China has been a challenging place to invest over the past few years but for investors who want to gain exposure to the market, the Fidelity China Special Situations trust could be a strong option.

It has remained on top of its sector over most timeframes and continues to be highlighted by experts as one of the best-known vehicles run by Fidelity.

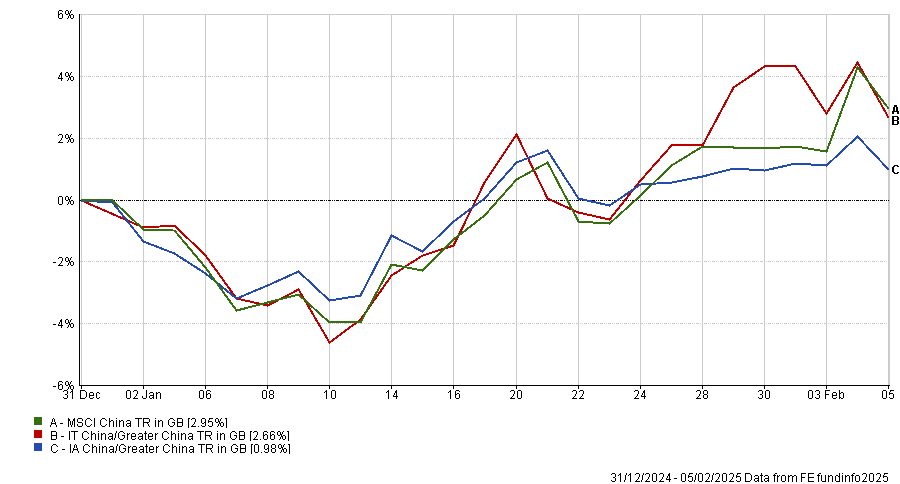

China remains as relevant as ever but equally hard to predict. The launch of AI chatbot DeepSeek sent shockwaves in the technology market last week, but returns were stifled, as the chart below shows, as Donald Trump’s tariffs threat kept the market under scrutiny.

Below, Fidelity manager Dale Nicholls tells Trustnet how he avoids value traps, why not owning Xiaomi is his biggest mistake of the year and talks about the future of electric vehicles (EVs).

Performance of sectors and index over the year to date

Source: FE Analytics

How do you select companies for your portfolio?

I buy companies that trade at significant discounts to their intrinsic value. To establish what that value is, I look at three things. First, how big a business can be in the next five, 10 and 15 years, given the state of the industry and how the company is positioned in it.

Second, I study its competitive advantage and how that is likely to change in the future as I try to find out about the incremental returns on capital the company can generate. The third element is management – you can have a great business, but management needs to execute on that.

Of the three, which drives returns the most?

In the long term, it's the quality of the business. A key part of meeting with companies is understanding the competitive moats, how they are changing and why. We are always going into meetings trying to understand the structure of an industry and the competitive edges. That's probably the most important thing.

Does this process steer you toward any particular sector or style?

Style-wise, we spread the net very wide. Smaller companies are a big part of the market we play in, as they come with less information and therefore more mispricing. The process is very bottom-up and focused on individual companies.

How do you avoid value traps?

If a company is cheap and going nowhere, it’s because it is not creating value. If it’s creating value and adding cash to the balance sheet but trading below net cash, then something strategic will happen – the market will recognise that, it may privatise or an acquirer steps in.

If a company is creating value, something has to give over time. But as a manager you have to get the thesis right in the first place.

When was the last time you got a thesis wrong?

My biggest mistake in the past 12 months has been not owning Xiaomi, underestimating its ability to execute in a top market. I viewed the handset market as a tough one for eking out decent returns but Xiaomi has done very well with the supply chain by integrating its own chips.

It is also going into electric vehicles (EVs) and the new model has hit the right price point, the right functionality and was branded very well. Frankly, I've underestimated the markets interpretation of that as well. The stock has gone to valuations that I wouldn't have expected.

Are you still happy not owning it?

I am reasonably comfortable not owning it at this type of valuation. Also the EV space, although Xiaomi is doing extremely well there, is going to be quite competitive. It's hard for me to imagine that we will have the same number of players that we have now in five to 10 years, there has to be consolidation.

It’s a big technology transition with lots of new players and at the same time, the incumbents are bringing out more as well. It will be tough.

What was the best contributor of the past year?

Hesai Technology contributed close to 2% in 2024. It makes sensing tools with multiple applications but it will be increasingly important in autonomous driving. We are just on the cusp of a really significant growth as this technology becomes the core sensing tool by which autonomous cars create a 3D image of objects that are ahead of them.

And the worst?

Auto and maintenance service provider Tuhu Car's contribution to relative return was -0.3% in 2024.

Tuhu created a highly scalable, capital-light model and has consolidated its position as the largest player. In 2024, its store revenue trended down due to current deflationary pressure from the entire sector and motor oil price decline driven by consumption downgrade.

However, store growth and sales volume remained steady, so we could still see operating leverage if consumption recovers. The company also has substantial margin expansion potential through private-label products, offline traffic growth, and enhanced chassis services.

Insurers, with names such as Ping An Insurance, also did worse than expectations. I like the insurance space over the long term in China, it fits the definition of a very cheap growth sector, as life insurance penetration is still quite low and has the potential to grow as the consumer becomes richer and seeks more protection. In the shorter term, interest rate cuts are a headwind.

Who is this fund for?

It can be for anyone. China scores at a high-teen percentage of global GDP and continues to outgrow the world, and yet it's less than 3% of global portfolios.

It is extremely out of favour. By our numbers, it is close to the widest discount it has ever traded to the US market, approaching a 60% discount for comparable levels of growth.

Investors may need a bit of a contrarian mindset, as there is definitely fear out there. But as Warren Buffett would say, the time to be greedy is when there is fear.

What do you do outside of work?

I try to keep fit with meditation, yoga and exercise, and then the other escape for me is cooking. This is where the Aussie comes through, barbecue is a big thing for me.