Funds from BNY Mellon, Man Group and Veritas are among those to top the equity income sectors on a broad range of risk and return measures over the past three years, Trustnet research shows.

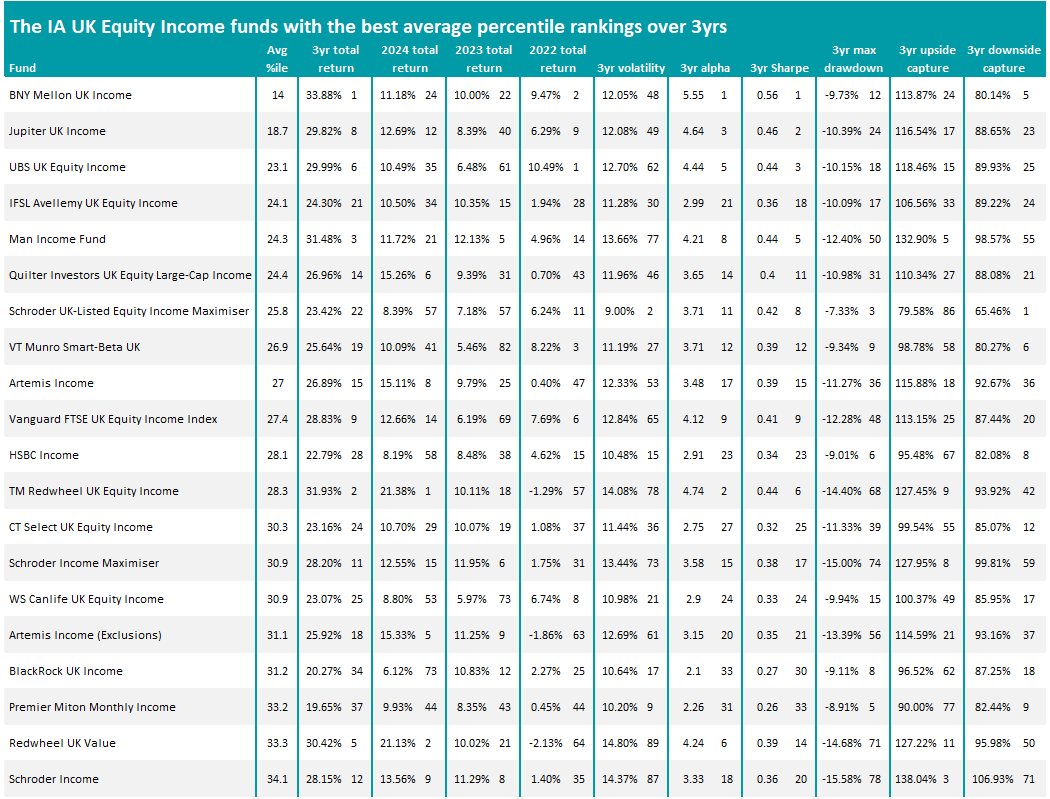

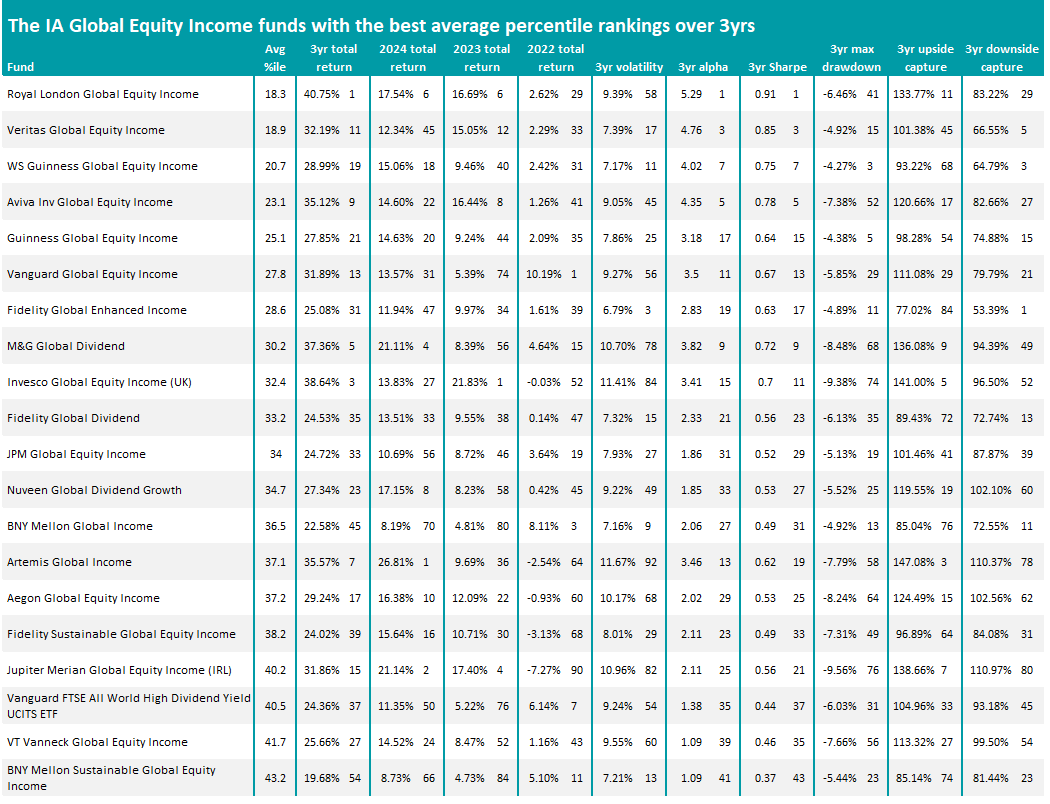

This annual series scores funds on 10 key metrics: cumulative three-year returns to the end of 2024 as well as the individual returns of 2022, 2023 and 2024 (to ensure performance isn’t down to one exceptional year), three-year annualised volatility, alpha generation, Sharpe ratio, maximum drawdown and upside and downside capture, relative to the sector average.

We then use each fund’s average percentile ranking for the 10 metrics to discover which were consistently at the very top of the sector across the board. Essentially, the lower a fund’s average percentile score, the stronger it has been over the past three years.

In the IA UK Equity Income sector, BNY Mellon UK Income took first place in this research with an average percentile ranking of 14. This was driven by a three-year return of 33.9% (the peer group’s highest) with strong numbers for alpha generation, Sharpe ratio and downside capture.

The £1.5bn fund is managed by Newton Investment Management’s David Cumming and Tim Lucas, who focus on finding sustainable dividends when building a portfolio of between 40 and 60 holdings. This means they look for high-quality and cash-generative companies with reliable dividend yields.

Top holdings include Shell, GSK and Barclays, while the largest overweights are to the consumer discretionary, energy and financials sectors.

Source: FE Analytics

Adrian Gosden and Chris Morrison’s £1.4bn Jupiter UK Income fund comes in second place with an average percentile ranking of 18.7. However, it has undergone some changes over the three years examined in this research, with Gosden and Morrison assuming control in April 2024 and repositioning the fund after taking over from previous manager Ben Whitmore.

Gosden and Morrison, who worked together at GAM before joining Jupiter, focus on the ability of companies to generate free cashflow. They argue that knowing how cash generative a company is allows them to gauge the likelihood of it being able to pay a growing dividend.

Other well-known funds in the above table include Man Income, in fourth place after scoring 24.3 across the 10 metrics. Managed by FE fundinfo Alpha Manager Henry Dixon, the £1.8bn fund is run with a strict focus on valuations (looking for companies whose shares are trading at distressed levels) and dividend growth prospects.

