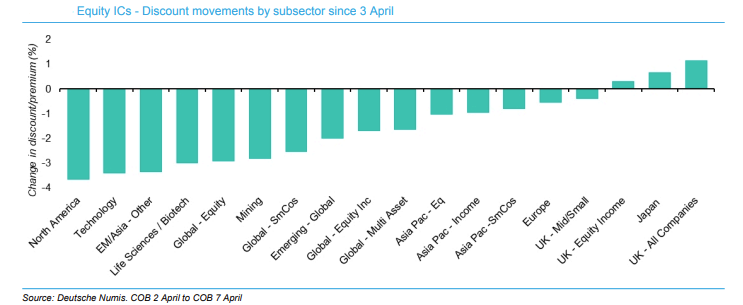

Even before ‘Liberation Day’, swathes of investment trusts were trading at wide discounts. Donald Trump’s imposition of crushing tariffs on America’s trading partners at the start of this month sent stock markets into freefall and the share prices of many trusts fell due to indiscriminate selling, causing discounts to widen further.

As William Heathcoat Amory, managing partner at Kepler Partners, said: “Share prices have been buffeted by market volatility and investment flows. It’s not obvious how the likes of Greencoat UK Wind are affected by tariffs or a recession, yet the share price has taken a hit.”

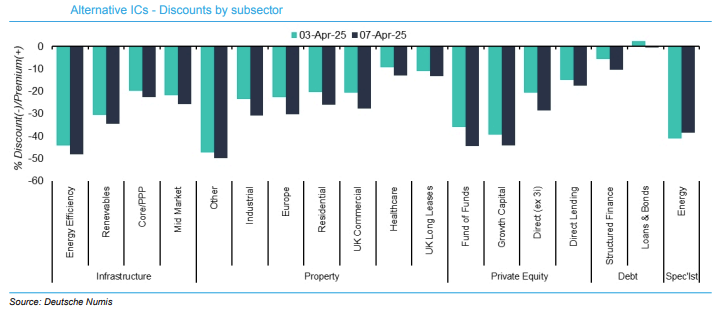

Discounts for alternative investment companies by sub-sector

Equity trusts: Discount movements by subsector, 3-7 April

On 9 April, Trump reduced tariffs to 10% for all countries except China, with a 90-day reprieve from higher ‘reciprocal’ charges. Even so, markets are likely to remain volatile for some time yet.

Amidst the stock market carnage, investment trusts may appeal to investors for several reasons: wide discounts provide an attractive entry point; and many trusts invest in alternative assets such as infrastructure and property that are not closely correlated to global trade, so should be relatively insulated from the impact of tariffs.

The silver lining to the current crisis – according to Charlotte Cuthbertson, co-manager of the MIGO Opportunities Trust – is that US equities are “no longer the only game in town”. “People might sit on their hands for a bit and feel very nervous but they will also be looking for a different source of return,” she said.

Below, analysts highlight trusts for investors who want to diversify their portfolios and snap up a bargain.

Private equity

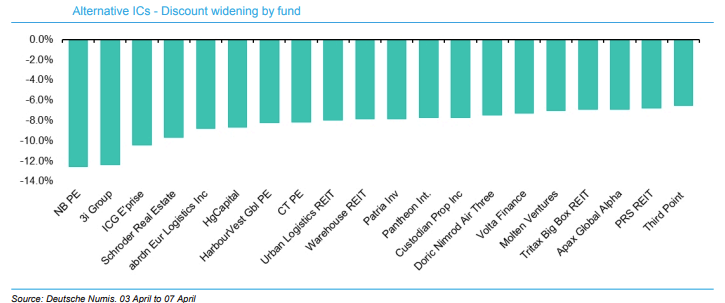

Even before this month’s turmoil, several private equity trusts were trading on discounts of 30-40%. By 7 April, ICG Enterprise and Pantheon International’s discounts widened to 47% and HarbourVest Global Private Equity reached 45%.

Ewan Lovett-Turner, head of investment companies research at Deutsche Numis, said: “Listed private equity investment companies have been amongst the sharpest fallers in share price terms, given the potential for slower dealmaking and investor concerns around leveraged businesses. Some of the falls have reversed, but the sector remains very cheap and volatility has thrown up numerous discount opportunities.

“We believe [this] offers an excellent entry point. Boards have been more active with buybacks and we would expect this to continue given where share prices are currently trading.”

Discounts widening for alternative investment companies, 3-7 April 2025

Cuthbertson warned investors to look at private equity trusts’ underlying portfolios. Those with exposure to consumer spending could have a tough time, she said.

