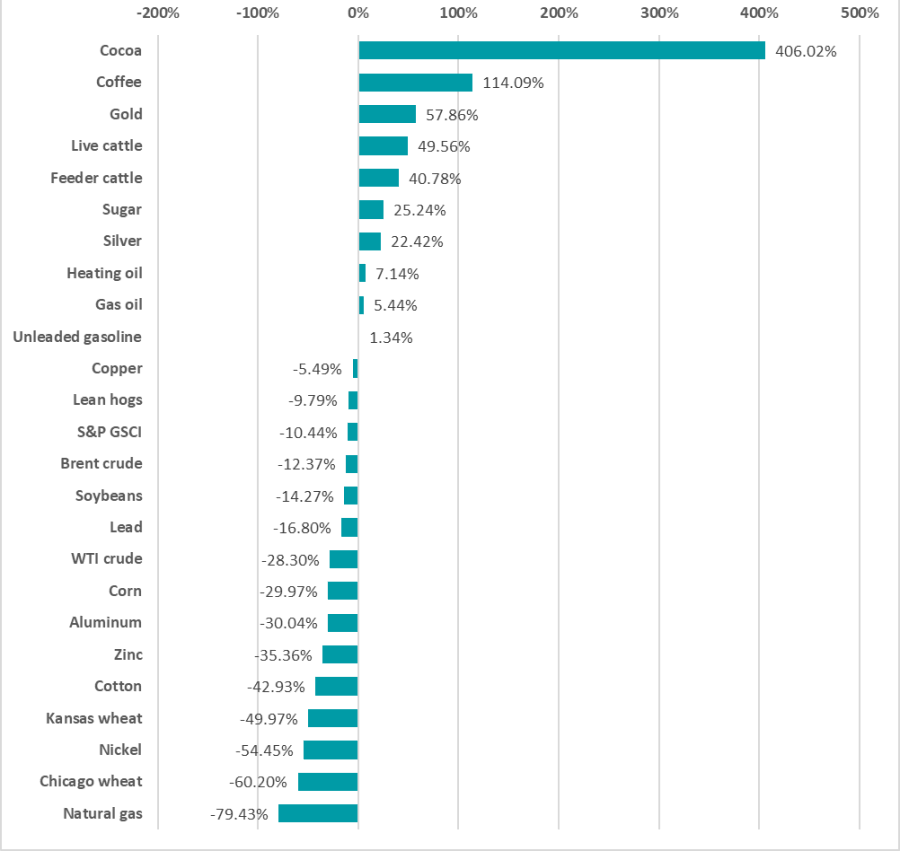

Gold has exploded in value in recent years. On 15 April, the precious metal was trading at more than $3,200 per ounce, a surge of 57.9% over the past three years.

As markets have been tested by waves of volatility this year, particularly recently following president Donald Trump’s Liberation Day tariffs, investors have become increasingly optimistic about the precious metal.

Fidelity International’s Caroline Shaw and Chris Forgan entered the year bullish on gold and said they have remained that way following Liberation Day volatility. Across their range of multi-asset strategies, gold is consistently one of their top 10 allocations.

Prices of commodities over 3yrs

Source: FE Analytics

However, not all fund managers were quite so keen. Will McIntosh-Whyte, multi-asset manager at Rathbones, said he was sceptical of the precious metal’s high price and sold most of his exposure late last year.

Below, the managers explain their outlooks for the precious metal this year.

Fidelity: There is no reason why gold will stop performing

Forgan and Shaw are optimistic on gold and have held a meaningful position in the yellow metal for several years.

The managers have a cautious view of the current investment landscape and regard gold as an attractive hedge against stock market volatility.

The increase in central banks purchasing gold has been conductive to the gold price and gold has been performing above expectations recently, making it very appealing, Forgan explained.

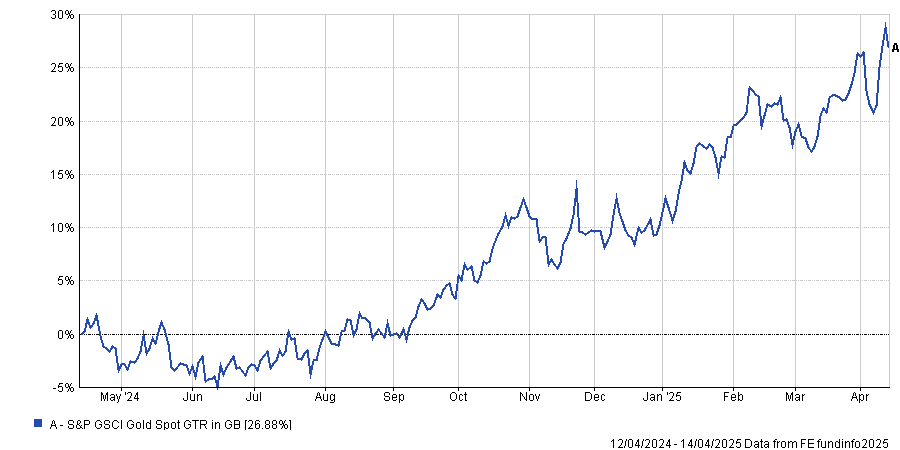

Indeed, of the 57.9% rise in gold over the past three years, 26.9% of that has happened in the past 12 months alone.

Performance of S&P GSCI Gold Spot over the past year

Source: FE Analytics

Even if trade volatility declined, Forgan argued the precious metal still has plenty of room to run because “uncertainty around the direction of central bank policy is not going anywhere”. If central banks begin to cut rates more aggressively in response to market developments, the resulting fall in bond yields would continue to make gold attractive, he explained.

Shaw added that investors can get exposure to gold in several ways beyond buying the metal itself. For example, she pointed to gold mining companies. As listed equities, investors get the benefit of investing in a higher risk, higher return asset class while maintaining allocation towards a traditional safe haven.

“There was a point last year where gold and gold miners were rising, but the gold mines have got a little bit more oomph to them and they were flying,” Shaw noted.

Fidelity’s multi-asset managers recently trimmed their position in miners because they entered this year a bit more cautious, so did not want to take on the extra volatility of owning gold equity shares but still wanted exposure to the metal itself.

Forgan concluded: “In the current environment, we like the defensiveness of gold and think there is no reason it will not continue to perform for us."

Rathbones: Rising valuations are a concern

Will McIntosh-Whyte, multi-asset manager at Rathbones, sold most of his gold allocation towards the end of last year, when the price was closer to $2,700. “While I think it [gold] has a place, I am currently wary about it,” he said.

Gold and yields usually have an inverse relationship, “yet as yields have gone up, gold has continued to outperform,” he pointed out. “It is not trading in line with any historical expectations.”

When assets begin trading against the norm like this, it becomes increasingly difficult to value and justify allocations, he said.

The other challenge with gold is that it doesn’t have an income so "you do not get paid to hold it" and there are plenty of opportunities elsewhere to generate yield, such as fixed income, which the Rathbones multi-asset team has been favouring over gold.

The average government bond yield is around 4.5%, an inflation-beating return, he noted. While he acknowledged that inflation has been proving sticky, particularly following recent tariffs, there are a range of opportunities within fixed income that could provide an attractive return while being similarly low risk to gold.

As an example, he argued that government bonds from the UK, New Zealand or Portugal can deliver a compelling return while having less opportunity cost.

“It is difficult for us to justify holding gold, when we are getting paid 4.5% just for owning government bonds,” McIntosh-Whyte added.