In a previous article, Trustnet examined the investment trusts trading at the widest discounts. However, a wide discount can be a sign of long-term underperformance, so this study looks at those trusts that have also delivered a high return over five years.

When an investment trust trades at a discount to its net asset value (NAV), it can be a great opportunity to pick up a bargain if that figure is wider than its long-term average.

But this is where some of the trusts included in the first article came undone as performance had consistently languished in the doldrums and the wide discount was a permanent fixture rather than an attractive opportunity.

However, what if the trusts were trading at an attractive discount and had a record of historically attractive returns?

Using data from FE Analytics, Trustnet ranked equity investment trusts by five-year performance, only including those currently trading at a double-digit discount to NAV.

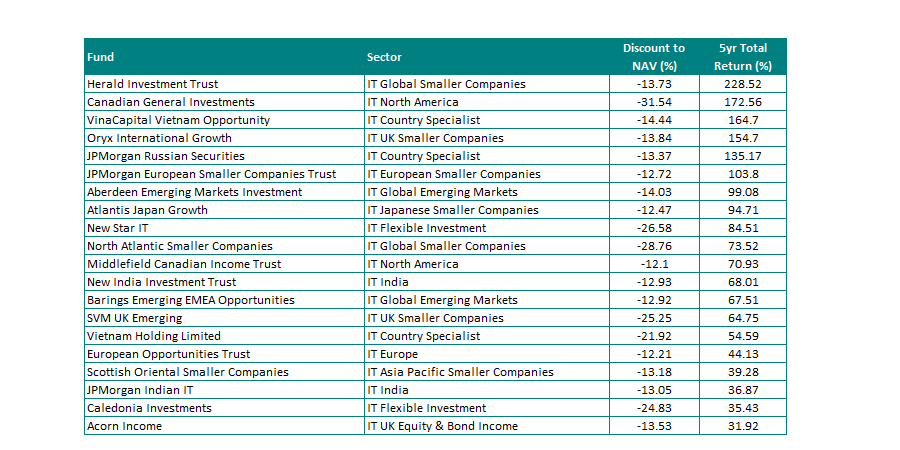

Top performing trusts trading at the widest discount

Source: FE Analytics

The trust that has delivered the highest total return over five years and that is trading at a double-digit discount is the £1.4bn Herald Investment Trust, run by Katie Potts since launch in 1994.

It made 228.52 per cent over the period in question, but is still trading at a discount of 13.73 per cent.

Potts invests in global small caps within the communications, multi-media and technology sectors.

The largest holding in the portfolio is GB Group PLC, an identity verification, location intelligence and fraud prevention company.

The trust in second place is Canadian General Investments, which made 172.56 per cent over five years, outperforming its IT North America sector over this time, as well as over one and three years. This is all the more impressive considering it holds just one of the FAANG – Facebook, Apple, Amazon, Netflix and Alphabet (Google) – stocks, which have been responsible for much of the growth in world markets over the past decade, in its top-10.

Something else that separates it from many of its sector peers is its desire to deliver an income, and it is currently yielding 2.31 per cent.

Even more attractive is the trust’s discount – 31.54 per cent. However, it is worth noting that it has hovered around this level for most of the past five years.

Analysts at Shore Capital explained why the discount remains high: “One of the key discount-management tools used by most funds, a buy-back or tender offer, is not a possibility for Canadian General Investments given the fund’s investment corp status, which eliminates a layer of taxation, with capital gains only being taxed at the shareholder level.

“We believe that a steady/growing dividend should boost the attractiveness of the shares and could lead to some contraction in the discount.”

VinaCapital Vietnam Opportunity is an interesting prospect for anyone who wants exposure to one of the fastest-growing frontier markets out there. A number of open- and closed-ended funds use this trust to get exposure to Vietnam, including Premier Miton Worldwide Opportunities and Henderson Far East Income.

The managers of VinaCapital Vietnam Opportunity have a private equity-like approach to investing in Vietnam, taking meaningful stakes in each company and acting like partners once they are invested.

The trust has made 164.7 per cent over the past five years and is on a discount of 14.44 per cent, which is broadly in line with its one- and three-year averages.

For a UK play, the Oryx International Trust is trading at a 13.84 per cent discount and has made a total return of 154.7 per cent over five-years.

The five FE fundinfo Crown-Rated trust has been managed by Christopher Mills since 1995.

Its objective is to seek consistently high absolute returns while maintaining a low level of risk through investing in medium- and small-sized quoted and unquoted companies in the UK and US.

Another single-country play is up next, JPMorgan Russian Securities, with a discount of 13.37 per cent and five-year gains of 135.17 per cent. However, this discount can be partly explained by ongoing sanctions against Russia, meaning this figure could remain at this level for some time.

Investors may feel more comfortable with the next trust from the same asset-management house: JPMorgan European Smaller Companies, which has made a return over five years of 103.8 per cent.

The team at Winterflood said the trust “benefits from an experienced management team (Francesco Conte and Edward Greaves) which has delivered good performance”.

Its discount of 12.72 per cent is not an outlier within the long-term average, but nevertheless could still be a viable entry point for investors who are positive on European smaller companies.

Next up is the Aberdeen Emerging Markets Investment Trust, which has made 99.08 per cent over the last five years and is trading at a 14.03 per cent discount.

Emerging markets gained 2.1 per cent in April as some of the asset class’s short-term headwinds abated. For example, a weaker US dollar and lower US bond yields were supportive of the sector.

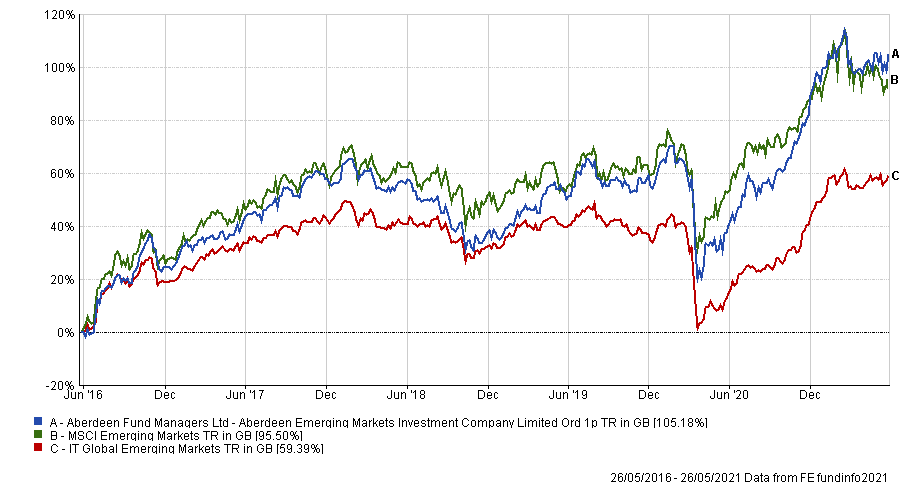

Performance of trust vs sector & benchmark over 5yrs

Source: FE Analytics

Emma Bird, a research analyst at Winterflood Research, said this trust could be viewed as a core holding in the sector: “While the fund is unlikely to be the best-performing emerging markets fund at any one time given its investment approach, we believe it offers core exposure that has the potential to deliver lower-volatility returns.

“The 10 per cent allocation to fixed income should provide diversification benefits and help to reduce volatility, while it also acts as an interesting differentiator to its peers.”