With wide discounts across the investment trust sector, boards are looking for other ways to realise value for shareholders, including the dramatic decisions to wind-down or merge with competitors.

A well-managed wind-down can be profitable for shareholders, providing that assets can be sold quickly at a price close to fair value – or for a much narrower discount than that reflected by the trust’s share price.

For instance, abrdn Property Income agreed on 27 September to sell its entire portfolio to GoldenTree Asset Management for £351m: a 6.7% premium to the trust’s share price on 26 September but a much larger 20.1% premium to its share price on 28 May 2024 when shareholders approved the wind-down.

The share prices of investment trusts usually bounce when a wind-down is announced, which is why Charlotte Cuthbertson, co-manager of the MIGO Opportunities, tries to identify ahead of time which trusts might go down this route.

One way she does this is by looking through shareholder registers to ascertain which trusts are unlikely to pass upcoming continuation votes. Ultimately, she is looking for a catalyst that the market has not yet priced in. About 30% of the trusts in MIGO’s portfolio are going through a wind-down, she said.

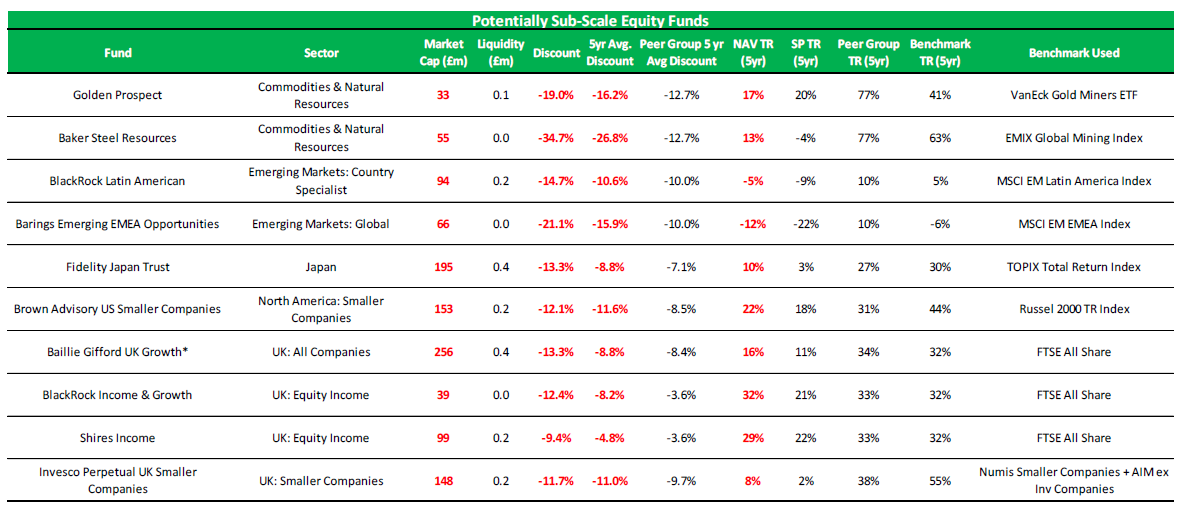

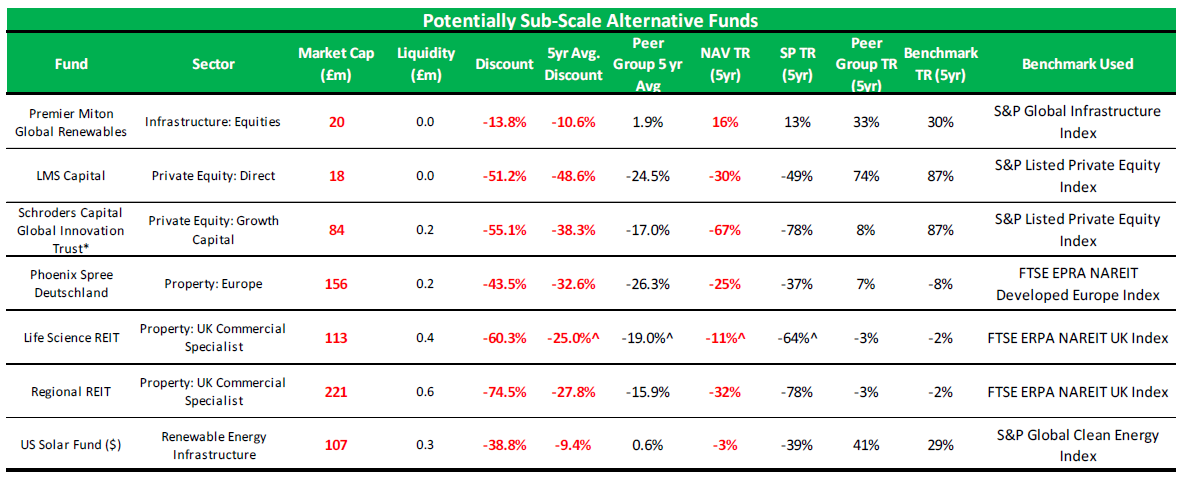

Winterflood Investment Trusts has identified 17 potentially sub-scale trusts where it thinks corporate action might be in shareholders’ best interests, be that a merger or a wind-down. They include 10 equity funds, listed below, and seven alternative investment strategies.

Potentially sub-scale equity trusts

Source: Winterflood Securities, as at 20 Sep 2024

Some of the above trusts have catalysts that could lead to corporate action. The board of Barings Emerging EMEA Opportunities has said there is a “strong likelihood” that it will miss its five-year performance target to the end of September 2025. That would trigger a tender offer for up to 25% of issued shares, which would further reduce the size of the already-small trust (its market capitalisation is £66m).

Baillie Gifford UK Growth will have a tender offer and continuation vote in 2027. Elliott Hardy, an analyst at Winterflood, said this could lead to corporate action because the trust has lagged its peers and trades on a discount of -13.3% compared to the sector average of -11.3%.

Winterflood also identified three potentially sub-scale real estate investment trusts: Phoenix Spree Deutschland, Life Science REIT and Regional REIT.

This sector has seen a lot of corporate activity. “We estimate that the number of direct property-focused investment trusts has fallen from 31 to 25 since the end of 2021, with a further five due to exit upon the completion of wind-downs or mergers,” Hardy said.

Property trusts have faced multiple headwinds in recent years, including high interest rates, persistently wide discounts, macroeconomic uncertainty and cost disclosure concerns.

