Many Baillie Gifford funds have generated top-quartile monthly returns at least half of the time in 2021 so far, despite the changing investment landscape being seemingly against the group.

Baillie Gifford has a very strong long-term track record with most of its funds at the top of their respective sector over the past decade as ultra-loose monetary policy acted as a boon for the group’s quality-growth approach.

However, the rollout of the Covid vaccine and 2021’s ‘re-opening trade’ following in its wake has boosted the value style of investing, which tends to do better when the economy is stronger, and held back growth stocks.

This has acted as a headwind for Baillie Gifford and, at the end of June, just two of the group’s 30 or so funds were in their respective sector’s top quartile. This is in stark contrast to 2020, when 22 were first quartile after the growth stocks that the firm’s strategies favour, especially disruptive tech companies, surged.

The ‘re-opening trade’ has prompted some to recommend investors shift over to value funds, which have posted some impressive short-term gains in recent months after a long period in the cold.

But while this rotation into value – and its impact on past winners such as Baillie Gifford – has been one of the main talking points of 2021, it has been far from a one-way trade.

Monthly performance of investment styles in 2021

Source: FE Analytics

As the chart above shows, the MSCI AC World Value index outperformed in February, March and May this year – but its growth counterpart took the lead in the other three months.

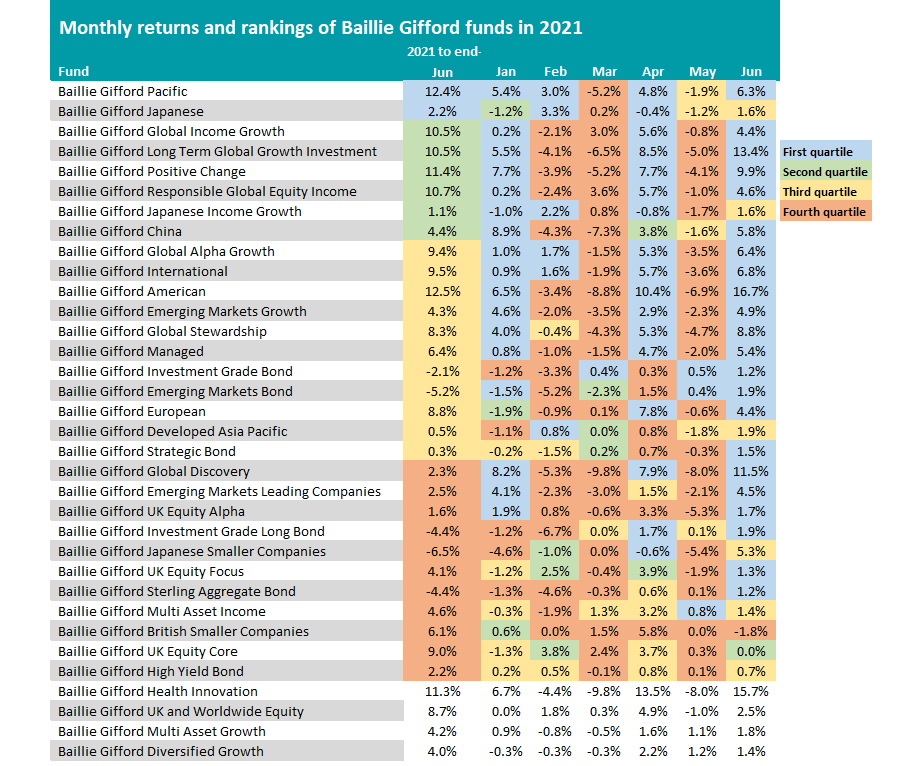

A closer look at Baillie Gifford’s monthly returns – a short time frame for a group so focused on the long term – shows that 12 of its funds made top-quartile returns in three months. Most were bottom quartile in the three remaining months.

Among these were names such as Baillie Gifford American, Baillie Gifford Long Term Global Growth Investment and Baillie Gifford Positive Change, which were standout performers in 2020.

Source: FE Analytics

Meanwhile, Baillie Gifford Pacific, Baillie Gifford Global Alpha Growth and Baillie Gifford International made top-quartile returns in four of 2021’s first six months.

James Budden, marketing and distribution director at Baillie Gifford, pointed out that investor attention in 2021’s first half centred around inflation and how this would support a rotation from growth to value. But these concerns have started to ease more recently, leading to the bounce in growth stocks seen in the chart below.

Total return of investment styles in 2021

Source: FE Analytics

“It is perhaps more important to reflect on how, over the past 18 months, stock markets have been effectively divided into two thematic buckets: lockdown beneficiaries and beneficiaries of re-opening,” Budden said.

“It would be fantastic if we could accurately predict the see-sawing of the market between these two poles, but we think that it would be impossible to do so in the short term. Instead, we seek to own the best growth companies available to us.”

He added that the types of businesses typically owned by Baillie Gifford funds had been “lockdown beneficiaries” but that this year the narrative had changed, with commentators quick to note the high valuations of certain stocks.

“These arguments are based on a mean reversion being a feature of the market. We strongly suspect that this does not reflect reality and that we are living in an age of disruption, change and opportunity,” said Budden.

Andy Merricks, co-manager of the EF 8AM Focussed fund, agrees with this sentiment. He described himself as a supporter of Baillie Gifford’s approach, although he does not own any as they overlap with his own fund significantly.

He was therefore hesitant to write-off growth investing in favour of value, arguing that value investing tended to be only successful in short bursts – once they have generated strong returns, value stocks historically tend to rise to the point where the ‘value tag’ no longer applies.

In addition, Merricks argued that “the world changed in 2008” and heralded in an era of low inflation and interest rates. This was very different to what was seen as ‘normal’ previously, yet Merricks said many fund managers and economists were wedded to the old world.

“When are they going to come to terms with the fact that, 13 years on, we may just be in a new normal that doesn’t match what they were taught?” he asked.

“I would far rather invest in the Baillie Gifford style, and accept some sharp drawdowns along a longer path upwards, than in the alternative style of investing in old favourites and scratching my head over why they don’t work so well for long periods and doing a lap of honour in the short times that they do perform.

“In short, I think it will pay to overweight the future and underweight the past.”