Emerging market equities have faced myriad challenges over the past decade, from President Donald Trump’s trade wars with China to interest rate hikes, a strong dollar at times, the Covid pandemic and then China’s subsequent economic slump.

The market environment was particularly tough in 2018 owing to tariffs and a strong dollar; no fund in the IA Global Emerging Markets sector delivered a positive return that year and MSCI Emerging Markets index fell 9.3%.

Given the eventful backdrop, investors may prefer to gravitate towards experienced managers who have proven their ability to add value consistently, through a variety of different market conditions.

Emerging markets are generally believed to be less efficient and less saturated by analysts’ coverage than developed markets, so theoretically this is an asset class in which active stock pickers should be able to add more value.

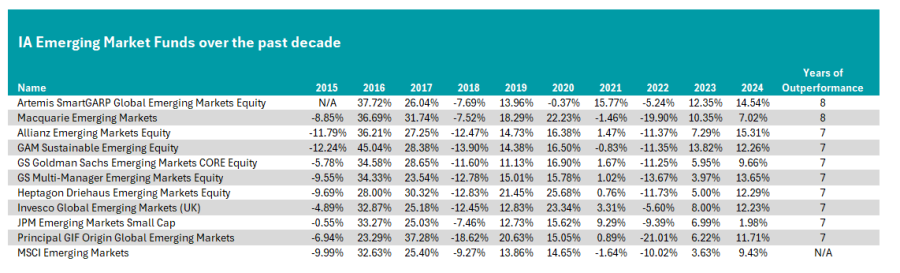

However, the MSCI Emerging Markets index was a tough hurdle to beat over the past decade; no funds in the IA Global Emerging Markets sector managed to outperform in nine or more years.

Source: FE Analytics

Yet two active funds rose above the challenging geopolitical and macroeconomic environment, beating the benchmark in eight years out of 10.

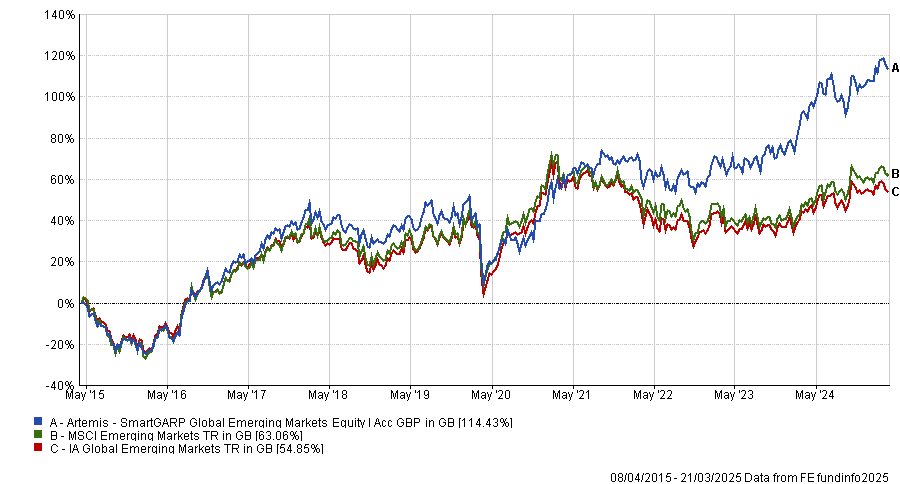

The best known was the Artemis SmartGARP Global Emerging Markets Equity fund, led by FE fundinfo Alpha Manager Raheel Altaf. He has managed the fund since its inception in April 2015, during which time it has surged by 114.4%, beating the benchmark by 50 percentage points.

Performance of fund vs sector and benchmark since inception

Source: FE Analytics

For analysts at Square Mile, the fund has set itself apart from competitors with its “pragmatic approach” founded on the SmartGARP (growth at a reasonable price) strategy of investing.

This process considers “both a company's fundamental potential for return” and its sector, which analysts said is essential in emerging markets where political and economic developments have a large impact on share prices.

“Overall, we believe that long-term investors have access to an attractive offering managed by an experienced manager who seeks to exploit market inefficiencies in the region,” they concluded.

