Knowing how to invest in each major region is difficult, especially when there are so many options to choose from. Whether it be a large-cap passive fund or a small-cap active fund, in truth all have merits as part of a wider portfolio.

However, for those that want to know the best way to invest in each major market, Trustnet has started a new series looking at three key themes – active versus passive, large or small and growth or value – over the past decade.

To start, we looked at the UK. The domestic market is one that is dominated by large value stocks, whether that be the oil giants Royal Dutch Shell and BP, mining conglomerates such as Glencore, or banking heavyweights HSBC, Barclays and RBS.

This has been to the detriment of investors over the past decade, who have patiently waited for a value rally that has barely materialised.

Indeed, over the past decade the UK has fallen behind other major markets that are more heavily dominated by fast-growing technology names. The S&P 500, for example, would have made investors five times their initial investment a decade ago, while the UK would have only doubled it.

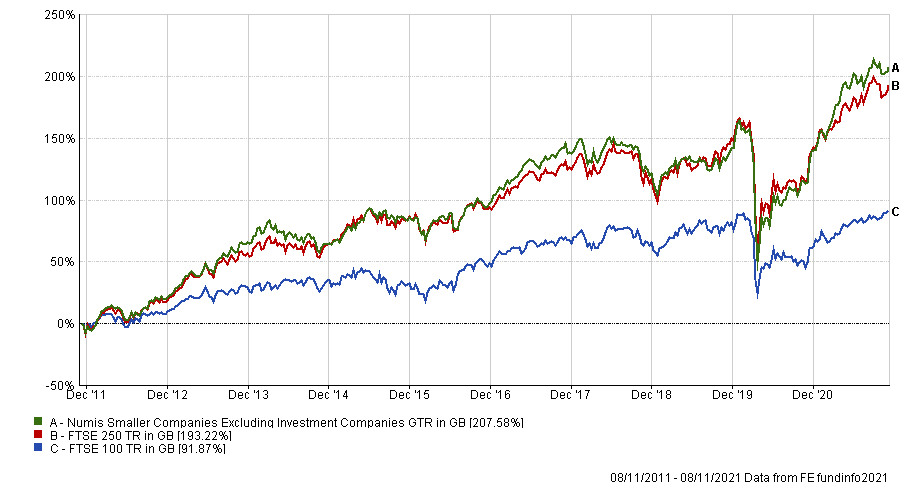

It may therefore be unsurprising to some to reveal that when looking at the three major UK indices – the FTSE 100, FTSE 250 and Numis Smaller Companies Excluding Investment Companies – it was the small-caps that came out on top.

Performance of indices over 10yrs

Source: FE Analytics

Indeed, over the past decade the growth-orientated small-cap index has returned 207.6%, more than double the 91.9% of the FTSE 100 and slightly ahead of the FTSE 250’s 193.2%.

Next, we looked at active funds. Once again, small-caps were victorious. The average IA UK Smaller Companies fund (268.4%) has beaten the average IA UK Equity Income (110.5%) and IA UK All Companies funds (127.6%) over the past decade.

This also shows that the average active smaller companies fund has beaten the Numis Smaller Companies Excluding Investment Companies over the decade, suggesting that – at least on average – active has performed better than passive.

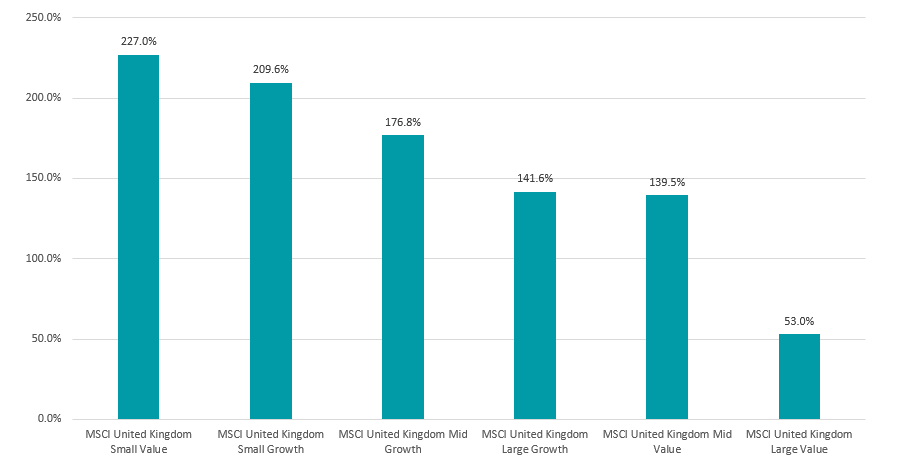

Having established that small-cap active funds have been the best way to invest, we turned to growth versus value. Here the difference was less stark. Indeed, looking at two UK small-cap indices, both the value and growth buckets have made more than 200% over the past 10 years, as the below chart shows.

