The Bank of England’s financial policy committee (FPC) struck a dour tone last week when minutes from its September meeting were released. It warned that global equity markets were facing significant structural vulnerabilities, prompting fears of a wider market sell-off.

In the FPC meeting, which took place on 19 September, members noted the “significant spike in volatility” on 5 August, which was based on “relatively limited economic news”, and highlighted the “potential for vulnerabilities in market-based finance to amplify shocks”.

“Markets remain susceptible to a sharp correction, which could affect the cost and availability of credit to UK households and businesses, with investors sensitive to short-term developments in a challenging global risk environment,” the FPC report noted.

The report added that the sell-off did not spill over to markets for long, with valuations quickly returning to previous “stretched levels”.

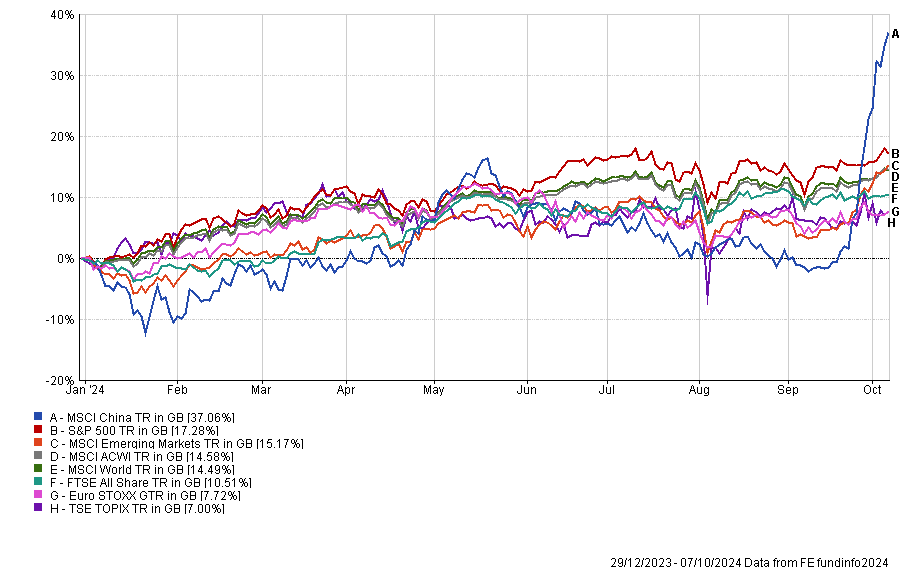

Indeed, even after periods of market volatility such as the 5 August sell-off, leading global market indices have been on the rise in 2024. The S&P 500 has particularly stood out, with the index up 17.3% so far in 2024, despite the market sell-off and poor results from some of the ‘Magnificent Seven’ firms in July.

Performance of market indexes YTD

Source: FE Analytics

Source: FE Analytics

There are also signs of turnarounds elsewhere, with the MSCI China index up 21.4% last month, taking its year-to-date returns to 37.1%. Domestically, the FTSE All Share index has made 10.5%, while the laggards of the domestic markets (Europe and Japan) are both still up 7% in sterling terms.

But some experts believe these fears are overemphasised. Talib Sheikh, multi-asset portfolio manager at Fidelity, disagreed with the FPC, taking a more optimistic outlook on global markets.

He said: “Are equities on a historic basis, globally expensive? Yes. Are they religiously overvalued? No. We’re much more sanguine than that.”

While global growth is slowing (the International Monetary Fund’s (IMF) latest projections in July suggest global GDP growth to drop from 3.3% in 2023 to 3.2% in 2024), this is occurring in line with recent trends.

Sheikh concluded: “It’s very easy for the Cassandras of the world to bang the drum and say the world’s about to end, but when you look at the details, it’s difficult to buy into such a pessimistic outlook”.

David Harrison, manager of the Rathbone Greenbank Global Sustainability fund, was another unconcerned by valuations pointed to by the Bank of England.

“Whilst some corners of the equity market are trading on more elevated valuations, in many cases (such as the UK, US mid-cap stocks, China and Europe) valuations are not overly stretched by historical standards,” he said.

Turning to the increased volatility that could cause tensions in the global equity market, Shaniel Ramjee co-head of multi-asset at Pictet Asset Management, did not believe this indicated any systematic weaknesses in the market.

He said: “We see far fewer imbalances in financial markets today than when we were participating in this analysis before the global financial crisis (GFC). Certainly, we assess the degree of leverage employed to be far less.”

Nevertheless, some experts do have their reservations, noting that, while the BoE may be overemphasising the challenges facing the market, its warnings are certainly valid.

As Trevor Greetham, head of multi-assets at Royal London Asset Management, said: “The Bank of England is paid to worry when it comes to financial stability.”

Indeed, there is significant room for market volatility to rise over the next 12 months. The VIX, one of the most followed measures of market volatility for the US has increased by 8.8% year-to-date. While this is still well below its peaks during the global financial crisis and Covid-19 pandemic, it does indicate rising volatility in global equity markets.

Performance of the VIX YTD

Source: Google Finance

Moreover, as we move into the end of the year, geopolitics is a hot topic, with an outbreak of war in the Middle East and – perhaps more crucial for markets at this current moment in time – an impending US election.

Indeed, despite big spending commitments from both presidential candidates, the US still faces a total federal debt of more than $35.7trn. Failure to address this from either candidate could kickstart global volatility.

Ramjee said: “One area which does concern us remains the level of debt accumulated by governments and the volatility of government bond markets is certainly the ‘Achilles heel’ of financial markets.”

Additionally, there are some concerns surrounding the rate at which central banks can ease interest rates, which could reverse into a rate hiking cycle given sufficient economic impetus.

Greetham said: “It's not beyond the realms of possibility that the Federal Reserve is hiking again next year in a parallel with 1998-2000 when tighter monetary policy ultimately burst the tech bubble.”