Beating the benchmark year in, year out is notoriously difficult, so it comes as no surprise that regional small-cap strategies have proven unable to achieve that feat in every year of the past decade. Just one small-cap fund got close, clocking up nine years of outperformance.

In an ongoing series, Trustnet looks at the most consistent funds in their respective sectors over the past decade. To do this, we have compared the funds' performance in each of the past 10 calendar years to the most common benchmark in the sector.

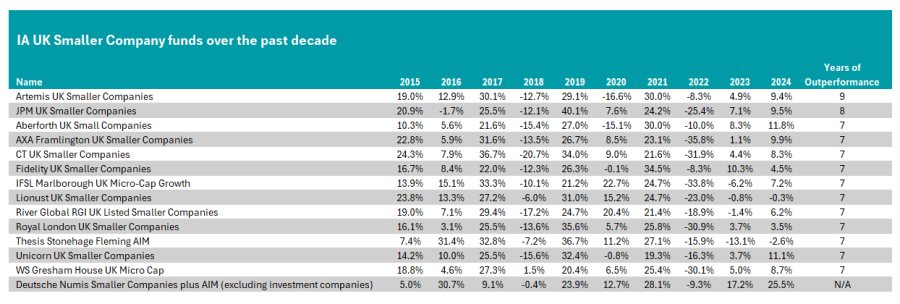

UK small-cap funds

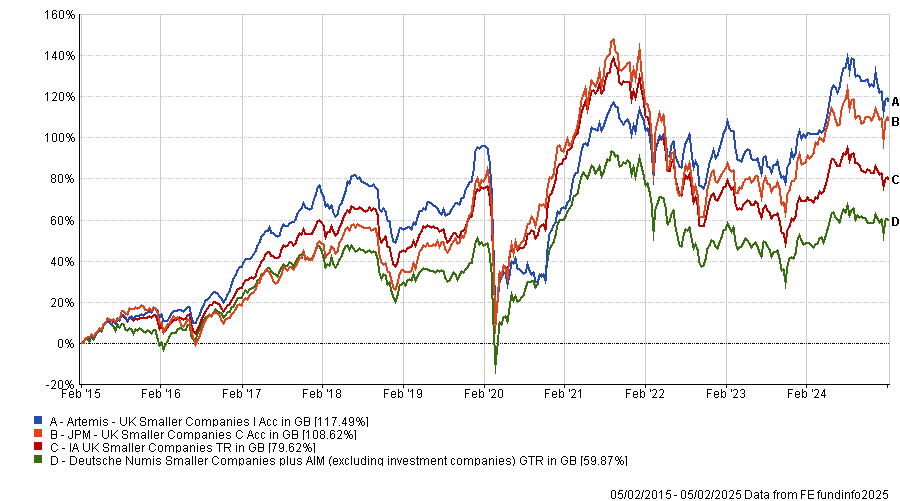

Artemis UK Smaller Companies attained the rare feat of beating the Deutsche Numis Smaller Companies Plus AIM index (the most common benchmark in its sector) every year of the past decade except 2020. That was an exceptional year, when the Covid-19 pandemic led to the largest worldwide recession since the global financial crisis.

Managed by Mark Niznik since 2007 and co-managed by William Tamworth since 2017, it returned 117.5% over 10 years, the sixth-best result in the sector.

The fund was added to Hargreaves Lansdown’s wealth shortlist last year due to its high-quality approach and valuation focus, which analysts said should “provide some shelter from the worst of market falls”. However, they conceded it may lag competitors in rising markets and conviction in the fund remains dependent on Niznik’s continued involvement.

Performance of funds vs sector and benchmark over the past 10yrs

Source: FE Analytics

Broadening our scope to funds that outperformed in eight years, the JPM UK Smaller Companies fund, managed by Georgina Brittain since 2000, stood out.

Over the past decade, it was up by 108.6% and only failed to beat the index in 2016 and 2022.

During this period, the fund had a bottom-quartile volatility of 16.4%, making it riskier than many of its peers.

Source: FE Analytics

As seen in the table above, a plethora of other smaller company funds outperformed in seven of the past 10 years. These included strategies such as the Royal London UK Smaller Companies fund, the Liontrust UK Smaller Companies fund and the WS Gresham House UK Microcap fund.

