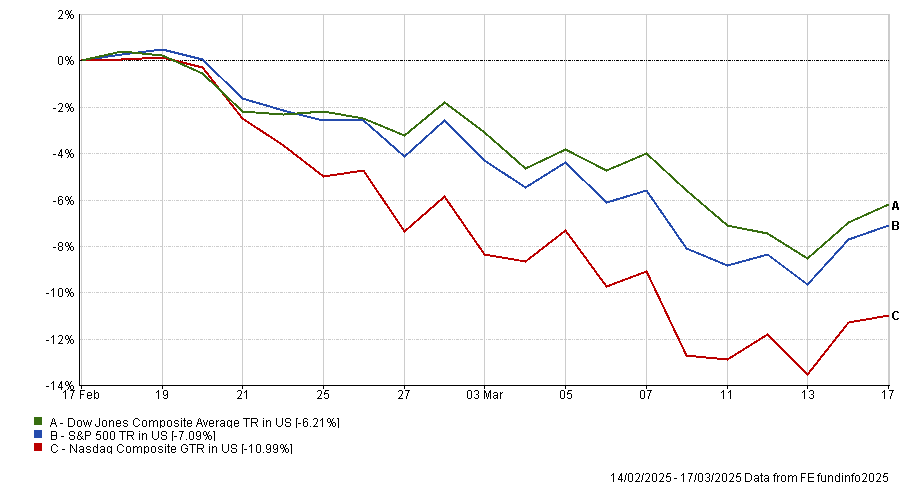

US equities have plummeted steeply since mid-February as weak economic data, tariffs and president Donald Trump’s unpredictable policy-making spooked markets. The US stock market bounced back yesterday, however, with its second consecutive session in the green.

Neil Wilson, an analyst at TipRanks, explained: “The S&P 500 added 0.64%, the Dow put in a stronger showing with an 0.85% rise, while the tech-heavy Nasdaq lagged slightly, up just 0.31%. Looks like a short-term rally into weakness [rather] than a reassertion of bulls’ strength.”

This begs the question of whether the steep correction has run its course or has further to go. “A bottom could be near now with this rally driving out some paper hands,” Wilson said.

Performance of US equities over one month

Source: FE Analytics

Will Low, head of global equities at Nikko Asset Management, thinks the most dramatic market swings have already taken place, so investors should not necessarily be selling out of US equities now. “The lion’s share of the first wave of correcting prior positioning has probably happened already,” he said.

Although a lot of selling activity has been quickly implemented, with hedge funds adjusting their positions and traders selling futures and exchange-traded funds, other investors will take much longer to reposition their portfolios – potentially as long as six months, Low said. Therefore, he expects the US equity market to find its floor during the next quarter.

Investors had been over-allocating to the US at the expense of everywhere else and the unwinding of these overweights is “a long overdue, healthy correction of probably excess positioning”, he argued.

Asset managers have been selling out of US stocks in droves, according to this month’s Bank of America Global Fund Manager Survey. Allocations to US equities dropped 40 percentage points to a net underweight of 23% (the lowest level since June 2023).

Furthermore, data from this month’s poll supports Low’s view that the bulk of the US equity correction has taken place already.

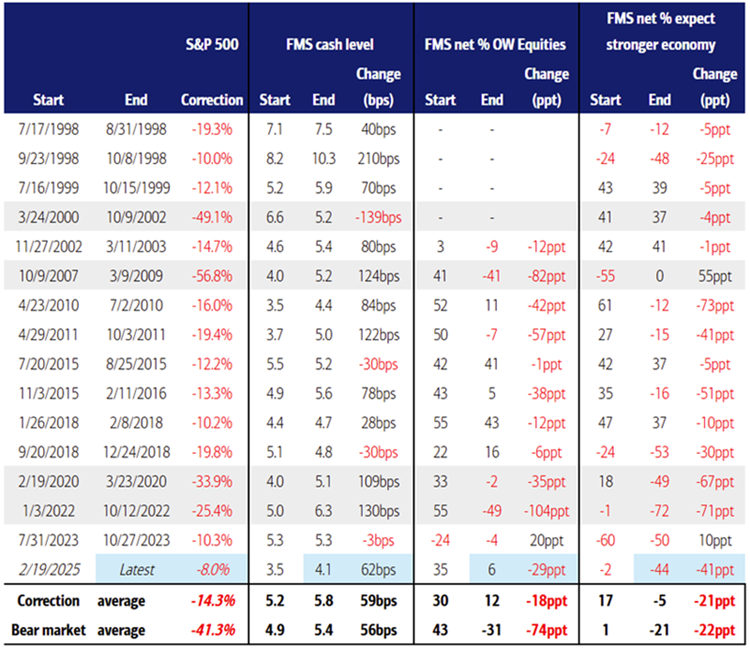

BofA analysed 11 corrections since 1998 during which the S&P 500 fell more than 10%, as the chart below shows. It found three indicators that show market swings are almost over.

The first two signals have been met: global growth expectations dropped 41 percentage points in March (a drop of 20 percentage points in a month would historically signal the bottom of the market) while global equity allocations fell 29 percentage points (a decline of more than 20 percentage points being the signal).

The third – that cash levels rise above 5% – is close as fund managers currently hold 4.1% in cash.

S&P 500 corrections: Signals to watch from BofA Fund Manager Survey (FMS)

Source: Bank of America Global Fund Manager Survey

Some professional investors are buying the dip. Wealth manager JM Finn is maintaining its underweight to the US but has been feeding money back into the market during the sell-off to take advantage of buying opportunities, said fund manager James Godrich. Buying on the way down also means the firm doesn’t have to call the bottom of the market, he added.

BlackRock, meanwhile, remains overweight US equities, not least because the tech sector is still forecast to deliver the strongest growth this year. Jean Boivin, head of the BlackRock Investment Institute, said: “Economic conditions don’t point to recession, yet prolonged policy uncertainty may hurt growth [although] policy uncertainty should ease over a six- to 12-month horizon.”

The goal posts have moved

The relative risk premium of the US versus other markets has increased due to Trump’s unpredictability, Low said, and “will probably stay that way until we get a change to the geopolitical scenario”. This is one of the reasons behind the correction.

The higher country risk premium for the US is leading investors to reassess what price they want to pay for US assets. “A degree of pricing down and being more careful about the valuations you pay in the United States is, I think, appropriate,” he noted.

A key element of this repricing, particularly for the largest companies in the US, is artificial intelligence (AI). Last year, investors were willing to pay a high price for the future growth potential of AI winners such as Nvidia and Microsoft.

More recently however, investors have grown concerned about whether the colossal capital expenditure plans of Microsoft and its peers will generate returns. As a result, Nikko has reduced its active weighting to Microsoft towards the lower end of its historical range and the Nikko AM Global Equity fund is about 5% underweight tech.

“I think the longer-term story of AI adoption, if you take a five to 10-year view, is still very powerful but that doesn’t mean there won’t be bumps in the road,” Low said.

“There could be periods where there’s overreach and investment reappraisal and cycles in terms of capex. Whether that cyclicality proves to be as big as now being discounted or worse, we don’t know.

“So the million dollar question we’re asking as capital markets adjust is: have we got to the point where it fairly reflects that outlook or are we still adjusting from excessive prior positioning between geographies?”