Investors have made a disastrous start to 2022 as higher inflation and the threat of higher interest rates has had a severe impact on markets.

In the US, Federal Reserve chair said last week that the central bank would raise rates in March “assuming that conditions are appropriate to do so”. It follows the Fed’s previously increased quantitative easing tapering, with the asset purchasing programme expected to end in March.

Meanwhile, in December, the Bank of England raised rates to 0.25%, with markets pricing in another increase at the next meeting on Thursday.

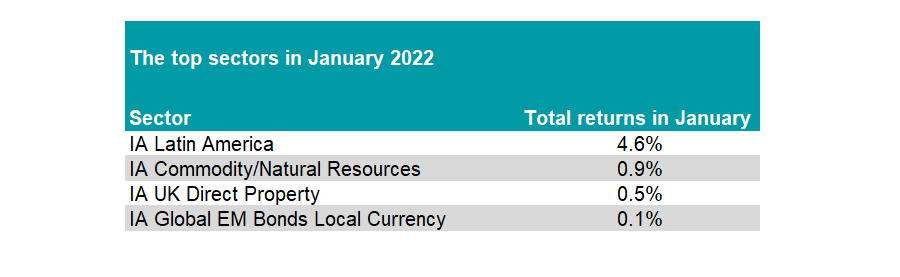

This, coupled with the ongoing pandemic and the potential Russian invasion of Ukraine meant that only four Investment Association (IA) sectors made a positive gain in January.

IA Latin America was the only sector to make a meaningful return, up 4.6%, while the IA Commodity/Natural Resources, IA UK Direct Property and IA Global EM Bonds - Local Currency made less than 1% for the month.

Source: FE Analytics

Brazil’s Bovespa index was 7% higher for the month thanks to the strong performance from index heavyweight Petrobras. The energy company rose as oil prices soared in January on the back of the political tension in Russia.

The Brent crude spot price rose 16.8% during the month, boosting many Latin American countries that rely on exporting oil. This also explains the rise in the natural resources sector, where energy funds led the way higher.

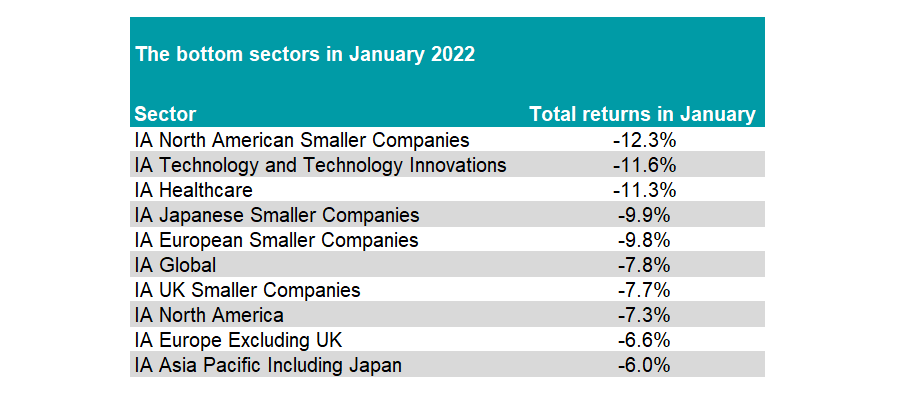

At the other end of the spectrum, the big market story in January was the change from growth to value, with the likes of the healthcare and technology sectors plummeting.

Source: FE Analytics

These companies tend to be priced based on their future earnings growth, but with inflation high and interest rates on the rise, the discount applied to these projections are more demanding.

The IA Technology and Technology Innovations sector lost 11.6% for the month, while the IA Healthcare sector dropped 11.3%.

Smaller companies also had a poor month, with the IA North American Smaller Companies sector down 12.3% – the worst performance across the entire universe. Small-cap funds in Japan, Europe and the UK also made the top 10 worst performers of the month as investors moved away from high-risk assets to deal with the ongoing uncertainty.

Ben Yearsley, director at Fairview Investing, said: “There were some savage price falls in January from some of the Covid winner stocks. Is this down to tiny rate hikes or the realisation that valuations were simply too high for some of these ‘never never’ stocks?