Analysts at FE Investments, who have the fund on their Approved List, said: “It is important to consider the performance of this fund over a minimum period of three years. The recovery process takes time to come to fruition and then it needs to be acknowledged by the market – therefore, this is a strategy that requires some patience.”

Artemis Income, managed by Alpha Manager Adrian Frost, Nick Shenton and Andy Marsh, also performed strongly in this research. Frost has worked on the £5bn fund for more than 20 years, over which time it has built up a strong track record and reputation.

Analysts at The Adviser Centre said: “The team has guided the fund steadily through numerous market cycles. The fund is one of the mainstays of the UK equity income sector and remains a solid home for long-term investors.”

Vanguard FTSE UK Equity Income Index, one of the few passive options in the IA UK Equity Income sector, has also outperformed many of its active rivals in this research. A three-year total return of 28.8% was not the only selling point for the £1.3bn fund, which has outperformed many of its peers for returns, alpha, Sharpe ratio, upside capture and downside capture over the period.

Source: FE Analytics

Over in the IA Global Equity Income sector, the £934m Royal London Global Equity Income fund sits at the top of the table, thanks to an average percentile ranking of 18.3. However, this is another fund with management changes – Richard Marwood took over the portfolio in 2024 after former manager Niko de Walden left with Peter Rutter and some other colleagues to launch a new investment business.

Veritas Global Equity Income is close behind. Andrew Headley and Ian Clark have worked on the £220m fund since 2019 with Mike Moore joining them as co-manager in 2023. It aims to provide a “high and growing” income with a secondary goal of preserving capital in real terms over the long term.

Matthew Page and Ian Mortimer have two funds in the above table: WS Guinness Global Equity Income and Guinness Global Equity Income. Both funds have the same approach – building an equally weighted but concentrated portfolio of high-quality companies with low debt – but the former fund is domiciled in the UK while the latter is domiciled in Ireland.

FundCalibre analysts described the fund as a core global income holding and said: “We believe the managers’ focus on first choosing the right companies – rather than filtering by dividend yield – gives them a greater chance of finding hidden gems in the market. They look for growing, rather than high, income and the equally weighted portfolio also sets the fund apart from many of its peers.”

Other popular IA Global Equity Income funds with good performance across the 10 metrics we examined include M&G Global Dividend, Fidelity Global Dividend, BNY Mellon Global Income and Artemis Global Income.