The rules of investing are being rewritten. Traditional public markets, once the cornerstone of a diversified portfolio, may no longer be sufficient to deliver the resilience and returns investors require in today’s environment. Higher and more volatile inflation and the rapid rise of private markets are reshaping how portfolios are constructed and managed.

Defining private market alternatives

‘Alternatives’ is often used as a broad term to describe any asset class outside of publicly traded stocks and bonds.

While it’s become common practice to lump alternatives together, grouping every asset class – such as private equity or global infrastructure – under a single label risks oversimplification.

Each asset class has a different risk and return profile and can serve a different purpose within a portfolio. Private equity, for example, focuses on long-term growth, while infrastructure offers steady cash flows and inflation protection.

Though the reasons for incorporating private market alternatives are becoming clearer, the specifics of what, how and which alternatives to choose remain less defined. The following four guiding principles aim to demystify the complex world of alternatives and provide a practical framework for effectively integrating these assets and strategies.

Focus on outcomes, not labels

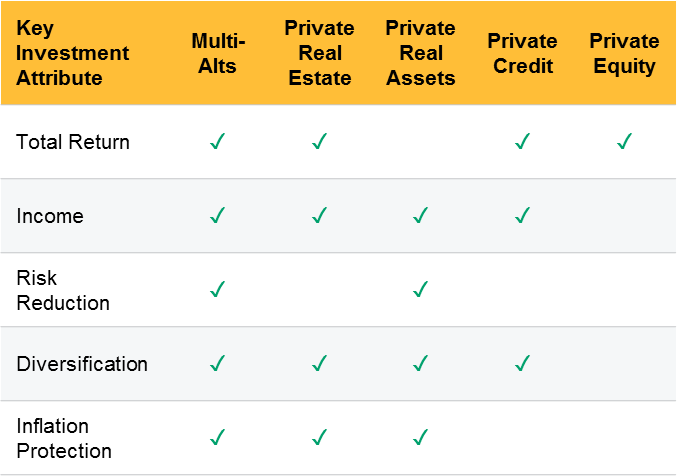

Investors often gravitate towards predefined categories like private equity or hedge funds without fully considering whether these strategies align with their specific goals. This can divert attention from the real objective: enhancing portfolio performance by improving returns, reducing risk or achieving specific outcomes such as inflation protection or income generation.

Instead of viewing alternatives as isolated asset classes, they should be reframed through their core contributions to a portfolio.

Alternatives offer return enhancement opportunities by unlocking excess returns through active management and their illiquidity premium. They provide stable income streams often protected from inflation and offer diversification by introducing exposures uncorrelated with public markets. By recognising the role alternatives can play in complementing traditional portfolios, investors can cut through complexity and focus on matching each alternative investment to their specific challenges and objectives.

Source: J.P. Morgan Asset Management, as of Dec 2024. Equity diversification score is based on long-term public equity beta; income-driven returns are based on the component of total returns derived from contracted income; appreciation-driven returns are based on the component of total returns attributable to increases in valuation over time. All scores are in the context of the alternatives shown in the table.

Sizing matters

Historical evidence shows that portfolios with larger allocations to alternatives consistently achieve better risk-adjusted returns. This is because alternatives bring attributes such as diversification, alpha generation and illiquidity premiums that require meaningful allocations to fully realise their impact.

Institutional investors have long recognised this. Yale University’s endowment, for example, has consistently allocated more than 60% of its portfolio to alternatives, outperforming a traditional 60/40 stock-bond portfolio by more than three percentage points per annum over the past 20 years.

Broader is better

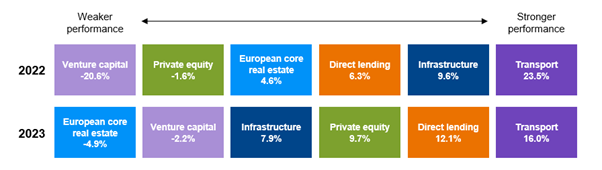

While sizing matters, breadth is equally important. Alternatives respond to distinct economic drivers, meaning that diversifying across strategies – such as private equity, private credit, infrastructure and real estate – can provide uncorrelated returns, reduce concentration risks and enhance portfolio resilience across market cycles.

Recent market performance illustrates this vividly. In 2022, surging inflation and sharp interest rate hikes led to significant sell-offs across risk assets such as public and private equity. However, these same factors were beneficial for the transport and infrastructure sectors, with the transport sector benefiting from a surge in shipping costs driven by geopolitical disruptions and strong pent-up demand.

By 2023, higher borrowing costs put significant pressure on commercial real estate values, yet those same interest rate increases contributed to robust returns in direct lending.

Alternative asset class returns

Sources: Burgiss, Cliffwater, MSCI, FactSet, J.P. Morgan Asset Management; data as of 30 Nov 2024.

This divergence in outcomes highlights the power of breadth. By allocating to alternative asset classes with different return drivers, investors can mitigate sector-specific risks, smooth volatility and build portfolios that perform more consistently, no matter the economic cycle. Moreover, active management can further enhance these benefits by effectively capturing return dispersions, leading to more consistent positive outcomes.

Balancing risks and rewards

While alternatives offer compelling benefits, they do come with trade-offs that must be carefully managed. Two critical considerations are balancing portfolio size with liquidity needs and managing systematic versus idiosyncratic risks.

Larger allocations to alternatives can unlock their benefits at the portfolio level. However, many alternative investments require long-term commitments, reducing access to capital for short-term needs or unexpected market conditions. Striking the right balance will depend on specific liquidity needs but still needs to be considered.

When it comes to managing systematic versus idiosyncratic risks, public market funds offer exposure to the former because they typically provide broad diversification across sectors and regions, reducing reliance on any single investment.

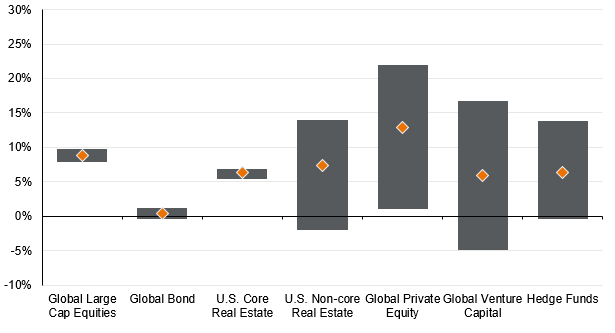

In contrast, private equity and riskier private real estate or private credit strategies often involve concentrated exposures to specific sectors, geographies or companies. This increases idiosyncratic risk, where the performance of individual investments or managers can significantly affect returns.

This results in much wider return dispersion between top and bottom performing managers than in public markets. Broader diversification across alternative asset classes can mitigate some of this risk, but thoughtful manager selection and diversified portfolio construction are essential to achieving consistent outcomes.

Manager dispersion in different asset classes

Source: Burgiss, NCREIF, Morningstar, PivotalPath, J.P. Morgan Asset Management. Manager dispersion is based on annual returns over a 10-year period ending 3Q 2024 for hedge funds, US core real estate, global large-cap equities and global bonds. US non-core real estate, global private equity and global venture capital are represented by the 10-year internal rate of return (IRR) ending 2Q 2024. Data are based on availability as of 30 Nov, 2024.

By carefully balancing these trade-offs – allocating thoughtfully to alternatives, sizing correctly to reap the benefits while maintaining liquidity, and diversifying across asset classes and strategies – investors can manage the risks while harnessing the full benefits of alternative investing.

Aaron Hussein is a global market strategist at J.P. Morgan Asset Management. The views expressed above should not be taken as investment advice.