The third-best performing IA North America fund of the past decade has had a substantial fall from grace in the opening weeks of this year but fund pickers recommend investors should stay put.

This strategy has led markets for several years, boosted by central banks’ loose fiscal policies, which have added liquidity in equity markets, as well as low interest rates.

But recently long-term bond yields have been rising on the back of changing economic policies and many of the holdings in these top-performing growth funds have faced pricing power and growth headwinds for the first time in years.

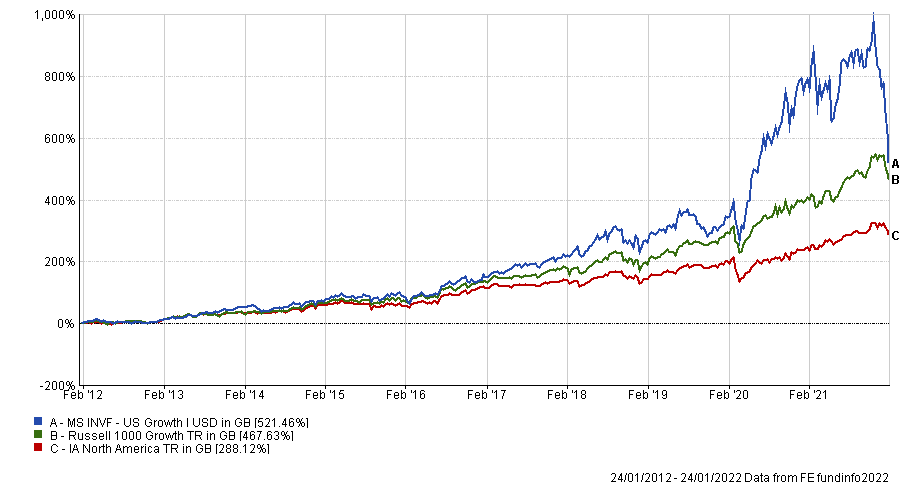

Morgan Stanley US Growth has not been immune. The fund, which was the highest-returning IA North America fund over 10 years (812.4%), has ranked second-worst over one year (-30.7%) and over the past month is down 29.7% – the worst in the sector.

Performance of the fund vs sector and benchmark over 10yrs

Source: FE Analytics

The $4.6bn (£3.4bn) is run by a six-person management team led by FE fundinfo Alpha Manager Dennis Lynch, who has run the fund since 1997.

Although it does not hold many of the blue-chip mega-cap names of its peers Rob Morgan, Charles Stanley’s chief analyst, said it is still a highly concentrated technology fund.

“Risk is therefore extremely high and swings in sentiment against innovative but highly valued companies can be expected to adversely affect it – as we have recently seen,” he said.

For Morgan, investors in the fund should only sell out if their portfolio already has a high allocation to “early stage and highly valued tech stocks” and they are “uncomfortable with the extreme volatility this gives rise to”.

But, for those who have a modest weighting and plan on taking a long-term view, the manager’s stock picking abilities are going to be more important “than current market preoccupation with the direction of interest rates and impact on ‘long duration’ assets,” he said, suggesting that, in this case, investors should hold on.

Fairview Investing’s co-founder, Ben Yearsley, also recommended holding the fund because “despite the savage recent drawdown, it has outperformed Baillie Gifford, the Nasdaq and the S&P 500 over the past decade”.

He added that if an investor was happy investing in growth prior to the recent correction then were was no reason to panic and sell out now. “Obviously you might be in a for a period of more muted performance than the last decade, but that was abnormal,” Yearsley said.

Some argued that the currently tough environment for technology stocks does not have to be all doom and gloom. Victoria Scholar, head of investment at interactive investor (ii), said that the rerating on some of the exorbitantly high names was a “healthy component of market price action, with stocks now fetching more realistic and less bubble-like valuations.”

These more digestible share prices could now be a buying opportunity for investors who want to access them.

“Looking ahead, with tech earnings front-and-centre this week, the sector is now at a fork in the road. If last week’s disappointment from Netflix is anything to go by, this week’s results could spark another leg lower. However, forecast-topping quarterly scorecards, coupled with upbeat guidance, particularly from Microsoft and Apple this week, could set the stage for some respite, and provide a reason for investors to make the most of the decline in valuations,” Scholar said.

But her colleague Dzmitry Lipski, head of funds research at ii, did not agree that the Morgan Stanley fund was the ideal way to access them. “We don’t recommend Morgan Stanley US Growth fund,” he said.

“Looking at performance numbers from one quarter is just a snapshot. It is essential to consider these figures in the context of investing over the long-term, five years as a minimum.”

Investors should not sell out if they are trying to time the market, Lipski clarified, or if they believed the growth style investing was about to turn.

“Instead, I would suggest make sure you’re well diversified and your portfolio is well balanced, without any strong biases,” Lipski said.

For investors remaining put, the researcher said that the risks facing the Morgan Stanley portfolio could be blended out with other funds offering different biases, such as the Premier Miton US Opportunities fund.

Unlike a lot of its IA North America peers the Premier Miton fund’s top holdings are not in the big-cap tech names which have dominated the S&P 500. Its top three sector allocations are almost equally split between industrials, financials and technology, giving a more balanced exposure to the US market.

“As such, the fund offers differentiated underlying exposure to the US market with stronger defensive characteristics and lower volatility, yet it has consistently outperformed its peers over the longer term,” Lipski said.