“On the flip side, old school value had a good month seen through the lens of the top performing FTSE 100 driven by oil. Is oil topping $90 the new normal? With oil companies showing no interest in expanding capacity, partly as they are spending billions on renewable energy, it feels like a high oil price is here to stay.”

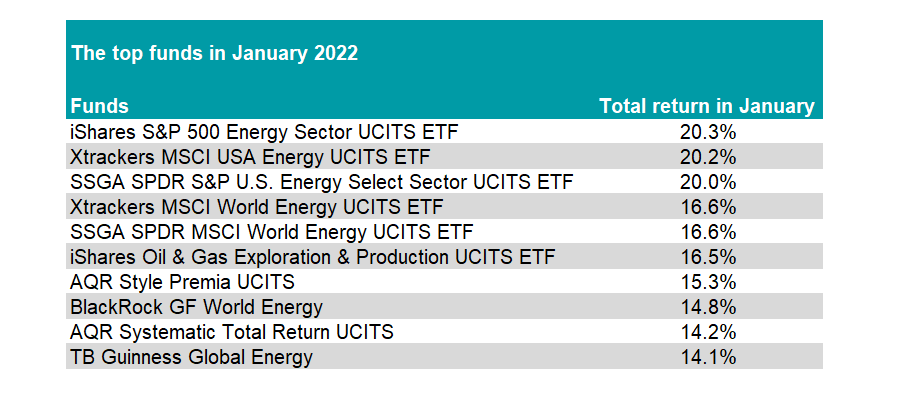

Turning to individual funds, it was a good month for anything related to energy, as mentioned above. The iShares S&P 500 Energy Sector UCITS ETF topped the charts in January, returning 20.3$, while the top 10 was dominated by oil and energy trackers.

This was followed by the Xtrackers MSCI USA Energy UCITS ETF and SSGA SPDR S&P U.S. Energy Select Sector UCITS ETF, which both made more than 20% in January.

Source: FE Analytics

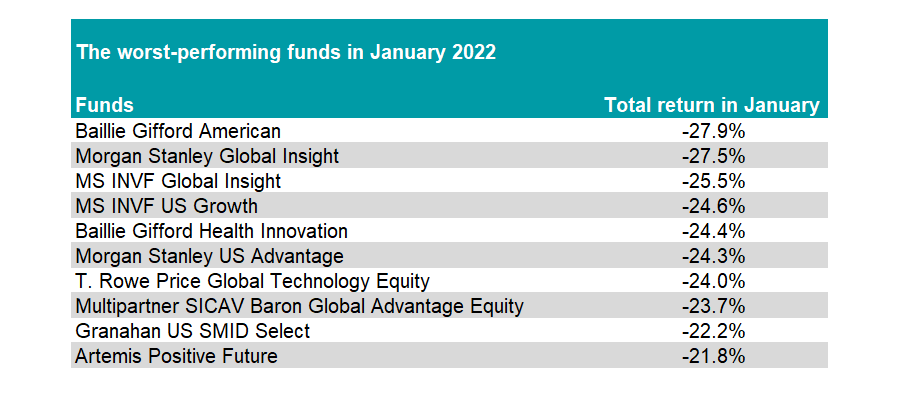

At the other end of the scale, it was another disastrous month for the Baillie Gifford American fund, which lost 27.9% in January. The fund, which is dominated by US tech giants and healthcare stocks, was the worst performer for the month.

Baillie Gifford Health Innovation also made the top 10 worst performers, while Baillie Gifford Global Discovery, Baillie Gifford Long Term Global Growth Investment and Baillie Gifford Climate Optimism all made the top 20.

Morgan Stanley Global Insight, US Growth and US Advantage all have a similar management style to Baillie Gifford and featured heavily in the worst-performing table.

Source: FE Analytics

“It’s painful being a high growth investor currently. Stocks that apparently could walk on water during much of the pandemic have recently been floundering, if not actually sinking,” Yearsley said.

“As ever it is all about balance though. Own your Baillie Gifford funds but ensure that you have some investments pointing in a different direction. The outperformance of the FTSE over the Nasdaq in January was fascinating as it was partly led by old economy oil and financials doing well but also by new economy doing extremely badly. After a decade of one direction of travel