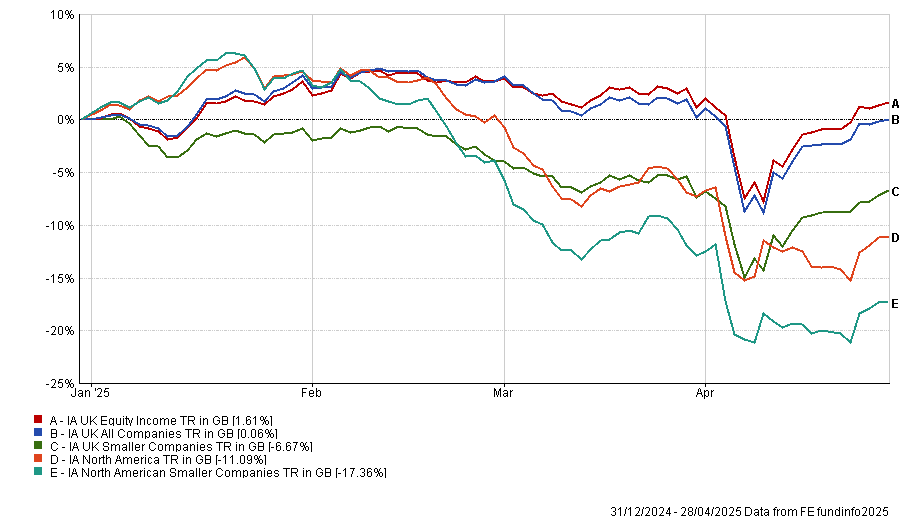

The average fund in the IA UK Equity Income sector gained 1.61% year-to-date to 28 April, while the IA All Companies sector was flat – perhaps reflecting the almost even split between mid- and large-cap stocks that lost and made money.

Performance of sectors ytd

Source: FE Analytics

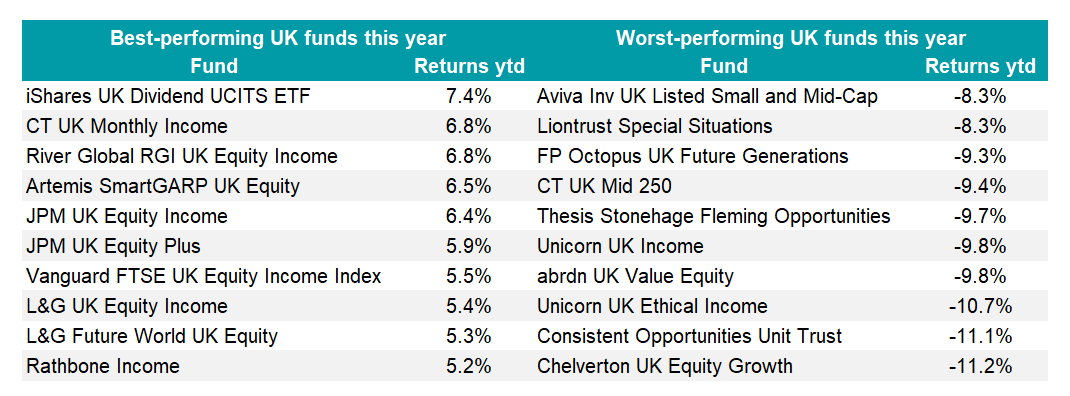

Yet the five best-performers across the two sectors returned between 6.3% and 7.4% whereas the five worst funds lost between 9.8% and 11.2%.

Best and worst UK equity funds YTD

Source: FE Analytics

Another aspect working in the UK’s favour this year is its rich seam of dividend payers, which global equity income managers have long mined. Indeed, eight funds in the IA Global Equity Income sector have more than 20% in the UK at present, including Evenlode Global Income, Trojan Global Income, Invesco Global Equity Income and Redwheel Global Equity Income.

Stephen Anness, head of global equities at Invesco, said: “We have been able to find several businesses at attractive valuations in the region. Part of this is linked to the UK now being such a small part of the overall index that it does get less attention from a lot of global managers and therefore you can find some really interesting opportunities and hidden gems.”

Dividends provide a steady return that can help offset share price volatility, making income-oriented investment strategies especially attractive during periods of market turbulence, such as this year.

Rob Morgan, chief investment analyst at Charles Stanley, said: “A steady return from dividends can help generate long-term returns and bolster portfolios in periods of market stress. Higher dividend shares often have a valuation ‘safety net’ of the income stream they provide, so they can be less risky. This is because dividend payers are typically more established and more likely to generate consistent profits.

“Knowing that dividends are likely to continue rolling in can be reassuring for investors, especially in times of market uncertainty.”

James Lowen, senior fund manager of the J O Hambro UK Equity Income fund, said several domestically orientated stocks beat his dividend forecasts during the full-year results season, including NatWest Group, Galliford Try, Kier and TP ICAP.

He expects to grow his fund’s dividend by 6% to 8% this year and has tilted the portfolio towards companies with domestic earnings. International companies with overseas earnings are more vulnerable to the headwind of a weaker dollar, he explained.

Several global equity managers are also leaning into the UK’s resurgence. Within the IA Global sector, 37 funds have more than 20% of their portfolios in the UK, according to FE Analytics, and 15 of them have in excess of 30%, including Lansdowne (Lux) Developed Markets, Lindsell Train Global Equity, MFS Meridian Contrarian Value and Holland Advisors Equity.