Gold and clean energy funds were the strongest performers in October, according to data from FE Analytics, while Brazilian funds struggled.

October marked the start of the US earnings season, where strong results boosted the shares of many companies during the month, with the S&P 500 index up 7% and the MSCI World up 5.5% over the period.

However, fears surrounding rising inflation dominated headlines during the month as the UK’s central bank warned that inflation would likely hit 5% and, in the US, key inflation measures continued to grow at a record pace.

These fears were widely reflected in the performance of the Investment Association’s sectors, where the IA UK Index Linked Gilts peer group was the highest performer during the month as inflation-linked bonds rallied alongside rising inflation.

This was followed closely by the IA Commodity/Natural Resources sector as many investors consider gold and commodities to be good hedges against rising prices.

The IA North America sector was the third best performer for the month, boosted by rising share prices off the back of the region’s robust earnings season.

Source: FE Analytics

Given the price action of the bond markets and persistently rising inflation, Ben Yearsley, investment director at Fairview Investing said an interest rate hike “now seems inevitable”.

He said: “The economy is still growing strongly (despite Brexit, energy prices and Covid) and inflation shows no sign of slowing. It still seems a big jump from printing money to upping rates with no intermediate step, however it also feels as if that’s what’s needed.”

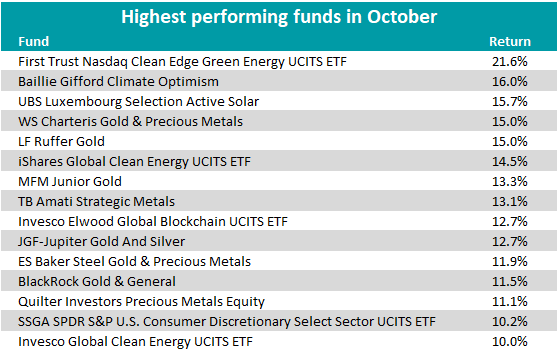

Turning to individual funds, clean energy and ethical funds were among the strongest performers for the month as investors seemed to favour them during the run-up towards the COP26 summit where world leaders are gathering to discuss a plan to tackle climate change.

One third (5) of the top 15 funds for the month of October were clean energy-related funds. The First Trust Nasdaq Clean Edge Green Energy ETF (Exchange-Traded-Fund) was October’s highest returning fund with a performance of 21.6%.

In addition to the rise of clean energy stocks, the fund was boosted by the rapid share price surge of electric vehicle manufacturer Tesla – which makes up just under 10% of the portfolio and is the ETF’s largest position. Shares in Tesla rose 47% during October.

Source: FE Analytics

Gold funds also topped the performance charts after being amongst the worst performers during August and September. During October, eight out of the top-15 performers were gold and precious metals strategies.

After struggling during the two months prior to October, gold and silver miners enjoyed a strong performance last month on the back of a modest rise in the price of precious metals.

The WS Charteris Gold & Precious Metals fund and LF Ruffer Gold fund were among the top performing precious metal strategies, both with returns of just under 15% over the month.

One notable outlier in the top-performers for October was the Invesco Elwood Global Blockchain UCITS ETF, which returned 12.7% over the period.

This ETF tracks the performance of companies involved in the growth of blockchain technology and has benefited from a rise in the price of Bitcoin and other cryptocurrencies over the past month.

The ETF holds stakes in companies such as cryptocurrency miner Hive Blockchain Technologies, cryptocurrency exchange Coinbase, and chipmaker Taiwan Semiconductor Manufacturing Company.

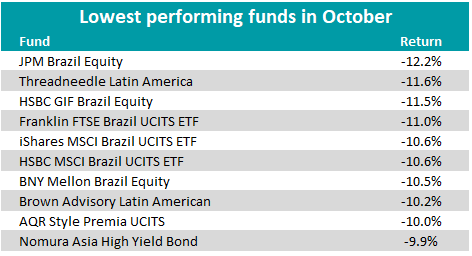

Turning to the worst performing funds, the Latin American and Japanese sectors were the hardest hit sectors in the IA universe.

Source: FE Analytics

Brazilian funds were dragged down by the country’s rising inflation which was reported to be more than 10% last month due to rising transport and housing costs.

The country’s geopolitical uncertainty also weighed on the region after its president Jair Bolsonaro was accused of crimes against humanity due to his poor handling of Covid-19 by a Brazilian senate report at the end of the month.

Japanese funds were also held back as investors weighed whether the nation’s economic recovery was in doubt after factory output declined for the third month in a row after being hit by the global semiconductor shortage.

Markets were also uncertain as to whether the country’s newly elected prime minister Fumio Kishida would continue his predecessors ‘Abenomics’ economic policy of combatting deflation and deregulating the economy.

Source: FE Analytics

The worst performing sector dominated the list of worst performing individual funds for the month of October, with Brazilian and Latin American funds and ETFs making up eight of the top-10 bottom-performing strategies over the month. The Brazilian Bovespa index was down 6% in October.