Henderson EuroTrust, Miton UK Microcap and BlackRock Frontiers are just three of the investment trusts that are trading at a wider discount than they were five years ago, research from Trustnet has shown.

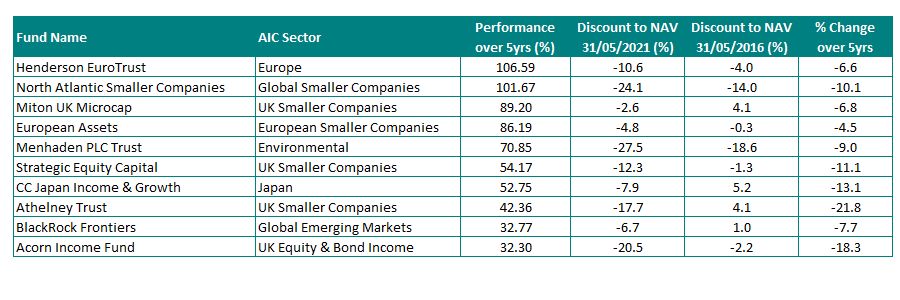

We used historic statistics from QuotedData to compare trusts’ discounts from May 2016 with May 2021, to see which are looking cheaper than they were.

However, a widening discount to net asset value (NAV) can be a sign of persistent underperformance. Therefore, only trusts with positive returns were considered and the table below is ranked according to their five-year performance.

That said, not all the funds selected have been top-quartile performers over five years, but for long-term investors keen on the mandate or the manager, the current discount could be a valuable entry point.

Those in the list have been selected after Trustnet looked across all the main sectors to find the trusts that may have gone under the radar with recent impressive returns or that could be poised for a bounce-back or correction.

James Carthew, head of investment trust research at QuotedData also provided his thoughts on some of the funds below.

The trusts cheaper than five years ago but with positive returns

Source: QuotedData/FE Analytics

In first place, as ranked by five-year performance, the £318.8m Henderson EuroTrust has achieved a 106.59 per cent return over the period and is currently trading at discount of 10.6 per cent, 6.6 percentage points lower than the 4 per cent it was at in 2016.

Jamie Ross took over management of the fund in 2018 and it has overseen a marked improvement. Despite a difficult environment EuroTrust has made 77.56 per cent since the March sell-off.

Ross told Trustnet in September: “The EuroTrust approach is finding the good companies of today – compounders, or the good companies of tomorrow – improvers. The primary metric for compounders is to have high sustainable returns on capital.”

While the compounders are for the short term, improvers are marked out to be the good companies of the future, but on current metrics look average.

Telecom Italia, which is the largest position in the portfolio, is one that Ross described as a classic “improver” given its valuation had reached historically low levels.

Its most attractive element is the potential of an upcoming merger with Italian fibre company called Open Fiber, this would create a fixed broadband spin-off FiberCop, creating a single national operator.

Second on the list is the North Atlantic Smaller Companies trust, run by Christopher Mills.

The £634.2m fund has made a 101.67 per cent return over five years and is currently trading at a 24.1 per cent discount to NAV, a further 10.1 percentage points below its 14 per cent discount in 2016.

However, while the trust has persistently been on a discount, this is the widest it’s been in five years.

Carthew said: “In some ways, it’s a value approach, but Mills buys growth companies and sometimes you get the best of both worlds.”

Performance of trust vs sector over 1yr

Source: FE Analytics

Over one year, North Atlantic Smaller Companies has made a total return of 63.91 per cent, while the average fund in the IT Global Smaller Companies sector has made 48.09 per cent and its Russel 2000 index posted 50.03 per cent.

Next up is Gervais Williams’ Miton UK Microcap Trust, which has been boosted by the strong vaccine rollout in the UK and greater certainty around the relationship with the EU post-Brexit.

Carthew agreed: “It seemed for a long time the fund was getting left behind – but the vaccines have proved to be a great catalyst for this being re-rated.”

The environment for UK micro-caps is conducive to this outperformance and the manager explained that in this climate micro-caps can make “transformational” returns.

Williams said: “I’ve never known a market quite like this. I’m finding stunningly cheap stuff at the wrong price and the best thing about micro-caps is they can grow when the world’s not growing.”

Considering, it was trading on a premium of 4.1 per cent in 2016, it is now on a small discount of 2.6 per cent.

From the IT Environmental sector, the £83.6m Menhaden PLC Trust is trading at a discount of 27.5 per cent to NAV, compared to 18.6 per cent five years ago.

The trust, despite being in the IT Environmental sector, gives exposure to two tech giants with a 24 per cent stake in Alphabet and 9 per cent position in Microsoft.

This, according to Carthew, is where the trust falls down from his perspective.

“It’s supposed to be environmental, but the portfolio doesn’t look like it to me,” he said. “It’s a strange portfolio for what it does and I’m not sure what the theme is.”

Managed by Luciano Suana, Ben Goldsmith and Graham Thomas, the trust announced on 15 June that it will change its name to Menhaden Resource Efficiency, perhaps to better reflect the investment strategy of owning businesses that are making efficient use of energy and resources.

CC Japan Income & Growth may seem an odd addition to this list, but for those interested in the long-term investment case in Japan, now could be an opportune moment to invest in the fund.

Performance has suffered over the long-term, but over three and six months, it’s been in the top quartile of the IT Japan sector.

Carthew said: “As it’s an income fund, it has more of a value tilt to it and so while things like JPMorgan Japan were flying - this fund was left behind.

“It’s slightly better this year but the ongoing problem in Japan is vaccine-related and, despite cases being under control, the slow vaccination roll-out hasn’t helped at all.”

A 52.75 return over five-years isn’t outstanding, but it is on a 7.9 per cent discount, considering it was on a 5.2 per cent premium five years ago it could reap rewards if Japan rebounds strongly next year.

The short-term performance suggests that a value-orientated approach is working well in Japan now.

Finally, and another trust that may be one to consider for its potential to rebound, is the £234.3m BlackRock Frontiers Trust, run by Sam Vecht and Emily Fletcher.

This rebound is already occurring in countries like Indonesia and the Philippines, according to the managers, and in a “post-Covid world awash with record liquidity, investors will remember the considerable attractions of our investment universe”.

Carthew agreed, adding: “Frontier markets have been more or less left behind for a while and consequently a lot of those stocks are really cheap.”

He conceded that it again depends on the Covid experience of each country.

“However, if you had to pick one of these trusts that could have a breakout and perform really strongly, it would be BlackRock Frontiers,” he said.

A 1 per cent premium in 2016 was certainly less attractive than the 6.7 per cent discount it currently trades at, and for those bullish on the investment case for emerging markets – it could be a worthwhile asset.

According to analysts at Rayner Spencer Mills Research: “The trust is a worthy addition as a satellite holding to supplement overall EM exposure where there is a global expansion taking place.

“The managers are seasoned and well versed in the pitfalls as well as the opportunities in the emerging market world.”