UK investors looking to get broad exposure to their home market have a wealth of choice among those in the IA UK All Companies sector, which comprise of numerous portfolios that range in style, market capitalisation and strategy.

However, this does mean that picking the right one is exceptionally difficult. Indeed, the average fund in the sector underperformed the FTSE All Share index by 4.2 percentage points over the past five years.

Investors may be losing faith as £486m was removed from the sector in April, more than double the outflows of IA UK Equity Income and IA UK Smaller Companies combined (£203m).

But there are still quality options for investors that want the ability to potentially beat the index over time.

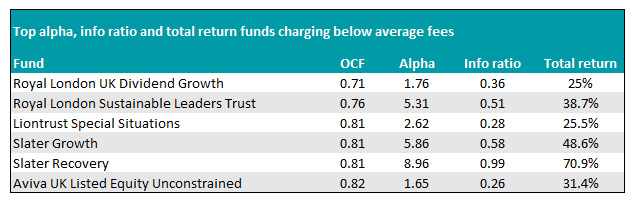

In this series there Trustnet looks at the funds that are in the top 10% of their sector for alpha, information ratio and total return over the past five years, while also charging a below-average cost to investors.

Alpha is the measure of a fund’s performance compared to its benchmark and is a good indicator of a manager’s stock picking skills. The scores below indicate that if a fund has made a 0% return, so a score of five suggests the fund would have made 5% while the benchmark is flat.

Information ratio takes the performance of the benchmark away from the fund’s own returns and then divides this by its tracking error, giving a score, or value, for the additional risk taken by the portfolio. The higher the score the better, although anything above 0.5 is considered good. The maximum score is 1.

Together, Alpha and information ratio give a clearer picture of how much the fund manager has added above the benchmark over five years.

The two cheapest funds that met this criteria were both managed by Royal London – they were the UK Dividend Growth fund and Sustainable Leaders Trust, which have a charge of 0.71% and 0.76% respectively.

It’s £1.1bn UK Dividend Growth fund is up 25% over the past five years, making it the worst performer on the list, but still a top-quartile effort. The aim is to deliver income growth to those that hold it in their portfolio, with the yield currently standing at 3.2%.

Its larger neighbour, the Sustainable Leaders Trust, which has £2.9bn in assets under management (AUM), outperformed the other Royal London portfolio by 13.7 percentage points with a total return of 38.7% over the same period.

The sustainable portfolio also had a significantly higher alpha of 5.3 compared to the dividend fund’s 1.8, although it has a lower yield of 1.5%.

Environmental, social and governance (ESG) strategies have been under pressure in 2022 as they typically enter into growth stocks more than the unloved companies that income funds prefer, suggesting that the difference between these two portfolios could narrow if the current market conditions continue.

Total return of funds vs index and sector over the past five years

Source: FE Analytics

The Liontrust Special Situations, Slater Growth and Slater Recovery funds all have a below average charge of 0.81%.

Among those on the list, investors looking to maximise alpha while spending the least would have benefited from Slater Recovery fund over the past five years, with a rating of 9.

It had the highest alpha rating on the list because it has made the highest total return. It produced an impressive 70.9% over the period, beating the FTSE All Share index by 56.9 percentage points.

The Slater Growth fund, also run by Mark Slater, had the second highest return of 48.6%, although its 34.6 percentage point lead on the index was narrower.

Despite its greater performance, the recovery fund actually has a lower AUM of £523m compared to Slater Growth’s £1.4bn.

Total return of funds vs index and sector over the past five years

Source: FE Analytics

Even bigger is the £5bn Liontrust Special Situations fund, run by FE Alpha managers Anthony Cross and Julian Fosh. Despite charging the same amount as the Slater funds, investors got less alpha for their money with Special Situations – it rated 2.6 on alpha, and was up 25.5% over the past five years.

Marginally more expensive was the £220m Aviva UK Listed Equity Unconstrained fund, with a charge of 0.82. It had the lowest alpha rating of the funds on the list, at 1.7, although it did not have the lowest returns.

Total return of fund vs index and benchmark over the past five years

Source: FE Analytics

It beat both the Liontrust Special Situations and Royal London UK Dividend Growth funds with a total return of 31.4% over the past five years.