For analysts at FE Investments, the fund benefitted from a quantitative approach to stock selection, which “allowed it to avoid human behavioural biases” in a constantly changing market. They said because of this rigorous approach, performance was “likely to be steadier than peers with a similar strategy”.

“The fact that the fund does not only look at deep value or distressed stocks, and the model incorporates a variety of factors beyond value implies that it could be a core emerging-market allocation,” analysts said.

However, analysts conceded that the portfolio's success was "tied to how good the model was" so failure to improve the model or address inefficiencies could lead to underperformance.

Artemis’ strategy is not bulletproof. In 2020, it underperformed the MSCI Emerging Markets by 15 percentage points, while the average peer surged by 13.7%.

The other fund which beat the MSCI Emerging Markets index in eight of the past 10 years was the £141m Macquarie Emerging Markets Equity fund. Despite underperforming in 2022 and 2024, it produced a 10-year return of 113.2%, the third-best result in the sector.

If we broaden our scope to include funds that beat the benchmark in seven of the past 10 years, eight more funds qualify.

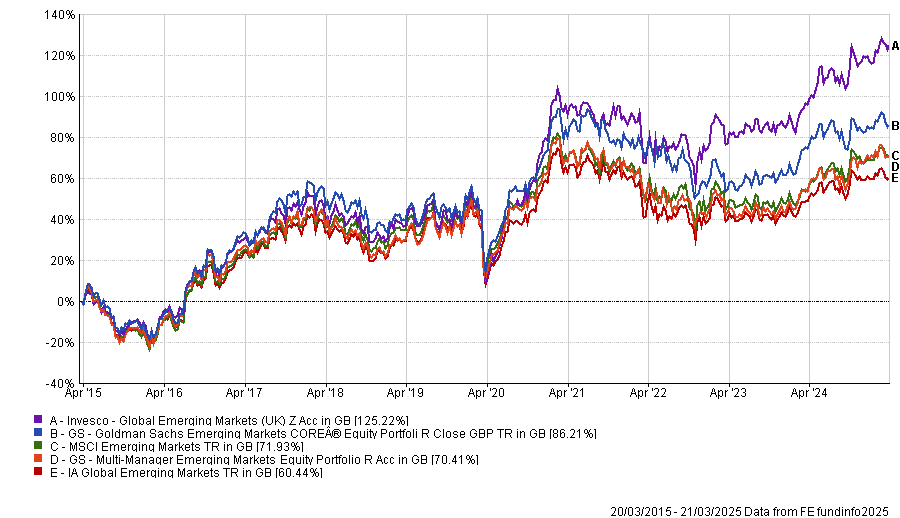

Two strategies from Goldman Sachs stood out: the £2.3bn Goldman Sachs Emerging Markets CORE Equity portfolio and the GS Multi-Manager Emerging Markets Equity portfolio. Respectively, the funds were up by 86.2% and 70.4% over the past 10 years.

Performance of funds vs sector and benchmark over the past 10yrs

Source: FE Analytics

Elsewhere, the £660m Invesco Global Emerging Markets fund, led by a four-strong team including Alpha Manager William Lam, was another consistent choice for investors.

Despite underperforming the MSCI Emerging Markets index between 2017 and 2019, it posted a 10-year return of 125.2%, the best result in the sector. Over the past one, three and five years, it delivered further top-quartile results, never ranking outside of the top 10 in the peer group.

Analysts at FundCalibre said: “The high esteem in which we hold this fund has been backed up by its outstanding long-term track record”.

They explained that the fund benefitted from an “adaptable investment style” and a “tight focus on valuation and contrarianism”, which allowed it to exploit changing market conditions and inefficiencies while competitors may have struggled.

Additionally, they praised the fund's expert management team, with most of the managers having decades of experience analysing emerging market equities.

Other funds which beat the market in seven of the past 10 years included: the JPM Emerging Markets Small Cap fund, the Heptagon Driehaus Emerging Markets Equity and the Allianz Emerging Markets Equity fund. They were up by 85%, 101% and 92.9%, respectively, over the past decade, all of which are top-quartile results.