Donald Trump’s Liberation Day tariffs have initiated a seismic shift in markets, forcing fund managers to act fast to ensure their portfolios are fit for purpose.

Chris Forgan and Caroline Shaw, multi-asset managers at Fidelity International, have ventured into relatively expensive areas such as India and European defence stocks. Despite being struck by last week’s volatility, Shaw and Forgan felt both areas possess compelling long-term growth stories that have not yet reached their full potential.

“We obviously want to manage the portfolio’s risk but we also do not want to pass up any big structural growth trends we see, such as India or European defence,” Shaw explained.

“It’s not a sea change in risk at the top of the portfolio; it’s more of a rotation or evolution towards the areas which seem most attractive right now.”

Concentration is another aspect to this month’s changes. Shaw and Forgan have distilled their Asian exposure to focus on India and similarly, they have trimmed down their European portfolio to centre upon defence.

Rotation towards India

Post-liberation day, Fidelity's multi-asset managers trimmed their exposure to Asian equity funds and invested in an India fund.

India has a proactive and growing population, composed mostly of young people and STEM graduates who are likely to contribute to the country’s science and technology potential. Coupled with a growing middle class and a “mostly stable democracy”, Shaw believes the country is poised for further growth.

Forgan added: “The structural story in India remains strong and the weakness you saw at the start of the year and over the past week was a benefit for us.”

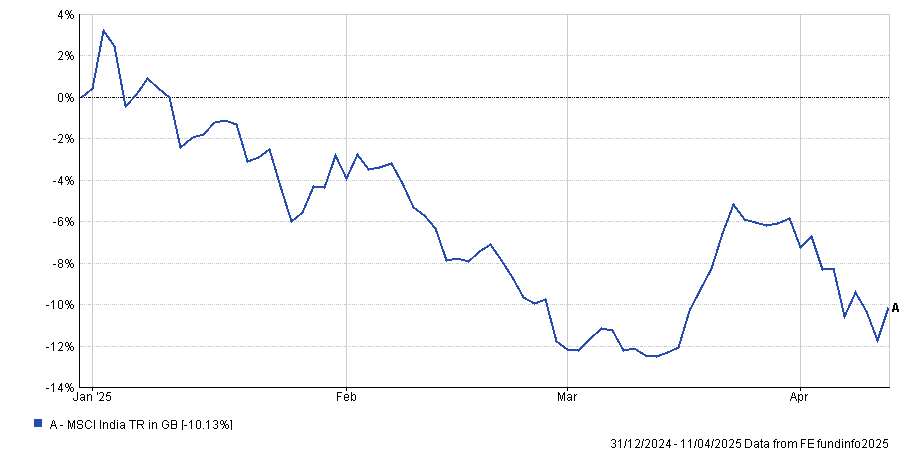

Following MSCI India’s 10.1% slide this year, its stock market is now “far more reasonably valued”, making now an attractive entry point to a fundamentally strong market, he explained.

Performance of MSCI India year-to-date

Source: FE Analytics

India has a predominantly services-based economy, Shaw said, which means “the other nice thing about India is that it is less exposed to the US tariff risks”.

“We dipped our toes into India about a month ago and we topped it up last week, because it plays into the current environment as well as the long-term one,” she added.

Moving into European defence

Shaw and Forgan have invested in a European defence ETF and reduced their exposure to European and UK equity funds.

“It is still European equity exposure but just tilted towards industrials in the aerospace and defence sector,” Shaw explained.

The decisions by German chancellor Friedrich Mertz and UK prime minister Keir Starmer to pledge significant investment towards defence have provided a major tailwind for these businesses moving forward, she said.

European companies will be the main beneficiaries of higher military spending because Europe is “relatively better off than some other parts of the world on tariffs” and is still considered broadly cheap compared to the US, Shaw said.

Forgan added that the recent sell-off has made European defence names more appealing. Many European defence companies had done very well over the past year as geopolitical tensions increased, and valuations seemed incredibly stretched prior to this month’s downturn, he explained.

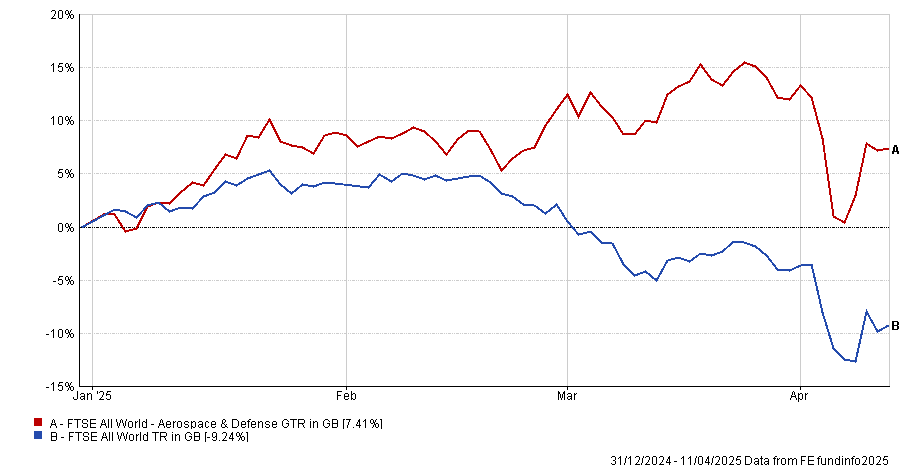

Recent volatility has brought valuations closer to January levels, making it a far more attractive entry point into a structural trend that still had a lot of room left to run. For example, despite sliding by 13% in the recent sell off, the FTSE All World Aerospace and Defence index has bounced back and is up 7.4% year to date, at the time of writing.

Performance of defence stocks year-to-date

Source: FE Analytics

“Quite frankly, defence spending globally is going to be on the rise with the new administration in the White House and we want to participate in that rally,” Forgan concluded.