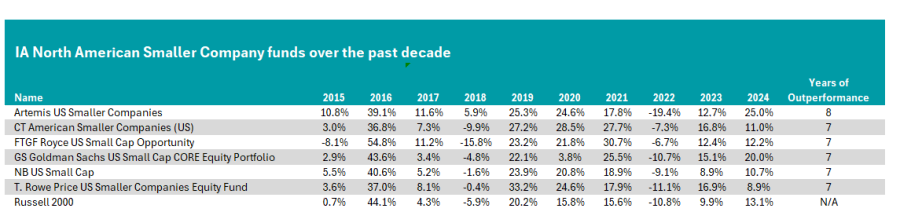

US smaller companies

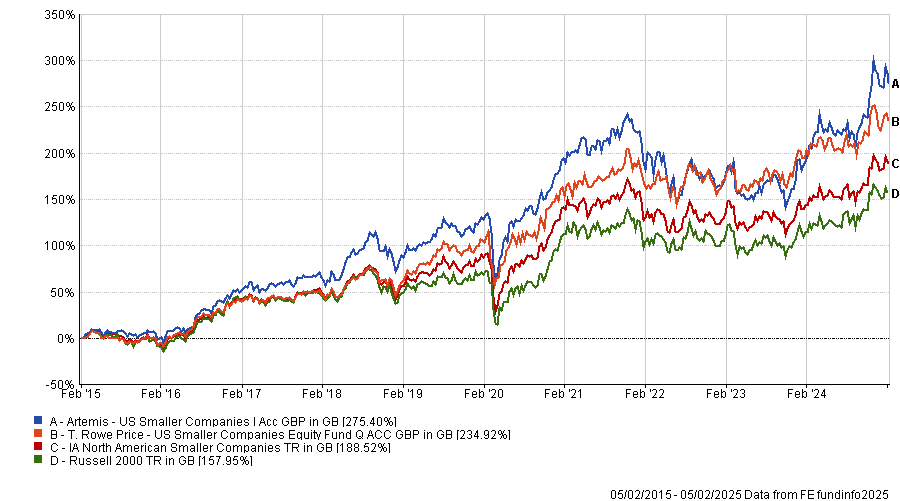

In the US, Cormac Weldon’s Artemis US Smaller Companies strategy was the most consistent fund of the decade, beating the Russell 2000 in eight of the past 10 years.

It faltered against the index in 2016 and 2022. This was because the Russell 2000 surged by 44% in 2016, a hard result to beat. Meanwhile in 2022, the sudden bear market led to poor results for most funds, with the peer group average sliding by 10.8%.

In more benign environments, the fund performed much better. Indeed, over the past 10 years, the strategy has delivered a best-in-sector result of 275.4%.

Performance of funds vs sector and benchmark

Source: FE Analytics

Last year, the fund received more than £245m in inflows, making it the most bought active fund in the IA North American Smaller companies sector in 2024.

Analysts at Square Mile Investment Consulting & Research said the fund benefited from a small but experienced management team. “We acknowledge that compared to a number of its competitors, the team is by no means large, but in this case, we think its size is advantageous as it leads to swift decision-making in a market that can be prone to short, sharp changes in investor sentiment,” they explained.

Five more funds the market over the past seven years, the largest being the T. Rowe Price US Smaller Companies Equity Fund.

Despite underperforming in 2016, 2022 and 2024, it delivered a 234.9% return over the past decade, the second-best result in the sector.

Source: FE Analytics

As demonstrated in the table above, several other funds also outperformed the Russell 2000 in seven out of 10 years, including the £1.1bn CT American Smaller Companies (US) fund.

European small-cap strategies

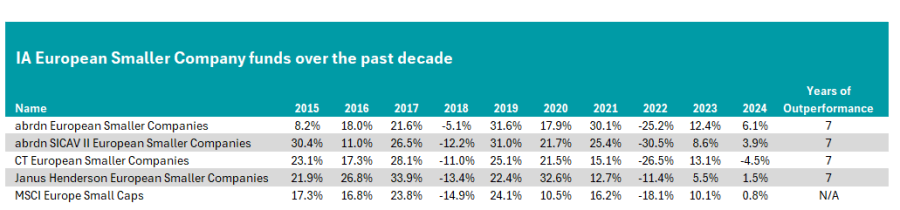

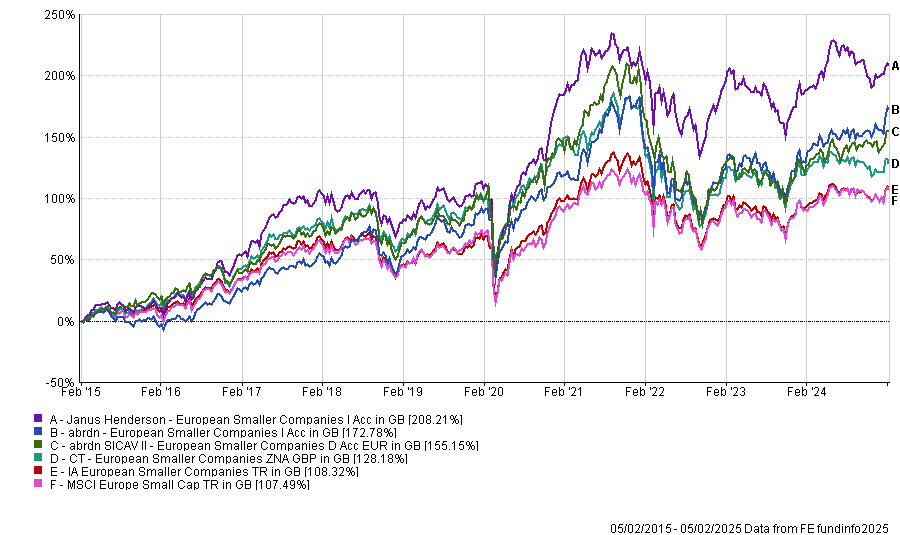

In Europe, four funds outperformed in seven of the past 10 calendar years. The largest was the abrdn SICAV II European Smaller Companies strategy, managed by Andrew Paisley.

Source: FE Analytics

Over the past 10 years, it was up 155.2%, the third-best performance in the sector. However, it failed to beat the MSCI Europe Small Cap index in 2016 and underperformed in 2022 and 2023.

Its stablemate, the abrdn European Smaller Companies fund, also made the cut having beaten the benchmark every year except for 2015, 2017 and 2021.

The Janus Henderson European Smaller Companies fund also qualified. Over the past 10 years, it rose by 208.2%, the best performance of European small-cap funds over the past decade.

This supranormal result meant the fund delivered an alpha score of 4.1 over the past decade, another best-in-class result.

Performance of funds vs sector and benchmark

Source: FE Analytics

Finally, CT European Smaller Companies lagged the market in 2019, 2021 and 2023, but still delivered a 128% return to investors over the past decade.