Imran Sattar has shaken up Edinburgh Investment Trust’s £1.1bn portfolio since becoming co-manager at the start of this year and lead manager in May, when James de Uphaugh retired from Liontrust Asset Management.

Sattar has turned over 15-20% of the trust’s holdings and taken profits on strong performers such as Weir, the mining technology company, and Mondi, which provides sustainable packaging and paper. He and deputy manager Emily Barnard have recycled the capital into higher conviction ideas like Spirax Group, which provides engineering solutions for industrial processes.

They have also introduced a growth bias whereas de Uphaugh had a value bent. “I'm a bottom-up stock picker with a slight bias towards structural growth businesses with a powerful economic moat,” Sattar explained.

The investment approach remains flexible and pragmatic to enable the trust to perform in different stock market and economic cycles.

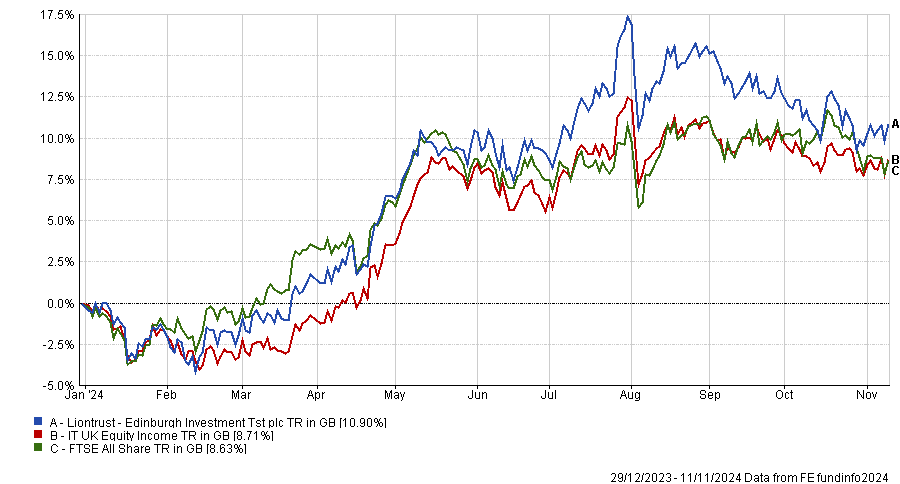

Performance of trust vs benchmark and sector year-to-date

Source: FE Analytics

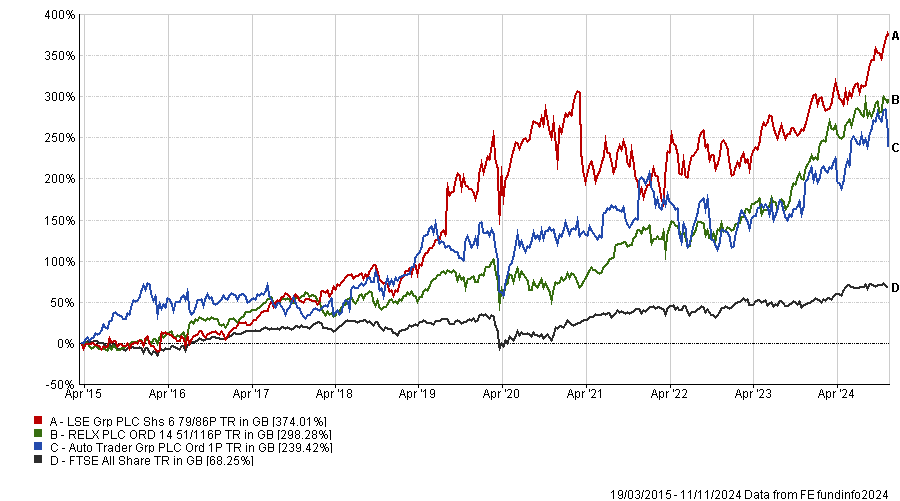

Sattar recently invested in LSEG, RELX and Auto Trader, whose valuations would probably have made de Uphaugh uncomfortable. “I'm happy to pay a slightly higher multiple than James for very special businesses,” he said.

“Our portfolio is slightly richer [than the broader market] in terms of valuation, but we think it's richly deserved, given the quality, the better growth and the resilience.”

In other funds, Sattar has owned RELX for 15 years, LSEG for over a decade and Auto Trader since its initial public offering in 2015 and they remain high conviction holdings. He believes LSEG’s revenue growth in the mid-to-high-single digits is sustainable for a decade or more.

All three are “brilliant businesses with structural growth and very powerful economic moats”, he said.

Performance of stocks vs FTSE All Share since Auto Trader’s IPO

Source: FE Analytics

Auto Trader is a network business and the vast majority of used car dealers subscribe to its platform. “So if you want to buy a used car, you have to go to Auto Trader. If you go anywhere else, you're doing yourself a disservice because you're not seeing the whole market,” Sattar explained.

“It makes embarrassingly high margins, nearly 70%, my favourite kind of margins by the way. But when you have embarrassingly high margins, you're going to attract competition and therefore you need to have a very powerful economic moat.

“That moat is around having all the suppliers on its platform and having all the consumer eyeballs come to the website search for their used car. And it's very, very hard to break that.”

Auto Trader increases its prices by at least 4-5% every year and sells more software and services to its customers on top of that. The company grew its dividend by 20% in the past financial year and then used excess cash flow to buy back shares.

What makes pricing power sustainable is delivering enhanced value to customers, Sattar continued. RELX could have been more aggressive with its pricing over the years, but it has taken a more thoughtful approach to delivering value and has built up goodwill with its customers as a result.

AJ Bell is another example of a business that thinks for the long term, he said. “We love our meetings with those companies because we're all on the same page. They're trying to create economic value over years and decades, not just over the next quarter.”

On the other side of the ledger, Sattar sold Marks & Spencer and Centrica to take profits after successful turnarounds and has also removed BAE Systems and Ashtead Group from the trust.

Despite strong recent performance and a turnaround that probably has further to go, M&S hasn’t made the cut in Edinburgh’s high conviction, concentrated portfolio of 40 to 50 stocks. “No one will say M&S has a very powerful economic moat. It's a decent business, but in a very competitive space. We think that there are better opportunities elsewhere,” he said.

Meanwhile, Sattar is bullish about the propensity of UK consumers to increase their spending. American consumers built up savings during the pandemic which they have subsequently spent, but British people have continued to save.

“We think there's a lot of pent-up demand potential in the UK, there's a lot of extra potential firepower. UK consumer balance sheets are very healthy, so we've got some quite chunky holdings in in UK retail,” he said. The trust owns Tesco, Dunhelm, Greggs and Howdens.

Edinburgh Investment Trust focuses on UK equities but is permitted to invest up to 20% abroad. Currently it only owns four international companies with 5.5% of the trust’s assets. “We're so excited about the UK market that the international exposure is actually at the lower end of the historic range,” he noted.