On the other hand, Seraphim Space looks promising because it will benefit from European governments’ pledges to increase defence spending and it is not exposed to the consumer, she noted.

The MIGO Opportunities Trust has just increased its exposure to Chrysalis Investments following its sale of InfoSum to WPP, which has generated cash for the trust’s buyback programme – a catalyst that is not impacted by trade wars.

Chrysalis has not been unaffected by the tariff crisis, however. It holds Klarna, which has postponed its initial public offering due to market volatility, Cuthbertson noted.

Real assets

As investors look for steady income streams to anchor their portfolios through turbulent times, infrastructure and renewable energy trusts could see renewed interest.

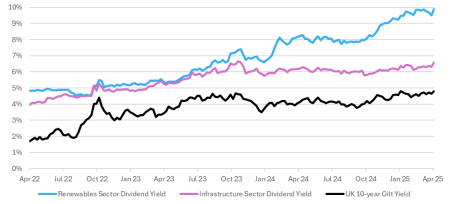

Dividend yields are at all-time highs following last week's sell-off, according to Stifel research analysts Iain Scouller and William Crighton. “The yield on the infrastructure funds sector has moved close to 7%, which is near the previous peak in October 2023. The renewables funds sector yield is at an all-time high of 10% and this compares with an 8% yield a year ago. Of the 11 renewables funds we cover, the dividend yield is now in excess of 10% on five of them,” they said.

Infrastructure and renewables dividend yields vs UK 10-year gilt yield

Sources: Stifel, Datastream to 9 Apr 2025

Furthermore, if central banks cut interest rates, lower yields from cash and bonds could prompt income investors to look elsewhere and the discount rates used in portfolio valuations should stabilise, Scouller and Crighton said. However, weaker power prices could be a headwind for the renewables sector.

Heathcoat Amory thinks Greencoat UK Wind could do well in the current environment. “Higher inflation in the UK will be a positive for the trust. But at the same time, it appears central banks may be poised to cut interest rates to minimise the risk of recession, which may mean a lower discount rate applied to valuations. At the very least, [rate cuts would] make the trust more attractive on a relative basis, given it currently offers a dividend yield of 9.9%.”

Cuthbertson thinks trusts investing in solar power should not be too badly impacted by trade wars. “The sun will still shine and you’ll still have power created from a solar panel and it’s not that America suddenly doesn’t need any power,” she pointed out.

In a similar vein, one of the MIGO Opportunity Trust’s largest holdings is PRS REIT, which focuses on residential rental properties. Regardless of trade wars, people will still need to rent homes, she said.

Lovett-Turner also highlighted specialist debt trusts such as TwentyFour Income (9.4% yield) and TwentyFour Select Monthly Income (8.4% yield), as options for investors in search of consistent cashflows.

Exit opportunities

Several investment companies have exit opportunities coming up and these may appeal to tactical investors. “We believe that volatile markets can often present an opportune time to invest with the comfort that some or all of the holding can be redeemed close to NAV [net asset value], although clearly there will still be market risk,” Lovett-Turner explained.

Mobius and Strategic Equity Capital have full exits approaching in November at NAV and are currently trading on discounts of 11% and 13%, respectively.

Another trust worth watching is Polar Capital Global Healthcare, which is on an 8% discount and is at the end of its fixed life. The trust is working to bring forward proposals for a corporate reorganisation in 2025, with the potential for a cash exit offered as part of the reconstruction, he said.

Caveat emptor

Cuthbertson said many investment trusts looked cheap before the tariff crisis and have become even cheaper in recent days but that does not mean their share prices cannot fall even further. “They could halve again,” she said. “In wild markets when investors are nervous, share prices fly around everywhere.”

Investors need to look under the hood at investment companies’ underlying assets and ascertain whether they have confidence in the valuations of those assets. “Are the discounts real and how stale is the NAV?” she asked.

Unlike equity trusts, the NAVs of alternative investment companies are not marked to market daily, so have not moved in recent days and thus do not reflect current market conditions. Investors, if they are lucky, receive valuation updates monthly, but valuations are more likely to be revised quarterly and, in some cases, every six months.

She expects valuations to be revised downwards eventually and believes the discount rate is likely to increase due to bond market movements and also because the world has become riskier. Some valuers will add 50 basis points or 1% onto the discount rate to factor in that additional risk, she explained.

“It’ll take time to work out where discounts are going to settle. It’s a really bumpy ride,” she concluded.