Investment companies come in several flavours, from mild to spicy, and allow investors to get exposure to sectors usually deemed too illiquid for open-ended vehicles. As this year’s ISA season draws to a close, Trustnet has put together a menu of eight picks, selected by experts to suit a range of investors’ appetites.

A core global equity trust

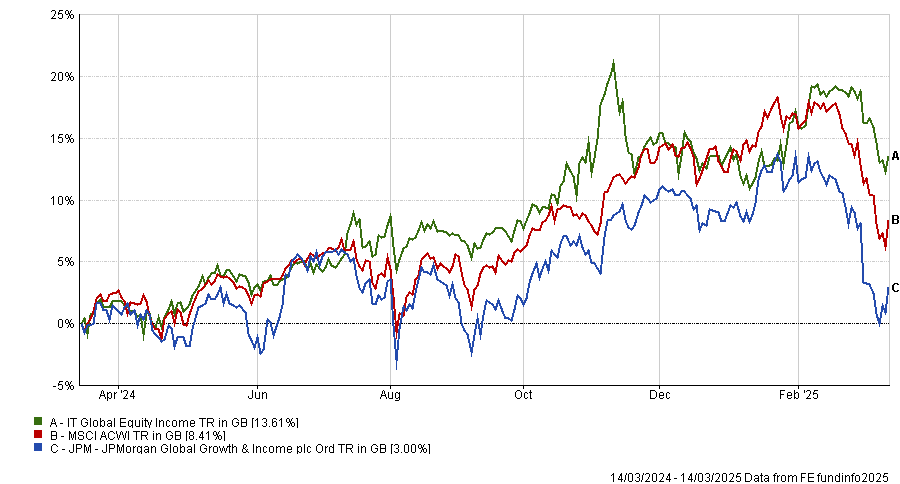

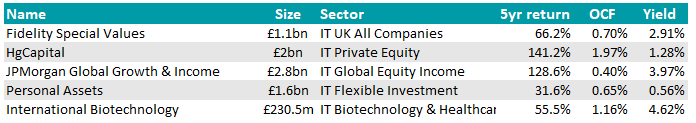

Emma Bird, head of investment trusts research at Winterflood, chose JPMorgan Global Growth & Income* for its exposure to global equities, reliable yield and track record of outperformance.

On a NAV total return basis, it has outperformed the MSCI All Country World Index in each calendar year from 2019 to 2024 – a “commendable” level of consistency for the management team, made up by three FE fundinfo Alpha Managers – Timothy Woodhouse, Helge Skibeli and James Cook.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“The disciplined application of the managers’ style-agnostic, research-driven investment approach has been a key driver of the consistency of performance, and would expect this to continue,” she said.

“The enhanced dividend policy, targeting at least 4% of the previous year-end NAV, makes good use of the investment trust structure, and the fund currently provides an historical yield of 4%.”

With a market cap of £2.8bn, the trust is a large, liquid and low-cost vehicle, Bird noted. Its ongoing charges fee is just 0.5%, the joint-lowest in the IT Global Equity Income peer group.

A specialist UK stalwart

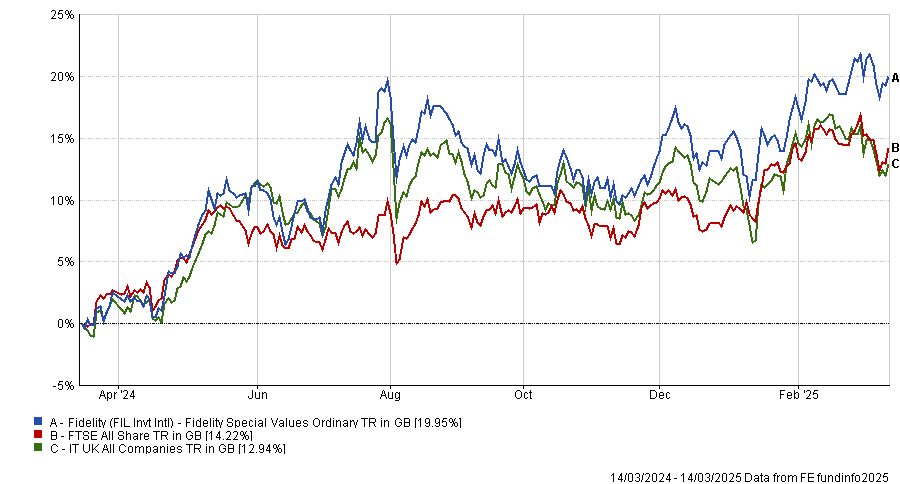

For those ready to take on slightly more risk, Jonathan Moyes, manager of the Wealth Club Portfolio Service at Wealth Club, suggested Fidelity Special Values. Alpha Manager Alex Wright invests in UK companies that have fallen out of favour, but which he believes have the potential to recover.

