The world is facing a generational infrastructure challenge and a growing funding gap. Estimates suggest that $140trn in investment is needed globally by 2050, yet nearly $64trn of that remains unfunded.

The UK is no exception. The country requires £1.6trn in infrastructure investment by 2040, with at least £700bn still unfunded even under current fiscal plans.

This backdrop should be a tailwind for investors. Infrastructure offers exposure to long-duration, inflation-linked, cash-generating assets across sectors such as transport, energy, digital connectivity, healthcare, and housing. And in multi-asset portfolios, it plays a valuable role as it is typically less volatile than equities, more growth-oriented than bonds and increasingly central to the green transition.

So, here’s the paradox: if demand for infrastructure is so strong, why are UK-listed infrastructure trusts trading at steep discounts to net asset value?

Mind the gap

Since September 2022, the share prices of major UK infrastructure investment trusts have fallen by between 20% and 30%, even as reported net asset values (NAVs) have remained relatively stable. This has resulted in wide discounts.

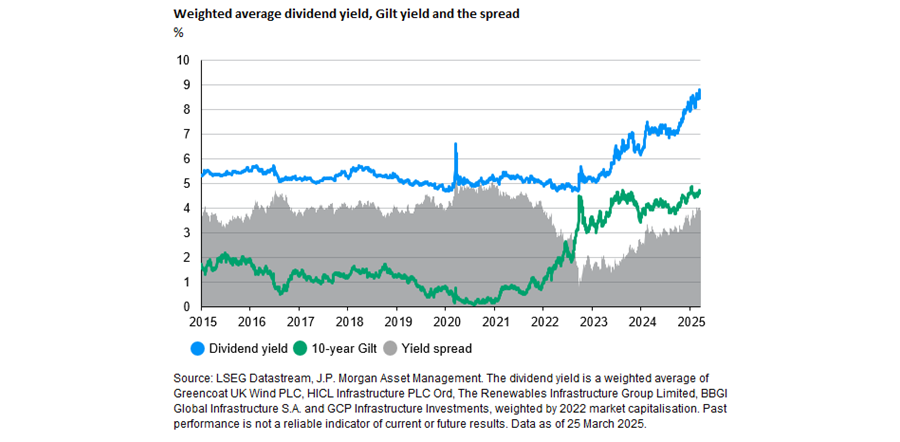

The divergence is driven by both top-down macro pressures and bottom-up operational frictions. On the macro side, it is largely an interest rate story. Post-global financial crisis, infrastructure trusts were pitched as income alternatives, offering attractive dividend yields when bond yields were low.

But as gilt yields surged in 2022, that relative appeal faded. Capital rotated back into traditional fixed income, and infrastructure trust share prices fell, bringing dividend yield spreads closer to their historical range.

At the same time, operational and structural pressures have weighed on sentiment. Construction cost inflation, grid connection delays, refinancing risk, and power price volatility – particularly in renewable-focused trusts – have reduced earnings visibility.

Meanwhile, some vehicles carry development-stage risk, use external contractors heavily, or have limited operational control. Add in stricter environmental, social and governance (ESG) screens and a relatively retail-heavy investor base, and it’s no surprise valuations have come under pressure.

Some of these UK-specific issues can be mitigated by diversifying globally. At the global level, public core infrastructure has maintained a beta of 0.4 relative to the MSCI World Index since early 2025, underscoring its defensive nature during periods of heightened market volatility.

By diversifying across regions and sectors, investors can effectively reduce sector and country-specific risks.

Different vehicles, different experiences

But infrastructure exposure isn't just about what you own—it’s about how you access it. Public and private vehicles often invest in the same underlying assets but the investor experience can diverge significantly depending on the type of investment vehicle used.

Listed infrastructure trusts are priced daily, subject to market sentiment and tend to move more quickly with changing interest rate expectations and short-term equity flows. This mark-to-market feature creates liquidity, but can create volatility, especially in uncertain macro environments.

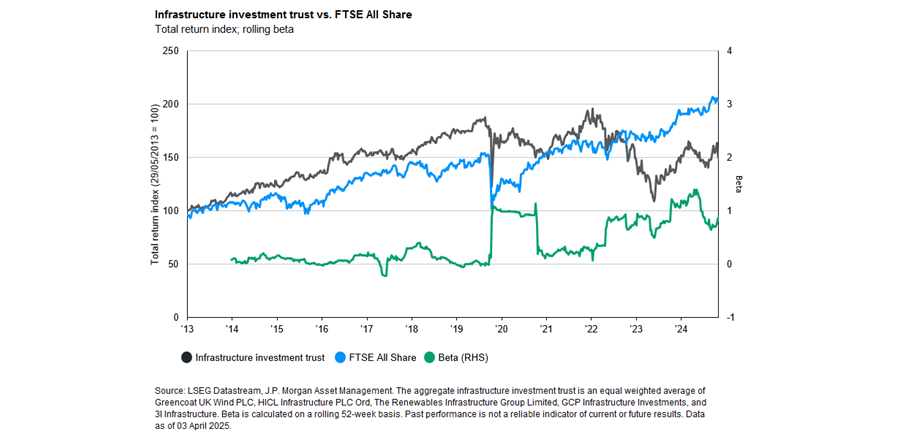

This became clear in 2022, when rising interest rates increased listed infrastructure’s sensitivity to broader market swings. Historically, these vehicles had low beta to equity benchmarks and were often treated as bond proxies.

But as monetary policy tightened, sentiment-driven selling introduced volatility unconnected to asset performance. In effect, listed infrastructure began trading more like equities.

Private infrastructure funds, by contrast, are valued quarterly and are traded infrequently. While this means they are far less liquid than publicly traded infrastructure investment trusts, they also exhibit significantly lower volatility and are not subject to equity-like swings due to changes in sentiment.

Their structure also creates better alignment of interests between investors and managers, with patient capital allowing funds to focus on long-term value creation insulated from the daily swings in sentiment that pressure managers to make short-term decisions.

This alignment of incentives is a key factor in the strong performance of private core infrastructure since 2021, achieving an average return of 9.1% on a rolling 12-month basis.

Conclusion: The case for infrastructure remains but vehicle selection matters

UK-listed infrastructure trusts are trading at steep discounts despite more stable underlying asset values and growing national investment needs. While some of the discount can be explained by fundamental factors, the structural realities of the UK public market (daily pricing, sentiment-driven flows, and limited investor breadth) have contributed to the decline.

For investors looking to gain exposure to the broader infrastructure theme that are comfortable with equity-like risk, these discounts may offer a compelling entry point, with elevated dividend yields and the potential for re-rating as market conditions stabilise.

For those focused on reducing overall portfolio volatility and can tolerate illiquidity, global private infrastructure may offer a smoother, more stable profile anchored by a longer-term investment horizon and less reactive pricing.

The key is to focus on vehicles whose structures align with the role infrastructure is meant to play in the portfolio, whether that is generating income, lowering overall portfolio volatility, or providing inflation-linked growth.

Aaron Hussein is a global market strategist at JP Morgan Asset Management. The views expressed above should not be taken as investment advice.