Investors’ favourite growth stocks could be under pressure by end of the year as their decade-long run of dominance comes to an end.

From the start of 2010 to the end of 2020, the S&P 500, led by technology giants Facebook, Amazon, Apple, Netflix and Google parent company Alphabet made investors 295.2%, more than 100 percentage points higher than the MSCI World index.

It has not just been these well-known stalwarts however, with more recent giants such as electric carmaker Tesla also boosting returns.

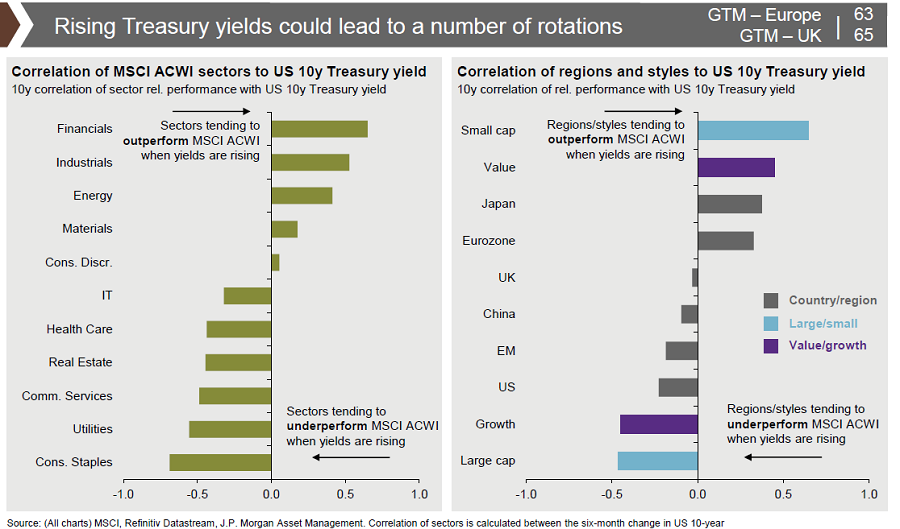

These companies have become very popular with investors, but rising bond yields and as the Fed tapers could give value stocks the momentum to finally outperform their growth rivals, after more than a decade in the cold.

This is according to Mike Bell, global market strategist at JP Morgan, who said that in the US growth looks unlikely to maintain its extreme outperformance over value.

A key part of this is a rise in US treasury bond yields. While he did not expect them to rise “in a straight line”, he said by the end of the year they would be a “fair bit higher than they are now – and that would see value reaccelerating.”

Typically value does well in this type of market environment, with sectors such as financials and small-caps especially outperforming, Bell added.

Evidence of this has already been seen earlier this year when bond yields rose in late-February. This was driven by growing inflation concerns as the market looked like it was entering a period of recovery and strong economic growth post Covid-19.

This is a change from the decade of historically low interest rates and loose monetary policy aiding growth’s outperformance during that time.

During that period value soared and year-to-date value has outperformed growth, as the graph below shows.

Performance of MSCI ACWI Growth vs MSCI ACWI Value year-to-date

Source: FE Analytics

In the past few months however value has given way to growth slightly with the latter rallying after a slow start to the year.

Bell said this could be explained by the recent fall in 10-year treasury yields. Just this week real yields fell to minus 1.1%, fuelled by growing anxieties over the economic growth outlook.

Still, Bell said: “If we’re right and bond yields go higher from here then we think we’re going to see value outperforming, particularly financials at the expense bond proxies like consumer staples.”

It is not just bond yields creating a headwind for growth though.

Bell pointed to the high valuations of growth stocks which he said was a major contributor to the past decade of outperformance.

Looking at the price-to-earnings ratio (P/E), in 2008 at the beginning of the last market cycle valuations of growth stocks were a “fraction of what they are today”.

Bell said that unless these are going to continue increasing relative to value stocks then “the main reason that most growth stocks outperformed is in the rear-view mirror rather than something that's likely to repeat.”

As a result, the strategist is applying a value bias for the growth-dominant US market.

“The main takeaway for us would be that the rotation into value will reassert itself having given up some ground,” Bell said.

He added that this is not just an American phenomenon, but one that will be exhibited across all developed markets. The one exception to this is Asia where Bell is bullish on growth.

Here Bell explained that the long-term story for growth “remains intact” as economic expansion was promising, especially in China – a dominating element of Asia’s economy - which he said was set to grow by more than 50% over the next ten years.

This makes it “by far and away the largest growth opportunity in the world over the next decade,” Bell said.

Paul Flood, portfolio manager of the BNY Mellon Multi-Asset Diversified Return fund, agreed with Bell that there would be a shift due to policy makers’ new fiscal measures, which were likely to support the real economy, but said it would be more of a balancing act.

“Going forward, a wider part of the market would therefore participate in growth compared to the current small cohort of companies,” Flood said.

“Whilst this doesn’t change the growth outlook for technology companies or its deflationary dynamics it may impact the valuations investors are willing to pay as the growth elsewhere picks up.”

Flood added that increasing fiscal policies makes a good case for adding more to value stocks to take advantage of this shift and add diversification to buffer the risk of higher inflation upending the tech trade.

“Ultimately you want to believe you have got good value for the quality of whatever company you have paid for,” he said.

But it’s not such a straight line for value to outperform, according to independent commentator Adrian Lowcock.

He said that value has had its best period of outperformance for some time recently, explaining it was coming off of a “low base” and “natural rotation out of growth stocks as the economy reopened.”

“The next few months and year are likely to be challenging for both growth and value styles,” Lowcock said.

There are several market outcomes and ongoing events that could swing the outperformance one way or the other between growth and value, he added, including ever-changing economic data, how the recovery plays out and the potential for another wave of Covid elongating the pandemic.

“Value stocks still have scope to recover further and will benefit more if we see higher inflation over growth stocks. Any return of lockdowns and growth will be favoured,” Lowcock said.

“In addition the power of technology is still disrupting things and long term that trend is set to stay.”