Chipmaker Nvidia’s share price dropped 12.5% last week after the technology giant and staple of the ‘Magnificent Seven’ announced it would take a $5.5bn hit from tightened controls on US exports to China, which mean it can no longer export its H20 chips to Chinese customers without a special licence.

The firm expects the hole in its revenues due to a backlog of stock and committed sales, for which it will now be charged.

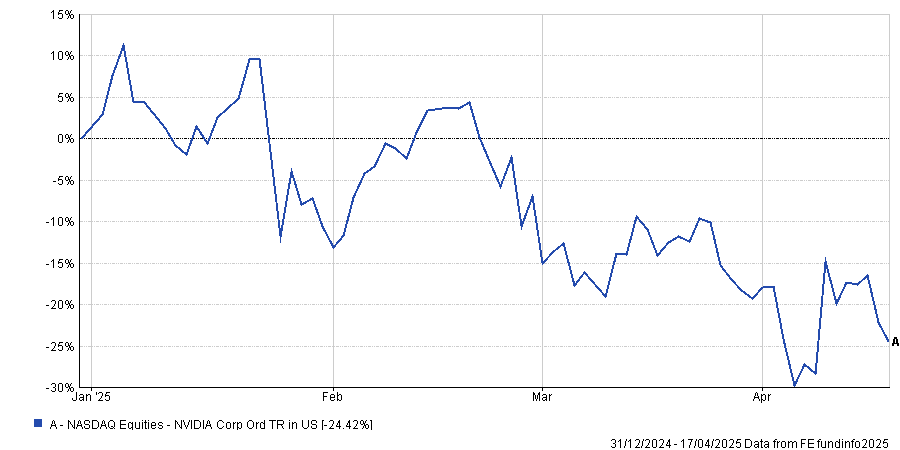

It continues a bleak run for the artificial intelligence (AI) darling, which has lost some 30% in dollar terms since its peak in early January, when Chinese tech firm DeepSeek rocked the tech industry with the release of a low-cost chatbot developed using older Nvidia chips.

Share price performance of stock in dollar terms YTD

Source: FE Analytics

Is there more pain to come for Nvidia and other chipmakers?

Much of the pain for investors has been felt since US president Donald Trump’s ‘Liberation Day’ tariffs. Although these have since been paused for the majority of countries (albeit with a 10% base rate still applied), China’s tariffs were increased, heightening speculation of an all-out trade war between the two countries.

Neuberger Berman head of thematic, YT Boon said that in the short term, the US is trying to “get China to the negotiation table” and the ban on H20 chips is “the latest tool the Trump administration is using to put pressure on China”.

“Advanced AI chips like the H20 are China’s ‘Achilles heel’ as it embarks on its AI and technology localisation strategy, as China does not have the capability to make these chips yet. Without these advanced AI chips, China’s AI development will face significant challenges at a time when the Chinese economy is now looking for AI as a new growth driver,” he said.

Nvidia wasn’t alone, with AMD also announcing a $800m write-off, but he thinks this should be the end of the pain for investors.

“We believe this is essentially a complete write-off of all the AI chip inventory. This should mean that there is no more downside risk from here, as the latest developments mean there will be no more AI chip exports to China going forward,” said Boon.

In fact, he suggested now was a good time to invest in the chipmakers, as any negotiation between US and China, and a relaxation of the chip ban at a later stage, could create serious upside and a backtrack of these write-offs.

“As such, risk/reward is skewed towards the upside from here after the recent write-offs,” he said.

“While in the short term we expect continued volatility, we see medium- and longer-term upside as valuations are now particularly cheap, even on trailing EPS [earnings per share], or using lower earnings forecasts.”

Will further contagion spread to the rest of the tech sector, making Nvidia the ‘canary in the coalmine’ for the sector?

Mark Sherlock, head of US equities at Federated Hermes, said the issues relating to Nvidia were “a one-off” for three reasons.

First, it is the only company in the big tech universe that has its primary revenue exposure to the semiconductor sector, which the US government has targeted to stifle China’s innovation prospects and mitigate US national security concerns.

Second, Nvidia’s dominant market position in AI semiconductors is a plus as its “compelling value proposition and deep/durable moats” meant Chinese customers became dependent on them.

“Although domestic Chinese players are improving their value propositions, last week’s announcement will nevertheless slow down China’s ability to innovate and become the global leader in artificial intelligence,” he said.

Lastly, although Nvidia is not alone in having substantial revenue exposure to China (Apple and Tesla had 17% and 21% revenue exposure to China in 2024, respectively), there is “a more balanced competitive landscape in these markets (e.g. Huawei in smartphones, BYD in electric cars)”.

“In addition, it is worth acknowledging that whilst the US government is planning to introduce sector-specific tariffs, announcing a temporary exemption for smartphones/computers/other electronic devices in relation to reciprocal tariffs last weekend was a relief for Apple,” said Sherlock, which could show the government will step in to protect these tech names if required.

Richard Clode, portfolio manager on the global technology leaders team at Janus Henderson Investors, agreed.

“Nvidia has de minimis business left in China and, of the tech giants, only Apple and Tesla have ever had meaningful China revenues. Google, Amazon and Meta don’t operate in China and Microsoft has hardly any exposure,” he said, suggesting contagion to the other Magnificent Seven stocks is unlikely.