Should you invest in fossil fuels or renewable energy? And which is likely to deliver higher returns going forward?

Guinness Global Investors’ Jonathan Waghorn is ideally placed to answer these questions. He and Will Riley have been managing the $192m Guinness Global Energy fund since 2013 and 2010, respectively, and the $402m Guinness Sustainable Energy since 2019.

Oil and gas companies are undervalued at present but sentiment towards clean energy is far worse, potentially at the point of maximum pessimism, he said. Both areas could deliver compelling returns if they re-rate but timing a market turnaround is extremely difficult, so Waghorn personally invests equal amounts into both his funds.

The investment thesis for fossil fuels

The stock market is calling into question the longevity of oil and gas companies profits and discounting their cash flows too aggressively, Waghorn argued.

“Your typical investor is sitting there and saying: ‘Well, fossil fuels, they're dying, aren't they? We're not going to need them anymore, so therefore BP doesn't have a long-term business’.”

On the contrary, he expects oil demand to grow until 2030 then continue at a high level for several years and natural gas demand to grow until about 2040.

“We would argue that the returns of these companies will be sustained for a long time and therefore they are more valuable and they should trade back in line with how they used to trade, which was at a at a higher price,” he concluded.

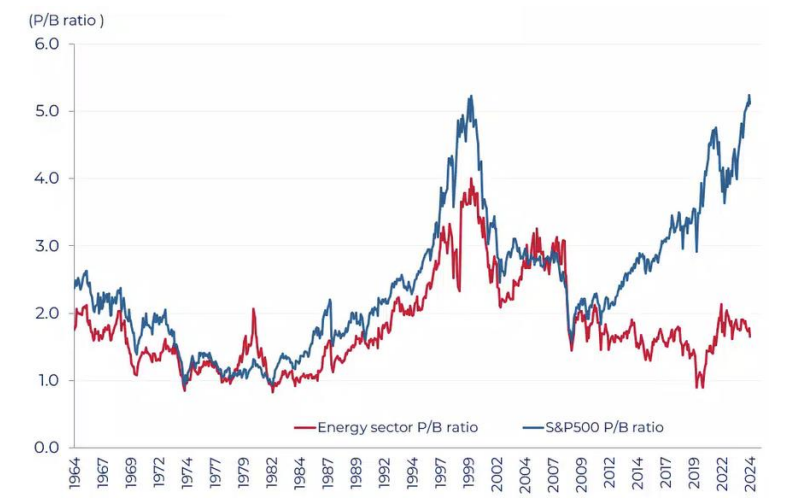

Historically, there has been a close correlation between increasing profitability and rising share prices and vice versa, but this correlation has become weaker in recent years.

Return on capital employed for oil and gas companies is about 12% this year, which is mid-cycle and would have historically merited a price-to-book (P/B) ratio of about 2x. However, the energy sector was trading at a lower P/B ratio of 1.7x last month.

Energy companies are also on a heavy discount compared to the broader market. The S&P 500 index was on a P/B of 5.1x last month, as the chart below shows.

Historic price-to-book ratio of energy companies vs S&P 500

Source: Guinness Global Investors, Feb 2025

The Guinness Global Energy fund’s 2025 price-to-earnings (P/E) ratio of 10.2x represents a 48% discount to the MSCI World, which was on a P/E ratio of 19.6x as at 31 January 2025.

The case for sustainable energy

Oil and gas companies may be undervalued, but market sentiment in the renewable energy space is far worse.

“Over the past six years, we've seen essentially a full cycle in optimism and enthusiasm, and now I would say abject despair in sustainable energy,” Waghorn observed.

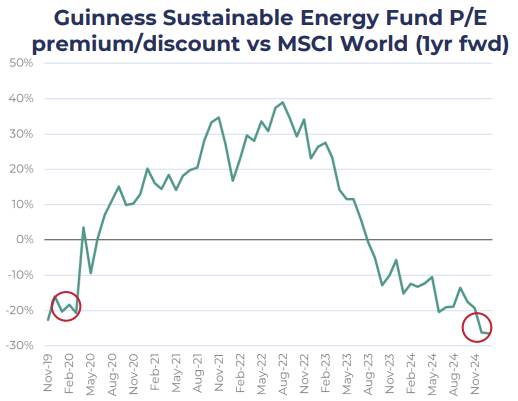

At the end of 2019, renewable energy was out of favour and the Guinness Sustainable Energy fund’s portfolio was trading at a 20% discount to the MSCI World, as the chart below shows.

Source: Guinness Global Investors, data to 31 Jan 2025

The next couple of years saw a sharp rally along with the rise of sustainable investing, particularly in Europe. Valuations increased to the point that Guinness’ fund was trading at an almost 40% premium to the MSCI World.

However, the Russian invasion of Ukraine led to supply chain issues, inflation spiking and “interest rates going through the roof”. The costs of financing and raw materials rose. Valuations and earnings growth expectations deflated accordingly then plummeted further in response to Trump’s election as Republican candidate then president.

“We're seeing the growth agenda delayed because of Trump causing confusion,” Waghorn explained. “Nobody is going to build a battery manufacturing plant in the United States if they don't know what subsidy they’re going to get and they don't know what the tax credit is. So the lack of clarity there has caused some pretty substantial problems.”

Trump continues to be a wildcard. “He's got a budget resolution which will come through before the middle of the year. His focus is very clearly on fundraising to offset tax cuts that he's offered elsewhere and renewable energy tax credits are a potential source of funding. He'd like to reduce them,” Waghorn said.

“The hope would be that Elon Musk, with his Department of Government Efficiency, finds cost cutting and savings elsewhere, in which case sustainable energy will get more of a free pass.”

In 12 months’ time, Waghorn thinks investors might look back to find that this was the point of maximum pessimism and therefore a great buying opportunity, but he conceded that it would take a fair amount of bravery to put more money into the space now. “We really are in a very difficult, opaque situation at the current time.”

There might be merit in waiting until the US budget is announced, after which there will be more clarity around Trump’s desire to support clean energy, upgrade the grid and move towards electrified transportation.

Meanwhile, the long-term future looks bright. Demand for renewable energy is increasing and the transition will progress – it’s just a question of timing, Waghorn said.

The prices of solar power and onshore wind have reduced dramatically since 2010 so economic motives are now driving the transition. “If you wanted to add power into a market tomorrow, the chances are it's a renewable that's going to be the cheapest route to doing it,” he pointed out.