There will be no V-shaped recovery in UK mid- and small-caps this year, according to BlackRock Throgmorton Trust manager Dan Whitestone, who said it is “frustrating” but it is “hard to get too constructive” on the asset class at present.

Much of his frustration stems from the Labour government’s Budget in October, which he described as having a “chilling effect” on UK economic figures.

For example, the CITI Economic Surprise index, which peaked at over 50 in the summer has fallen to -34, while UK GDP data has been revised down to close to 0 in the third quarter of 2024 with little growth expected in the final three months of last year.

“It is frustrating that only a few months ago I was writing about ‘robust’ UK macro data, falling mortgage rates and a positive outlook for 2025. For as Keynes said: ‘When the facts change, I change my mind’,” said Whitestone.

He said the “mix of policies” was “definitely worse” than he had expected, although the amount of spending was broadly in line with his forecasts.

Changes to National Insurance (NI) in particular drew his ire. While the 1.2% higher rate for employer contributions had been well communicated, the decision to lower the threshold at which NI is paid was “unexpected” and will “disproportionately affect those in part-time work and impose large costs on the businesses that employ them”.

“Companies are telling us that they will respond to these inflationary impulses by reducing staff and seeking efficiency savings, which suggests the outlook for UK employment is weaker,” Whitestone said.

“The UK’s twin deficit combined with a weakening growth outlook doesn’t inspire external investment, which this country badly needs.”

In addition to the Budget, bond yields also remain prohibitive, he wrote in the trust’s final results for the year to 30 November 2024. Although the Bank of England is cutting rates, the 30-year bond is at its highest level since 1998 and swap spreads, crucial for mortgage pricing, are following suit.

“The outlook for the housebuilding sector and supply chain has darkened as funding rates appreciate,” the BlackRock Throgmorton Trust manager said, meaning the government will need to “move at an even faster rate with supply-side reforms” to stimulate a housing recovery.

“Ultimately, we have moved from a situation of economic strength and financial markets looking supportive to one where economic data has weakened and UK fiscal policy looks increasingly at the whim of financial markets,” said Whitestone.

As such, it is “hard to get too constructive on the UK small- and mid-cap universe right now, given the domestic fiscal environment depicted”, he said, adding “our hopes for a V-shaped recovery in 2025 have been squashed”.

But it is not all bad news. UK construction purchasing managers index (PMIs) have come off their peak but are still the strongest in Europe, he noted, while mortgage volumes ended the year up 40% on 2023.

Disposable income was up, the savings rate is high and service sector PMIs remain “hovering above 50”, even as business confidence has fallen. Lastly, the Bank of England’s “sanguine” view on inflation gives “more scope to cut [rates] faster than currently expected”.

All of this means a deep recession is unlikely. Instead, Whitestone said 2025 will look a lot like 2023, when there was subdued demand and anaemic growth with the biggest downside risks coming from either “a fiscal misstep or punishment by the bond market”.

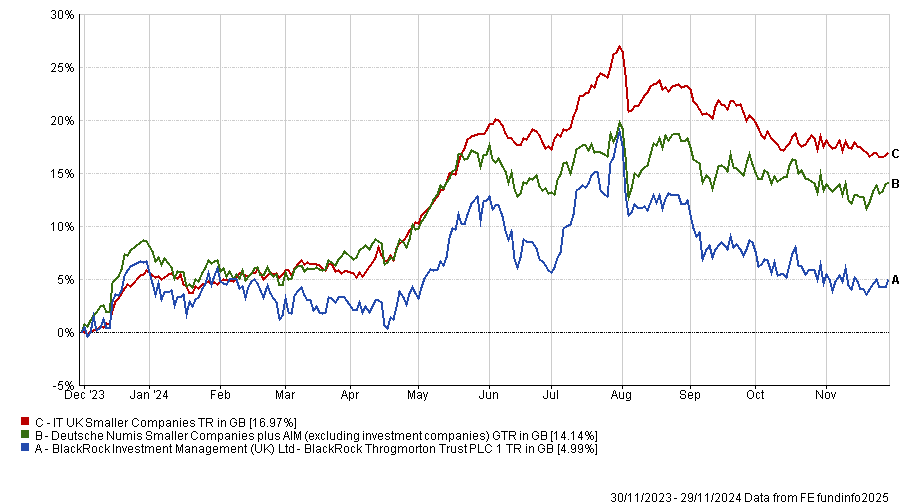

The manager wrote this in the BlackRock Throgmorton Trust’s full-year results to 30 November 2024. During the year it made 13.7% in net asset value (NAV) terms but the total return was just 5% as the share price discount continued to widen.

Total return of fund vs sector and benchmark in the 12 months to 30 November 2024

Source: FE Analytics

To navigate the shifting macroeconomic landscape, Whitestone has reduced long exposure to domestic UK companies with interest rate sensitivity and introduced or added to short positions in several areas, namely companies with incremental cost pressure or a “creaking” business model in 2024.

“We increased short positions in retailers who are heavily exposed to sourcing in dollars as well as in the technology sector, where we see budgetary pressures amongst small- and medium-sized enterprises, which will be disproportionately hit by this Budget, as well as those where the government is a large customer,” the BlackRock Throgmorton Trust manager said.

However, he is “nervous” about adding too much to the short book as share prices are down significantly since the Budget, there has been significant merger and acquisition (M&A) activity (which can unexpectedly drive share prices higher) and there is a chance of accelerated rate cuts from the Bank of England. All of these are positive for equities.

There have also been no significant changes to UK-listed international businesses, where the trust continues to prefer stocks with large US exposure.

Here he sees “long-term roadmaps for growth in infrastructure and data-centre capex, which should benefit holdings such as Hill & Smith and Rotork to name but two”.