It has been an interesting three months for equity markets. Last year’s top performer, the S&P 500, experienced a major market sell-off earlier this month, while former laggards such as China and Europe have surged.

With the 5 April ISA deadline creeping ever closer, investors might be tempted to be more cautious with holdings in case volatility and uncertainty continue to characterise the equity markets this year.

Below, Trustnet asks fund pickers for their favourite cautious funds, with most choosing a multi-asset solution to provide additional inflation protection and diversification.

Troy Trojan

The £5bn Troy Trojan fund, managed by FE fundinfo Alpha manager Sebastian Lyon and co-manager Charlotte Yonge, was a popular choice for fund pickers.

Ben Yearsley, director at Fairview Investing, described it as a “tried and trusted” fund that emphasised capital and wealth preservation as a primary objective. He explained its core goal was to preserve the “real” value of investments by matching inflation over the medium to long term.

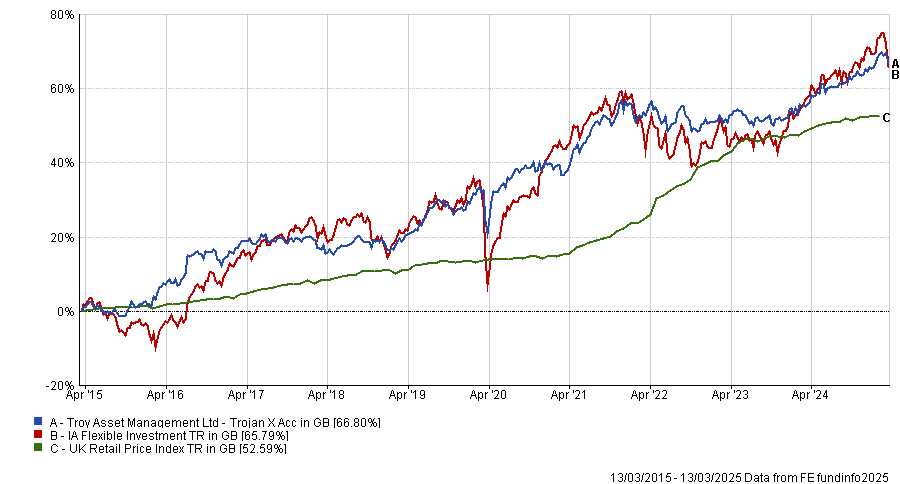

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The managers have a more flexible approach to asset allocation with the structure of the portfolio varying “based on the manager's economic outlook” because of this goal, he added. Currently, the portfolio favours quality global companies, inflation-linked government bonds and gold.

Due to this dynamic and flexible approach, the portfolio delivered a benchmark-beating return of 66.8% over the past 10 years and ranked as one of the least volatile funds in the sector.

Rosie Cook, investment analyst at One Four Nine portfolio management, also picked the Trojan fund. She explained that, as a multi-asset fund, it “has diversification built into the investment process”.

She said Lyon and Yonge’s approach to asset selection is particularly appealing, with the managers investing in sustainable businesses and index-linked government bonds, which provides further inflation protection and diversification. The significant allocation towards gold (11%) was a “a key differentiator” to competitor multi-asset funds for Cook.

She concluded: “The fund has delivered positive returns in five out of six market drawdowns since inception, which is evidence of good capital preservation characteristics, ideal for a cautious investor”.

Personal Assets Trust

This was not the only strategy from the Troy team to catch the fund pickers' eyes. Rob Morgan, chief financial analyst at Charles Stanley Direct, identified the Personal Assets Trust as an appealing option.

Also managed by Lyon and Yonge, Morgan said: “It is not likely to set pulses racing but it is the sort of resilient holding that could be considered for the core of an investor’s portfolio”.

It follows the same principle as the open-ended fund, prioritising not losing money in “real terms” instead of obsessing over benchmark performance. Morgan conceded that while this did lead to some “rather dull periods of performance”, the portfolio tended to “come into its own during difficult times”.

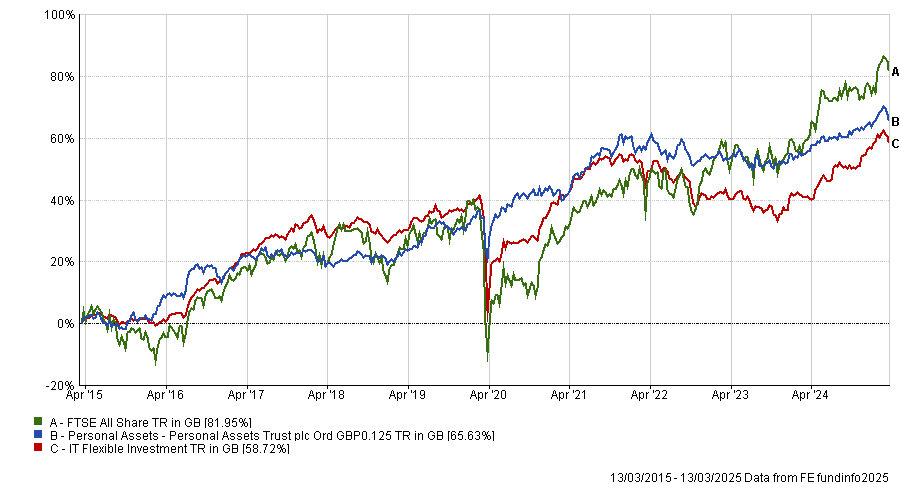

For example, during the 2020 global pandemic, it was one of the best-performing trusts in the IT Flexible Investment sector. However, it also performed well more broadly and beat 50% of its sector peers each year over the past decade except in 2017. As a result, it was up by 66.6% over 10 years, a top-quartile performance.

Performance of the trust vs sector and benchmark over 10yrs

Source: FE Analytics

Morgan explained that the managers have been concerned by “stretched valuations in the equity market for some time now”, which is reflected in the portfolio’s composition, with just a 30% allocation towards large blue-chip stocks.

He concluded: “With a disciplined record of asset allocation and the flexibility to add to equities on weakness, the trust’s philosophy could resonate with private investors wishing to balance opportunity and risk”.

Rathbones Total Return

Sticking with the multi-asset recommendations, Alex Farlow, associate director of multi-asset research at Square Mile, pointed to Rathbones Total Return as a “compelling option for more cautious investors”. Managed by David Coombs and Will McIntosh-Whyte, the fund is up 41.6% over the past decade.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Farlow explained the fund primarily invests in bonds and equities, with some “collective investments held for more specialist equities and alternatives”. The managers assess each security based on its volatility, liquidity and correlation, which allows them to have a more flexible portfolio structure, he explained.

“Importantly, the managers are consistently focused on delivering the fund’s objectives through a diversified portfolio”. Indeed, Farlow praised the managers for their experience and “proven ability” in asset allocation, with the fund having lower volatility than most equity funds.

“We believe this is a robust option for investors that require capital growth but are only prepared to accept a moderate level of volatility”, he concluded.