Performance of indices over 10yrs

Source: FE Analytics

Smaller companies are riskier than their large-cap peers, as the potential for companies to go bust, violent share price swings on lower trading volumes and the potential for mismanagement is higher.

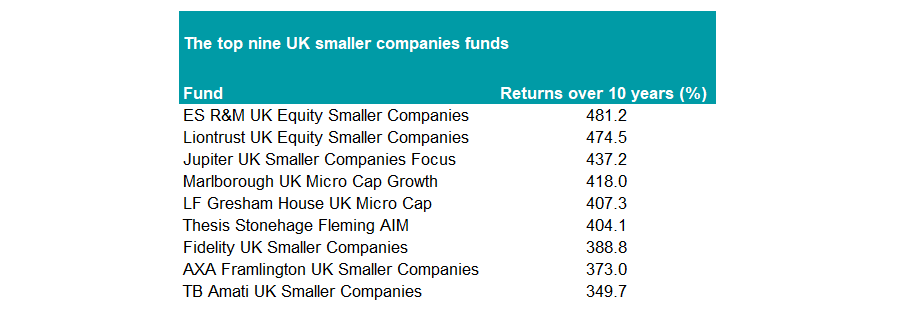

However, if done well, it has proven over the past decade to be the most lucrative way to invest in the UK. Indeed, across all three Investment Association (IA) UK sectors, nine of the top 10 funds over 10 years are in the IA UK Smaller Companies sector, as the below table shows.

Source: FE Analytics

Of course, it should be kept in mind that was has worked for the past 10 years might not necessarily perform as strongly for the next decade.

Top of the pile has been the ES R&M UK Equity Smaller Companies fund. Formerly run by Philip Rodrigs, manager Daniel Hanbury has been in charge since 2018 and has performed well, returning 63.8% since he took the helm, beating both the sector average and Numis Smaller Companies + AIM benchmark.

Matching the return profile set out above, the £641m active small-cap fund is 39.8% invested in growth stocks, with 45% in quality companies and 11% in value names.

Hot on its heels is the Liontrust UK Smaller Companies fund run by FE fundinfo Alpha Managers Anthony Cross and Julian Fosh, as well as Victoria Stevens and Matthew Tonge.

The fund uses the firm’s competitive advantage process to pick stocks that can sustain a higher-than-average level of profitability.

As part of this, management of their investee companies must have a minimum 3% stake in the business. This lends it to more quality growth stocks rather than unloved value companies.

The £1.8bn fund is overwhelmingly weighted to AIM, with 73.5% of the portfolio invested in companies quoted on the junior market, with 7% in FTSE 250 stocks and 8.3% in FTSE Small Cap companies.

| Fund | Sector | Fund size | Manager name(s) | Yield | OCF |

| AXA Framlington UK Smaller Companies | IA UK Smaller Companies | £255m | Dan Harlow, Chris St John | 0% | 0.84% |

| ES R&M UK Equity Smaller Companies | IA UK Smaller Companies | £641m | Daniel Hanbury | 0.91% | 0.89% |

| Fidelity UK Smaller Companies | IA UK Smaller Companies | £462m | Jonathan Winton, Jac Jones | 0.34% | 0.91% |

| Jupiter UK Smaller Companies Focus | IA UK Smaller Companies | £370m | Nick Williamson | 0.95% | 0.86% |

| LF Gresham House UK Micro Cap | IA UK Smaller Companies | £326m | Ken Wotton, Brendan Gulston | 0% | 0.98% |

| Liontrust UK Smaller Companies | IA UK Smaller Companies | £1,716m | Anthony Cross, Julian Fosh, Victoria Stevens, Matthew Tonge | 0% | 1.33% |

| Marlborough UK Micro Cap Growth | IA UK Smaller Companies | £1,771m | Guy Feld, Eustace Santa Barbara | 0.06% | 0.81% |

| TB Amati UK Smaller Companies | IA UK Smaller Companies | £1,024m | Dr. Paul Jourdan, David Stevenson, Anna Macdonald | 0.4% | 0.89% |

| Thesis Stonehage Fleming AIM | IA UK Smaller Companies | £138m | Paul Mumford, Nick Burchett | 0.11% | 0.67% |