The strategy, manager and investment trust structure – which, according to Moyes, allows for better management of an illiquid portfolio – have been “a winning combination”. Since its inception, the trust has never had a 10-year period where it has underperformed the UK stock market.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“£10,000 invested at inception would be worth £284,631 in February 2025, more than three times the amount you would have had if you invested in the UK stock market,” he said.

“There is a lot to like in the trust, an experienced portfolio manager, depth of supporting resource, focused investment approach and a strong longer-term track record.”

A trust that could have made you a million

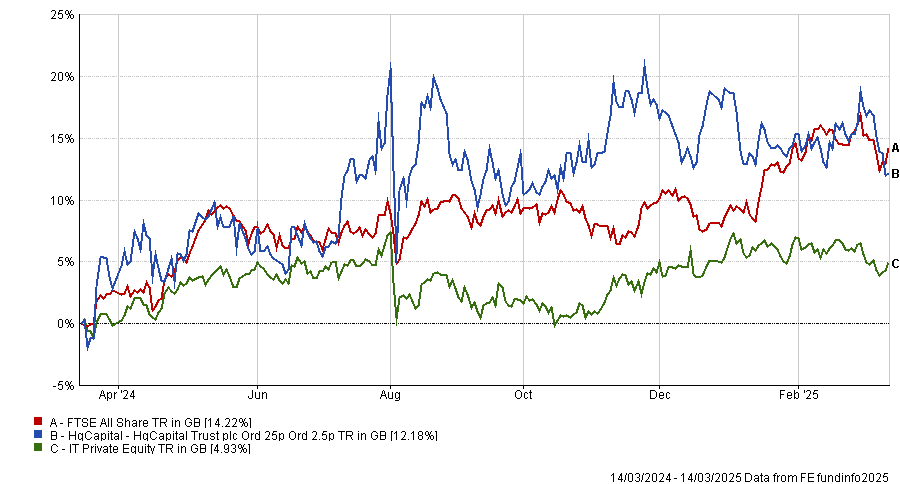

Moyes put forward two more options with more risk attached.

HgCapital trust** is managed by “one of the world’s most successful private equity firms”, he said, whose managers oversee more than $75bn and invest in businesses offering mission-critical software and services across Europe and America.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“A typical Hg investment might be a company offering software for human resource functions, regulatory compliance or tax filing. That might sound boring but they have historically been brilliant investments. They’re resilient in economic downturns, high margin and very scalable,” Moyes said.

“We rate Hg’s well-defined and well-rehearsed investment approach highly. Over 30 years, the trust has delivered extraordinary returns to investors. Had you invested your full ISA allowance in the trust every year since ISAs were introduced in 1999, your investment would today be worth around £2.1 million.”

A bit of Swedish family silver

In 2025, there is no need to limit your portfolio to just UK-listed investment trusts, according to Moyes, who said there are some “extraordinary listed investment companies to be found by those who are willing to look further afield”.

One of them is Swedish-listed Investor AB, founded in 1916 by one of Europe’s most successful industrial families, the Wallenbergs, and the family and their foundations remain major shareholders today.

The trust looks for companies that can generate consistently high returns on capital and holds them indefinitely.

“Investor AB takes a seat on the boards of the companies it invests in and has a team to support each director and company. Its 25-company portfolio is split across predominantly European-listed companies and a private equity portfolio,” Moyes said.

“We like the disciplined long-term investment approach here as well as the manager’s dedicated resource. The longer-term track record has been exceptional.”

