Patria Private Equity and Foresight Solar have joined the Association of Investment Companies’ (AIC) list of next generation dividend heroes – trusts that have grown their annual dividends for 10 or more consecutive years but fewer than 20.

Schroder Oriental Income and BlackRock Greater Europe lead the 30-strong list with 18 years of growing payouts. In two years’ time, they will qualify to join the ranks of the full-fledged dividend heroes.

Hot on their heels are CQS New City High Yield and Henderson Far East Income, with 17 years of unbroken dividend increases, followed by International Public Partnerships and abrdn Asian Income Fund, with 16 years.

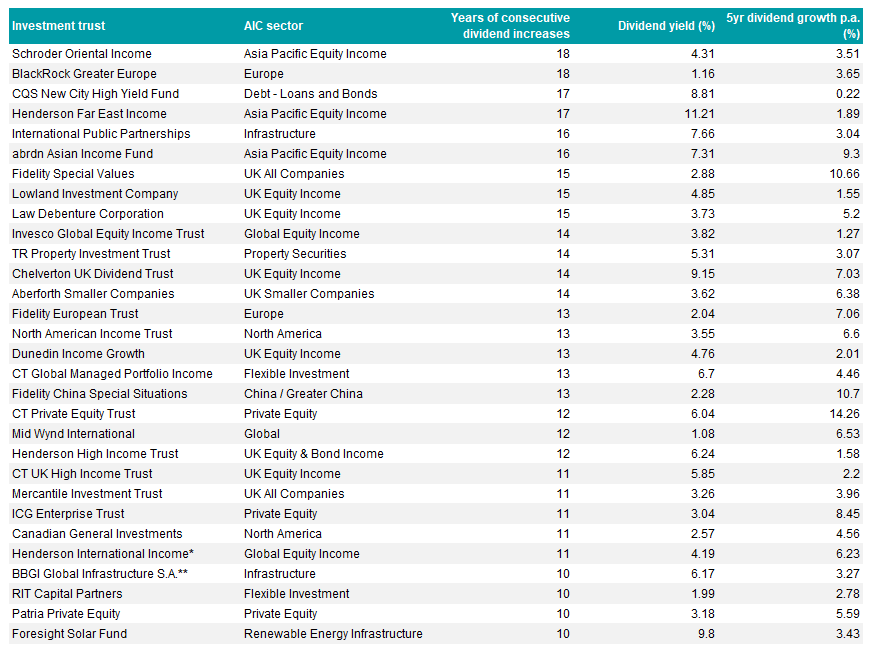

The next generation of investment trust dividend heroes

Source: Association of Investment Companies, Morningstar. Data as at 20 Mar 2025. *A merger between Henderson International Income and JPMorgan Global Growth & Income has been proposed. **A cash offer for BBGI Global Infrastructure S.A has been proposed.

Foresight Solar has a 9.8% yield – the second-highest amongst the next generation dividend heroes – and over the past five years it has grown its dividend by an average 3.4% per annum. Since Foresight Solar listed in 2013, its dividend has grown by 35% (including the 2025 target).

Lead fund manager Ross Driver said: “Our operational portfolio will continue to produce steady, reliable income from the sale of electricity to the grid. We have a dedicated team to monitor and manage our solar farm assets and ensure they’re producing in the most efficient way.”

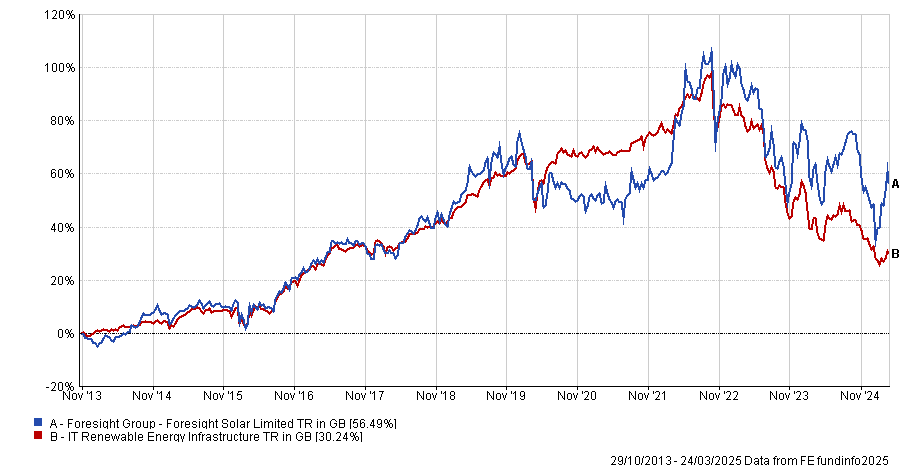

The trust has delivered solid long-term performance but made an 11.4% loss over three years to 24 March 2025 in total return terms. The whole IT Renewable Energy Infrastructure sector has struggled during the past three years due to higher interest rates and selling pressure, with an average loss of 28%.

