Taking bets on growth, quality or any investment style causes investors to accumulate risk and pushes them to buy at the worst possible time, according to Julian Bishop, co-manager of the Brunner investment trust.

“There are certain managers who have a few years in the sun, because their style is very much in favour, and then that fades from fashion, because it becomes overvalued. Typically, a lot of these style-focused funds have strong periods and then weak periods,” he said.

“We have three dials at our disposal, quality, value and growth, which we can tweak as we see fit, based on market conditions.”

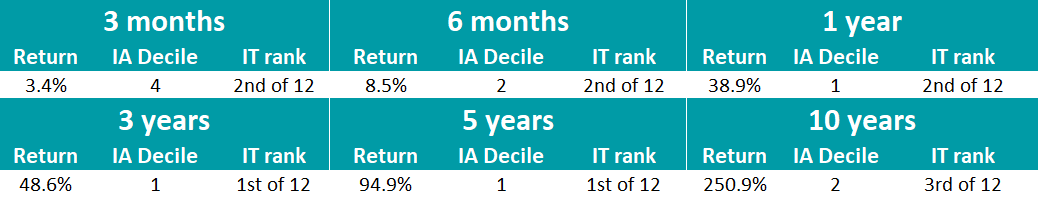

This flexibility has enabled the trust to beat its benchmark (a 30% to 70% mix of the FTSE All Share and the FTSE World ex UK indices) over the past 10, five, three years and 12 months.

It also reliably topped the 12-strong IT Global sector (except over one year) and comes out ahead of the competition even when compared against a larger reference group, such as the 559-strong IA Global sector, as the table below shows.

Performance of trust against IA and IT sectors

Source: FE Analytics

Furthermore, the £602m trust, which Bishop runs with Christian Schneider, has an enviable track record of increasing its dividend payout every year for the past 51 years.

Below, Bishop shares his views on investment styles, explains why he is moderately skewed towards value and reveals his best and worst calls of the year.

How do you invest?

Brunner is an all-weather global equity trust that tries to balance quality, value and growth – the three dials we have at our disposal. Some managers might describe themselves as quality, value or growth managers, but we want as much as possible of all three.

We do that by focusing on the cash flow streams that each business provides, which should grow as much as possible and be as reliable as possible. Repeating that with all of our holdings gets shareholders a good outcome.

It's a balanced, well-diversified trust that can be used as a core holding for the long term.

We don’t invest in private equity, it's all listed, liquid assets. We are plain vanilla.

Which of the three ‘dials’ is turned up or down the most right now?

The only pronounced bias is on the quality side, as we focus on companies that have good returns on invested capital, higher margins than the average and stronger balance sheets.

At the core of the portfolio are steady growers, not necessarily glamorous businesses, but they compound away gradually over time and grind out good results for shareholders.

At the margin, we have been adding more to value. We've seen a lot of multiples expand in some areas in the past year, which has pushed some of the valuations into somewhat uncomfortable territory, so we've been dialling things down and transferring into more traditional value sectors.

Why is it important to avoid style biases?

It's illogical to say: ‘I am a quality investor’, because quality with no reference to value is illogical, just as much as growth with no reference to value is illogical. It's all about balance.

When quality or growth do well for a while, everyone tends to rush into the winners, but by doing so, they sow the seeds of the destruction of that way of investing, because then everything becomes overvalued and collapses into its own weight.

When you chase what's worked for the past few years, you end up buying at the top of the market. This pushes you towards the top of the performance table in the short term perhaps, but might not work out so well over the long term.

To be at the top in the short term, you also have to be doing something quite extreme just to make sure that you're number one. We're not interested in chasing that, but in delivering good outcomes over long periods.

What was your best call of the past year?

This year, the most successful holding we've had is Taiwan Semiconductor Manufacturing Co., which has ended up as the last man standing, producing the most complex semiconductor chips on behalf of clients such as Apple and Nvidia. It is one of our larger holdings and it did very well, contributing 1% to our performance this year.

One of our more recent successes is a company in the Baltic states called Baltic Classifieds Group, which owns online classifieds listing portals – the equivalent of Rightmove and Autotrader in the UK – and has a great market position, great free cash flow characteristics and great growth.

We always think value accrues in niches, which is where you get incredible businesses. Autotrader is one we also own – it has become the only place where consumers go when they want to buy a second-hand car, with 70% operating margins. That's the highest of any business of scale that I can think of globally.

And the worst?

Over the year to date, the S&P 500 index is up more than 20% and some of our large positions just didn't keep up. One of them was US healthcare company United Health, which has been a drag on performance not because it's gone down so much, but more because it went sideways.

Another large position that had a difficult year was Microchip Technology. It produces basic microchips that go in everything from washing machines to car windshields and are used to detect rain or temperature. The negative impact on the portfolio was 0.8%.

Do you use gearing and buybacks?

We have modest gearing at 6% and its cost is fixed at 2.84% through to 2048. That means that if our returns on equities exceed 2.84%, it magnifies the performance of the trust slightly.

We don't do buybacks. We let the price of the trust be led by supply and demand. We have been doing a lot of marketing work and have a lot of long-term clients who view us as a buy-and-hold investment, and our discount has been narrowing.

What do you do outside of fund management?

I spend a lot of time being a glorified chauffeur for my teenage children. I like classical music and the opera and I am a lifelong supporter of Liverpool FC.