An ‘obvious’ place for growth investors

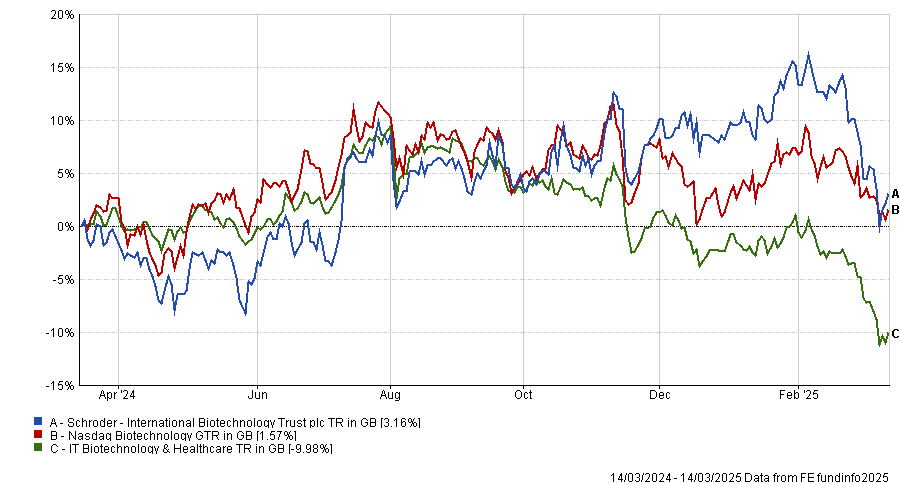

The biotech sector has been dealing with the fallout from the sharpest rate hiking cycle on record in 2022 and it has been out of favour with investors for the past couple of years. Growth investors seem to have forgotten about it, according to Thomas McMahon, head of investment companies research at Kepler Partners, but he believes the sector is an obvious place they should invest in.

“The sector looks strong on financial and medical fundamentals, with good cash levels on balance sheets and a high number of clinical approvals coming through. Large-cap pharma has a need of new drugs to replace those with expiring patents and this is driving a wave of M&A which could grow under a republican administration,” he said.

“A more stable rates environment could itself be enough to see biotech prices do well, but further cuts in the US are likely to be like catnip for the sector.”

Performance of fund against index and sector over 1yr

Source: FE Analytics

McMahon’s pick was the International Biotechnology Trust, which has been managed by Schroder’s Ailsa Craig and Marek Poszepczynski since 2021. “With a significant discount on its shares to add to the attractions, the International Biotechnology Trust could be one to tuck away for the long term,” he said.

The mixed-asset option

Finally, for cautious investors who prefer to err on the mild side of the spectrum, Paul Angell, head of investment research at AJ Bell, chose the Personal Assets Trust.

This defensive multi-asset investment trust is managed by Sebastian Lyon, who puts a high degree of emphasis on capital preservation.

The manager focuses on traditional asset classes (equities, government bonds and gold) and reacts to market opportunities by adjusting his weightings to them. Within equities, his preference is for higher quality, cash generative businesses.

Currently, the trust is defensively positioned, with 55% of assets held in US and UK government bonds (mostly inflation-linked), 10% in gold bullion and 30% in equities.

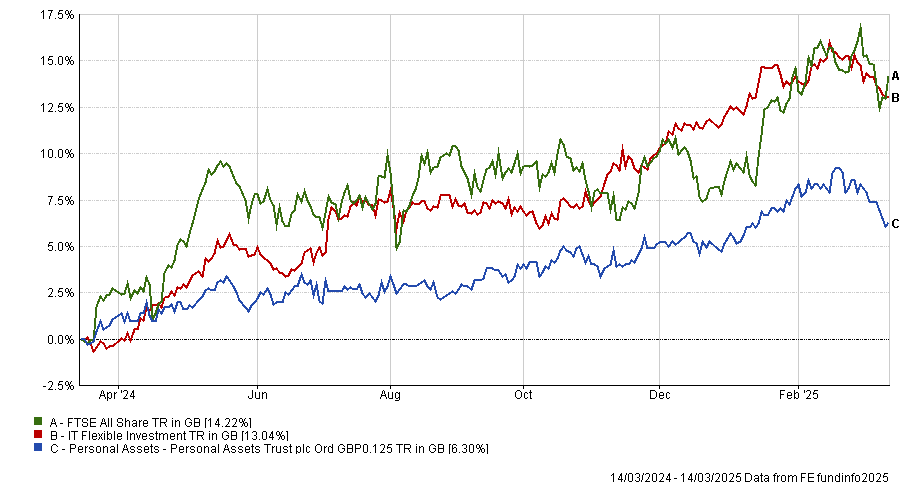

Performance of fund against index and sector over 1yr

Source: FE Analytics

“The vehicle typically plays a defensive role in portfolios, holding up when riskier assets, such as equities and credit, sell off. This has been the case through numerous market pull-backs including the financial crisis, the outset of the Covid pandemic and the rising interest rate environment of 2022,” Angell said.

“It is not typically geared, and a discount control mechanism is in place to keep the share price trading close to its net asset value (NAV).”

Source: FE Analytics

*Denotes a corporate broking client of Winterflood Securities

** An investor in FE fundinfo