The US is going through a period of such intense change that “change is the only constant”, to quote Ancient Greek philosopher Heraclitus.

A new and unpredictable president, intent on disrupting the status quo, is a big part of that but there are other forces at play. Artificial intelligence (AI) is unleashing a new industrial revolution, inflation is likely to be structurally higher and more volatile going forward, and tariffs have the potential to disrupt global trade.

Given the current backdrop, US equity specialist Findlay Park prefers to invest in businesses that are resilient to, or can profit from change. Paul Gannon, deputy chief investment officer, said the firm looks for “companies that can control their own destiny and can thrive across a range of macro [economic] and political scenarios”.

The Findlay Park American fund’s largest holding is Accenture, which Gannon described as a “picks and shovels winner of the AI theme”.

“Accenture is a business services company that tends to do very well in periods of significant technological change,” he explained. “To the extent that AI is adopted, we think businesses will need Accenture to help them organise and clean their data, and set up processes to harness the benefits of AI.”

Accenture is trading below its historical relative multiple and hasn’t seen the huge share price spikes that have characterised higher-profile AI winners.

Performance of Accenture over 5yrs

Source: FE Analytics

Findlay Park also invests in the insurance brokers Arthur J. Gallagher and Marsh McLennan, which insure small businesses against a variety of ever-changing risks and “provide real value to their customers”, he said.

Moving from beneficiaries of change to brands with the longevity to endure it: Formula One Group is a prime example of “an asset with great visibility”.

“It has survived and thrived through all kinds of political cycles and interest rate cycles,” Gannon said.

“There are very few things I’ve an extremely high degree of confidence will exist in 50 years’ time, but I am pretty certain that in 2075 they will run the Formula One World Championship.”

Liberty Media, which acquired Formula One in January 2017, has a successful Netflix show called ‘Drive to Survive’, which became a breakout hit during the 2020 Covid lockdown. “It brought a huge amount of fans into the sport and it's really helped grow the sport’s popularity in the US,” he explained.

As a result, Formula One now has US sponsors, drivers, teams and new race events. Its fan base has become more diverse globally as well as younger and more female, which is reflected in the sponsors it has attracted, such as luxury conglomerate LVMH and makeup brand Charlotte Tilbury.

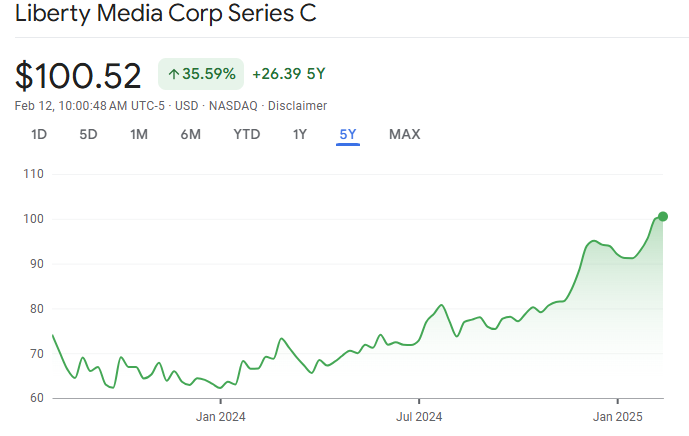

Performance of Liberty Media over 5yrs

Source: FE Analytics

Economic resilience is another theme, illustrated by garbage disposal company Waste Connections. It operates in regional monopolies where it has a dominant market position and benefits from strong pricing power, as well as consistent demand for its services. “The volume of your waste typically doesn't change a lot, whether GDP is plus one or minus one,” Gannon said.

Findlay Park also looks for businesses with “inevitable outcomes”, exemplified by data and exchange businesses such as S&P Global, MSCI and ICE. They provide high-value data and services that help customers make better decisions, giving them strong pricing power.

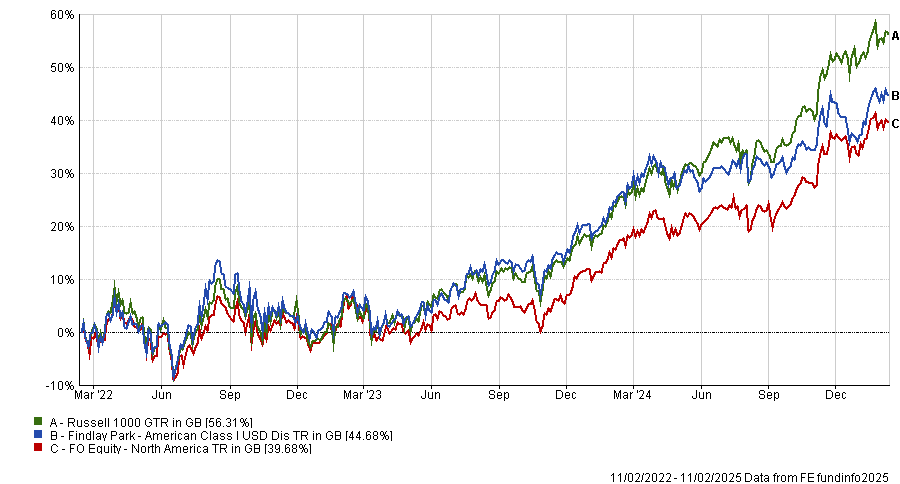

Performance of fund vs benchmark and sector over 3yrs

Source: FE Analytics

The other side of the coin is deciding which businesses to avoid, said chief executive-designate Rose Vangerven. The list includes: pharmaceutical companies dependent upon developing or acquiring the next blockbuster drug; agriculture, which is subject to the vagaries of weather and commodity prices; and companies facing regulatory headwinds, “now regulation is changing so quickly and being torn up and rewritten”, she said.

Findlay Park is also steering clear of artificial intelligence winners, with the exception of Microsoft. Even here, Findlay Park has downsized Microsoft from its largest holding to an average-size position due to concerns about AI spending and its significant investment in OpenAI. Capital expenditure as a percentage of Microsoft’s revenue has increased while its ability to convert earnings into free cashflow has diminished.

The emergence last month of DeepSeek – a Chinese company that developed a chatbot cheaply using old Nvidia chips – vindicated the firm’s concerns about AI, Vangerven said.

“Is the monetisation of AI by players that are acknowledged as AI winners really as certain as people think? Are we going to see the right returns for all this capital expense in a reasonable timeframe?” she asked.

Gannon added: “When we go on the road and visit ‘real world’ companies that we invest in, the AI use cases are somewhat underwhelming and the roadmaps around how they plan to implement AI or how much they plan to spend on AI are also in very early stages of formation. It adds to our sense of uncertainty around when will returns be generated from all the AI spend and who will all these benefits accrue to?”