Consistent outperformance has been difficult in recent years. Over the past half a decade, investors have been challenged by a pandemic, the largest recession since the global financial crisis and a sudden, short-lived bear market.

However, the £1.7bn Liontrust European Dynamic fund, withstood it all and became the top fund in the IA Europe Excluding UK sector over five years. During this time, it delivered above-average returns for investors every year.

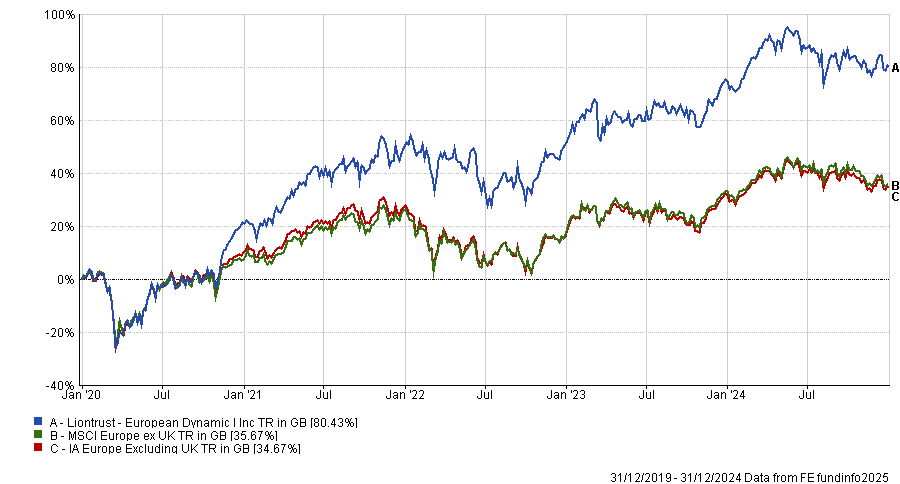

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics. Data accurate as of 31 Dec 2024

Led by Samantha Gleave and James Inglis-Jones, the fund has also made top-quartile returns over the past one, three, and 10 years.

Below, Gleave explains the importance of a disciplined investment process, why an Italian bank ticked all the boxes last year and how the fund weathered a volatile five years for European equities.

Could you sum up your process in three sentences?

The starting point for our process is that, based on financial historic evidence, stocks with good cashflow characteristics typically outperform. Our investment decisions are based on financial evidence and the strength of corporate cashflows.

So, we want to buy companies that are either generating lots of cashflow versus their asset base or a lot of cashflow versus their market capitalisation.

What differentiates your fund and why should investors pick it?

It is a quite differentiated process. In fact, it’s quite complimentary to other funds in the sector. We focus exclusively on financial evidence, in particular historic cashflow performance, which needs to look very attractive to get to the next stage of our due diligence.

In 2014 we implemented significant process improvements. One of those was applying what we call our ‘secondary scores’ and market regime indicators to stock selection. These guide us on whether we should be positive or cautious in our market outlook, and they guide us on the style tilt we want to have in the fund.

The market regime indicators pick up on different data sets, such as on how investors are reacting to political or macro-economic news, or how corporations are reacting to the market environment.

The fund has been the best performing strategy in the sector over the past five years – how did you achieve this?

When we designed our investment process, we wanted to ensure it was dynamic and flexible. During certain points in time the fund will have different shades – towards growth in some years and value in others.

If you think about the pre-Covid years, growth as an investment style was doing quite well, interest rates were low, so the fund was positively tilted towards growth. Covid then came along and turned the world upside down. Our market regime indicators were, for the first time in years, telling us to buy contrarian value stocks, so we were ahead of the curve.

More recently, the fund has done very well because our market regime indicators have told us to be more balanced. In other words, the fund is unusual today because it is blending both growth and value.

What was your best performing holding last year?

One that did well for us last year was UniCredit, the Italian bank. It scores well because it generates a lot of cash versus its market capitalisation. New management has also done a good job of restructuring the business, driving growth and improving efficiency.

It also benefitted from a solid balance sheet. It has excess capital and has been returning that capital to shareholders through dividends and share buybacks. From our investment perspective, it ticks several boxes. It was up by 59% last year.

And your worst?

Jerónimo Martins, a food retail business based in Portugal. We bought it originally in 2022 to add a more defensive quality to the fund, in a year when markets were in reverse and falling.

However, growth slowed down in 2024, and it just did not have any standout style characteristics anymore. It suffered from cost inflation that it could not offset through higher sales pricing and was being left behind. We sold out of it in late March 2024, when it was down by around 7.5%.

Has recent political upheaval in Europe impacted the portfolio?

Political uncertainty absolutely can create volatility in share prices. Of course, that presents opportunities, but you need to pay close attention to market dynamics.

For example, a stock we hold such as Saint-Gobain may be listed in Pars, but two thirds of its revenue comes from the US, so it is not that exposed to France domestically. When something like that gets sold because of political turmoil it makes for an attractive opportunity.

Moreover, we’ve all seen the headlines over the past two years of Germany dipping into recession and negative GDP growth, so that’s priced in. It’s not some sort of ‘new negative’. But also, there has been stocks such as Deutsche Bank which have done well for us despite a lot of domestic exposure.

What’s the biggest lesson you’ve learnt over your career?

It’s important to stick to your investment process and be patient. Our investment process focuses on financial evidence, on data, so we can exploit emotional or human behavioural bias.

I would also say that you should beware the wisdom of crowds. On occasion, it can pay off handsomely to be contrarian. For example, if the consensus for a stock is very high and its valuation reflects that, beware those positions.

What do you do outside of fund management?

In the wintertime I do skiing, and, in the summertime, I go sailing. They are great ‘in the moment’ activities and make for a healthy break.