“Clearly, some of these headwinds are starting to lift, which may attract further interest from potential acquirers, particularly in the absence of institutional buyers given the funds’ sub-scale size,” he observed.

Amongst the small alternative investment trusts listed below, Premier Miton Global Renewables has its next five-yearly continuation vote coming up in April 2025.

Potentially sub-scale alternative trusts

Source: Winterflood Securities, as at 20 Sep 2024

Winterflood used three criteria to identifying sub-scale trusts: a market capitalisation below £300m; a net asset value (NAV) total return that has underperformed the peer group and/or benchmark over five years; and thirdly, a discount that is currently wider than its five-year average and where the five-year average discount is wider than that of its peer group.

This methodology uncovered 37 trusts but Winterflood ruled out 20 of them because corporate action is unlikely for idiosyncratic reasons, such as a controlling shareholder disinclined towards strategic change.

The firm has a decent track record of identifying trusts that could pursue corporate action. Of the 14 sub-scale trusts it named in a May 2023 report, three are winding down, two are merging with another trust and three more have initiated a strategic review where a wind-down is one possibility being considered.

Almost 10% of the investment trust sector by number of companies (9.7%) are winding down currently, including acquisitions and companies that have proposed a liquidation. This trend impacts smaller investment companies the most; only 3.3% of the sector by asset value is in realisation, according to the Association of Investment Companies (AIC).

An additional 2.3% of investment companies have a strategic review underway (representing 0.9% of the sector’s assets). All these figures exclude venture capital trusts.

Companies that have announced a wind-down this year include Digital 9 Infrastructure Trust, Home REIT, abrdn European Logistics Income and Aquila European Renewables.

Annabel Brodie-Smith, communications director at the AIC, views wind-downs as a “positive” because “it means boards of directors are listening to shareholders and taking their views on board, which is what the investment trust structure is all about”.

Mergers are a related trend – one that Winterflood expects to gather pace due to pervasive discounts, as well as tie-ups between wealth managers, leading to a preference for larger trusts.

This has been a record year for mergers, agreed Brodie-Smith, with seven having gone through already, not counting the tie-up between Alliance Trust and Witan.

Generally speaking, shareholders prefer “larger, more liquid, more cost-effective companies [but] I think small can be beautiful, especially for specialist mandates like micro-caps”, she concluded.