Performance of trust vs sector since inception

Source: FE Analytics

“Our strategy has evolved to adjust to the new post-pandemic reality of higher interest rates,” Driver said.

“To amplify returns, we’re building a development pipeline of solar and battery storage projects that allows us to deliver an additional element of growth on top of the regular income provided by the operational portfolio – improving performance over time.”

Foresight Solar had a market capitalisation of £435m as at 31 December 2024 and was trading on a 31.4% discount to its net asset value of £634m.

The other new entrant, Patria Private Equity Trust (PPET), was run by Aberdeen until it sold its European private equity business to Patria Investments last year. The trust allocates to mid-market private equity funds run by external managers and also invests directly in private companies, alongside these managers.

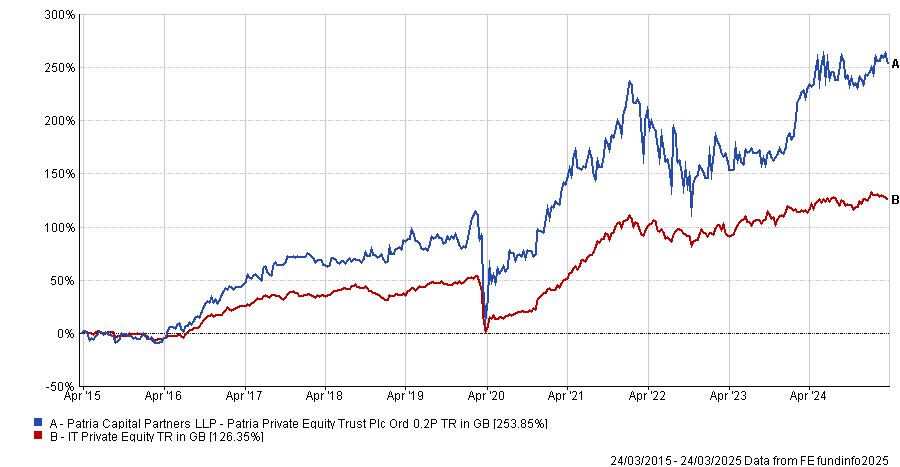

It has a market cap of £828m and a 3.2% dividend yield, and was trading on a discount of 29.9% as of 24 March 2025. PPET is the third-best performer in the IT Private Equity sector over 10 years.

Performance of trust vs sector over 10yrs

Source: FE Analytics

Lead fund manager Alan Gauld said: “Historically, there has been a debate over whether private equity trusts should be purely about capital growth or not. However, the board of PPET has consistently prioritised returning cash to shareholders. Having a consistent dividend policy has helped build trust with PPET’s shareholders.

“PPET’s portfolio is well diversified and generates a consistent cash yield, usually around 20% of opening NAV per year. As such, this allows PPET to comfortably support a growing dividend. The board’s strategy in recent times has been to at least maintain the value of the dividend in real terms. This has resulted in 5% growth in dividend in 2024 and 11% growth in 2023.”

More than half of the 30 next generation dividend heroes have yields above 4%, which illustrates the advantages of investment trusts for income seekers, said Annabel Brodie-Smith, communications director of the AIC.

“Investment trusts are able to smooth dividends over time because they can hold back income from their portfolio and use this to boost dividends in leaner years. They can also pay income out of their capital profits and their structure is particularly suitable for high yielding hard-to-sell assets, such as infrastructure and property,” she said.

Matt Ennion, head of investment fund research at Quilter Cheviot Investment Management, said the key thing for investors to watch out for is whether the dividend is a natural output of a trust’s investment strategy. A sustainable, growing dividend that is well covered is a good thing for investors, especially if the trust can maintain the dividend through downturns such as the Covid pandemic.

However, the potential problem with getting onto the dividend hero list is when a trust becomes desperate to keep growing its payout and potentially has to use capital to increase its dividend, he warned.