Retail money has flown back into funds in the fourth quarter of 2024, when new-found confidence boosted net fund sales by 20 percentage points against the previous quarter, the latest Pridham report shows.

The study highlights gross and net sales at the main fund groups that operate in the UK, and the stark difference between the two three-month periods highlights just how changeable investor confidence remains in the current environment, according to Benjamin Reed-Hurwitz, EMEA research leader at ISS Market Intelligence.

“Given the level of uncertainty in the global economy, investors are understandably cautious,” he said. “It’s too early to predict the start of a boom but the signs are nonetheless positive as we approach the halfway point in Q1.”

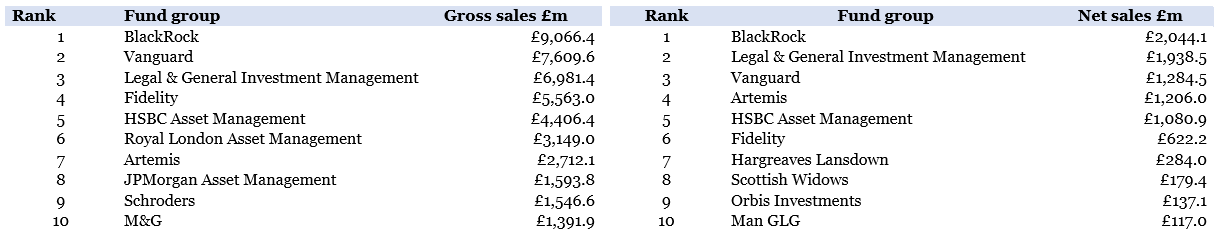

Source: ISS Market Intelligence, The Pridham Report, Q4 2024

BlackRock and Legal & General Investment Management led the table of net gains.

BlackRock, together with Hargreaves Lansdown, Vanguard and HSBC Asset Management, particularly stood out for being in the top 10 of net sales in all four quarters of 2024.

Boutique firm Artemis also had a record quarter, with the best quarterly performance by an active manager in all of 2024. The report attributed this success to its UK Select strategy, which did particularly well.

Further down the list, Orbis Investments continues to gain ground thanks to its performance-based fee offering in the mixed-asset class.

As for fund types, the most bought were passive fixed-income vehicles, as investors went looking for low-cost options to lock into the higher yields currently on offer as inflation recedes, Reed-Hurwitz explained.

Investors also backed active managers, increasing their exposure to sectors where they believe active managers are best positioned to deliver strong risk-adjusted returns. “High alpha generation is increasingly top of mind, with a growing number of investors opting for more targeted, nuanced approaches to generating gains that potentially complement other passive positions held,” he concluded.