Bond funds with low sensitivity to interest rates, ethical portfolios and value funds have been the clear winners since the previous FE fundinfo Crown Rating rebalance in January.

The FE fundinfo Crown Ratings help investors to distinguish between funds that have strongly outperformed their benchmark over the past three years and those that have not by taking into account three key measurements of a fund’s performance: alpha, volatility and consistently strong performance.

On average, the top 10% of funds are awarded five FE fundinfo Crowns, the next 15% receive four Crowns and each of the remaining three quartiles are given three, two and one Crown(s) respectively.

In the latest rebalance, the strong value rally and increased fears of higher interest rates during the first half of the year were key factors for some of the most-improved funds.

Of the nine funds to rise from a one-crown rating to five, eight were bond funds. Charles Younes of FE Invest said duration – a fund’s sensitivity changes in interest rates – has been a big reason for the shift.

.png)

Source: FE fundinfo

“Short-duration, or funds that have limited the sensitivity to interest rates have done well,” he said, adding that those funds that invested further down the credit market towards lower-rated bonds also performed better.

The GAM Credit Opportunities and GAM Star Credit Opportunities funds headline the group. Both funds have made double-digit gains over the past year, a rarity in the IA Sterling Strategic Bond sector, and have returned 24.7% and 19.8% over the past three years respectively – both among the highest in their peer group.

Conversely, Baillie Gifford Sterling Aggregate Bond is one of two bond funds to slip from a 5-crown rating down to 1. The fund has been caught on the other side of the trade, according to Younes, with a high duration.

“It invests in the corporate bond space, which is naturally high duration, while the credit spread has narrowed so much that yields have come down substantially,” he said, leaving little room for traditional corporate bond funds to make much of a return.

Of the non-bond funds to make the jump, VT Gravis Clean Energy Income has ridden the wave of sustainable investing well, with returns of 70.5% over the past three years.

The clean energy sector has boomed as investors have moved more towards environmental, social and governance (ESG) practices, although the fund has struggled over the past year.

At a fund group level, houses that have relied on a growth bias have struggled. Five funds run by Baillie Gifford, including the bond fund above, have dropped from a five-crown rating, while five funds run by Liontrust Fund Partners also dropped from the top ranking.

Conversely, asset managers that employ a more value-driven approach such as ABRDN (formerly Aberdeen Standard Life) have performed well in the latest rebalance.

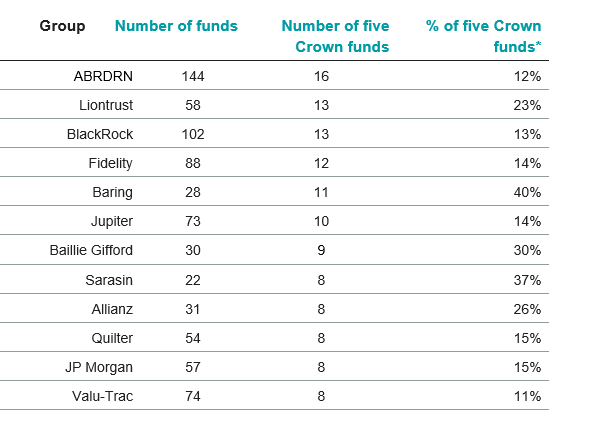

The groups with the most five-crown rated funds

Source: FE Fundinfo

Oliver Clarke-Williams, Portfolio Manager at FE Investments, said: “As the economy reopens, we can expect to see further rotational shifts within the market. Those equity funds which were riding the crest of the technology boom during lockdown will increasingly find it hard to replicate their outstanding performances over the past 18 months.

“In today’s climate, investors are looking for funds to generate income and are hunting yield wherever possible. Over the past six months the bond markets have been one of the few places to offer these pockets of yield, so for many investors, it will be pleasing to see so many bond-orientated funds performing so well.”

Across the different groups meanwhile, ABRDRN had the highest number of 5-Crown rated funds within its stable at 16, followed by BlackRock and Liontrust with 13 each and Fidelity with 12.